Greetings:

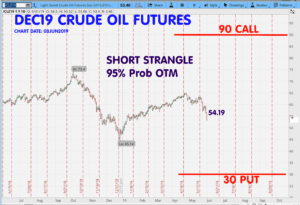

New Trade: I sold the DEC19 short strangle 30 PUT and 90 CALL for .30 ($300) this morning. I got 0.20 ($200) for the DEC19 30 PUT, and sold the DEC19 90 CALL for 0.10 ($100)

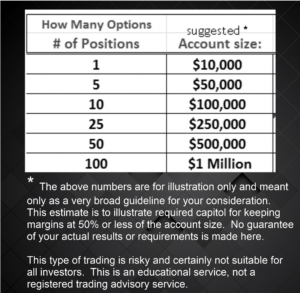

The initial net margin was $881, 165 Days until expiration on November 15, 2019. The Prob OTM is 95%. There is a possible ROI of (300/881) * 100 = 34%* (*potential ROI based on initial margin only, there could be drawdown during the trade.)

Closing Purchase: I made a closing purchase: I bought back my short SEP19 Crude Oil 80-strike CALLs for 0.05 ($50). I had sold them for 0.17 ($170), so the net profit excl. commissions = +$120

My current short SEP19 Gold 1500 CALL is trading around 1.80 today. Rather than close per “200% rule”, I’ve decided to wait until tomorrow to take any action on this. This one still very far OTM, and the stocks have taking a pounding already, so I’ll give it a little more time but watch closely.

Closed out SEP19 80-strike CALLs today (excl comm.):

Quantity 1 each: +$120

Quantity 5 each: + $600.00

Quantity 10 each: +$1,200.00

This illustration is hypothetical only. It is an approximation that can vary.

Comments: Here’s the chart for the new trade: Short 90C/30P DEC19 Crude Oil strangles I sold today. I hold the market opinion that these strikes should contain price movements until expiration. As you know, I seldom hold short options until expiration. I expect more volatility for crude ahead and may adjust the strikes over time.

In taking profits on my short SEP 80 Crude CALL today. I closed it because I had a nice profit and did not want to keep it at risk.

Comments Continued:

I await the 4PM Eastern time CROP PROGRESS REPORT at: https://usda.library.cornell.edu/concern/publications/8336h188j It seems the planting delays probably have not progressed much , so this report could drive the grains higher. We’ll see.

That is all today. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings:

New Trade: I sold the DEC19 short strangle 30 PUT and 90 CALL for .30 ($300) this morning. I got 0.20 ($200) for the DEC19 30 PUT, and sold the DEC19 90 CALL for 0.10 ($100)

The initial net margin was $881, 165 Days until expiration on November 15, 2019. The Prob OTM is 95%. There is a possible ROI of (300/881) * 100 = 34%* (*potential ROI based on initial margin only, there could be drawdown during the trade.)

Closing Purchase: I made a closing purchase: I bought back my short SEP19 Crude Oil 80-strike CALLs for 0.05 ($50). I had sold them for 0.17 ($170), so the net profit excl. commissions = +$120

My current short SEP19 Gold 1500 CALL is trading around 1.80 today. Rather than close per “200% rule”, I’ve decided to wait until tomorrow to take any action on this. This one still very far OTM, and the stocks have taking a pounding already, so I’ll give it a little more time but watch closely.

Closed out SEP19 80-strike CALLs today (excl comm.):

Quantity 1 each: +$120

Quantity 5 each: + $600.00

Quantity 10 each: +$1,200.00

This illustration is hypothetical only. It is an approximation that can vary.

Comments: Here’s the chart for the new trade: Short 90C/30P DEC19 Crude Oil strangles I sold today. I hold the market opinion that these strikes should contain price movements until expiration. As you know, I seldom hold short options until expiration. I expect more volatility for crude ahead and may adjust the strikes over time.

In taking profits on my short SEP 80 Crude CALL today. I closed it because I had a nice profit and did not want to keep it at risk.

Comments Continued:

I await the 4PM Eastern time CROP PROGRESS REPORT at: https://usda.library.cornell.edu/concern/publications/8336h188j It seems the planting delays probably have not progressed much , so this report could drive the grains higher. We’ll see.

That is all today. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.