Greetings: 01 April 2020

NEW TRADE: Sell 45-strike JUNE 2020 Crude Oil CALL option for 0.14 or better ($140)

Expiration: 14MAY20 in 43 days.

Initial Margin Deposit: $2070

Credit: $140/$2070: possible ROI: 6.7% in 43 days.

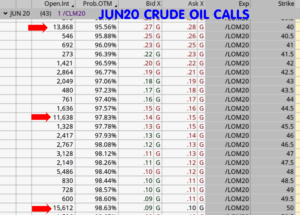

We have, obviously, a very volatile market and a great deal of uncertainty. This means trading is more risky than what used to be ‘normal.’ I have highlighted three CALL strikes for a traders consideration varying in risks. I have used the 45 CALL for myself, but would recommend caution and that any trader, if considering this trade also look at not only the 45 strike but the 40 strike and the 50 strike options. The prices and Prob. OTM are in the option matrix below. All three strikes have a Prob. OTM of 95% or higher. That figure is based on current volatility and time until expiration and does NOT factor in the politics, international actions by oil producers, and other things.

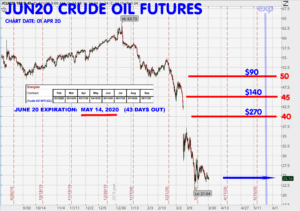

Comment: Here’s the JUN20 Crude Oil chart:

And here is the option matrix for JUN20 Crude CALLS:

All three of the strikes: 40, 45, and 50 seem to have ample open interests. If there is some unexpected factor that creates a fast market, the volume on these could be limited but for now is ample. The daily volume is NOT on the matrix below, so check it before you consider any trade.

Comments continued: I consider the grain and gold markets too unpredictable right now. Gold has had several days in the last month of $30 to $40 moves per day. As for the grains, the current global pandemic influence has distorted what would have been normal seasonal patterns in many commodities, including the grains – which would normally be trending UP in the Northern hemisphere. Other factors such as the finances and increased risk for farmers will influence planting acres, labor availability, and will likely make USDA projections very difficult this season. So without more information as this pandemic progresses, I am reluctant to try and trade them.

I wish I had more trades and better news, but it is what it is of course. Difficult times. – Don

Since selling commodity options has been going through a slow period with limited opportunities, I have been trading the new Micro E-minis a bit and enjoying the activity. Risky of course, but the small point value denominations of 50 cents to $5 a point, I find the risk tolerable and am enjoying the activity and making a few bucks along the way.

I have an entire YouTube Channel dedicated to show home investors how they might learn to Day Trade the Micros at this link: https://www.youtube.com/channel/UC3WzyRqTuFn2iBjBPu-D6HA/ or HERE

I have over 20 training videos there, all free of course. Most of them are for new futures traders, so it might be old hat for some of you. Hope you enjoy the channel. If you have a friend interested in learning about futures trading and who might be at home with lots of spare time these days, please recommend it for them. Thank you. I’d appreciate that.

A lot of investors who have never traded stock index futures are using these small 1/10th size contracts to learn them. If you’d like to see the Table of Contents page in my new book on the subject go to this Amazon link, then look for the “LOOK INSIDE” tab. There you can see the TOC, first chapter, and other parts. The link for that info is here: https://www.amazon.com/dp/169897941X

I wish great health and prosperity to you all. Please stay well and be safe. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: 01 April 2020

NEW TRADE: Sell 45-strike JUNE 2020 Crude Oil CALL option for 0.14 or better ($140)

Expiration: 14MAY20 in 43 days.

Initial Margin Deposit: $2070

Credit: $140/$2070: possible ROI: 6.7% in 43 days.

We have, obviously, a very volatile market and a great deal of uncertainty. This means trading is more risky than what used to be ‘normal.’ I have highlighted three CALL strikes for a traders consideration varying in risks. I have used the 45 CALL for myself, but would recommend caution and that any trader, if considering this trade also look at not only the 45 strike but the 40 strike and the 50 strike options. The prices and Prob. OTM are in the option matrix below. All three strikes have a Prob. OTM of 95% or higher. That figure is based on current volatility and time until expiration and does NOT factor in the politics, international actions by oil producers, and other things.

Comment: Here’s the JUN20 Crude Oil chart:

And here is the option matrix for JUN20 Crude CALLS:

All three of the strikes: 40, 45, and 50 seem to have ample open interests. If there is some unexpected factor that creates a fast market, the volume on these could be limited but for now is ample. The daily volume is NOT on the matrix below, so check it before you consider any trade.

Comments continued: I consider the grain and gold markets too unpredictable right now. Gold has had several days in the last month of $30 to $40 moves per day. As for the grains, the current global pandemic influence has distorted what would have been normal seasonal patterns in many commodities, including the grains – which would normally be trending UP in the Northern hemisphere. Other factors such as the finances and increased risk for farmers will influence planting acres, labor availability, and will likely make USDA projections very difficult this season. So without more information as this pandemic progresses, I am reluctant to try and trade them.

I wish I had more trades and better news, but it is what it is of course. Difficult times. – Don

Since selling commodity options has been going through a slow period with limited opportunities, I have been trading the new Micro E-minis a bit and enjoying the activity. Risky of course, but the small point value denominations of 50 cents to $5 a point, I find the risk tolerable and am enjoying the activity and making a few bucks along the way.

I have an entire YouTube Channel dedicated to show home investors how they might learn to Day Trade the Micros at this link: https://www.youtube.com/channel/UC3WzyRqTuFn2iBjBPu-D6HA/ or HERE

I have over 20 training videos there, all free of course. Most of them are for new futures traders, so it might be old hat for some of you. Hope you enjoy the channel. If you have a friend interested in learning about futures trading and who might be at home with lots of spare time these days, please recommend it for them. Thank you. I’d appreciate that.

A lot of investors who have never traded stock index futures are using these small 1/10th size contracts to learn them. If you’d like to see the Table of Contents page in my new book on the subject go to this Amazon link, then look for the “LOOK INSIDE” tab. There you can see the TOC, first chapter, and other parts. The link for that info is here: https://www.amazon.com/dp/169897941X

I wish great health and prosperity to you all. Please stay well and be safe. – Don

$12.95 free prime shipping usually 2-days

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.