National Day of Mourning: Closure of its U.S.-based equity – NYSE & NASDAQ – and interest rate futures and options products on Wednesday, Dec. 5, 2018, the national day of mourning to honor the death of President Bush (41). All other markets on CME Globex, CME ClearPort and the trading floor will remain open for regular trading hours on Dec. 5

OPEC Meeting this Thursday, 06 December 2018:

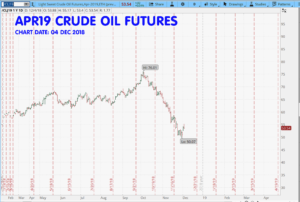

I wanted to post a new Trade Commentary today because after all the energy volatility, the holiday week for Thanksgiving, the G20 meeting last weekend, and now one more possibly major event this week, the OPEC meeting – it’s been a while since I placed any new trades. The short APR19 Crude oil $90-strike CALL I hold is doing well, the two short gold strangles: The FEB19 1500C/1100P and the short APR19 1600C/1100P are doing well, and my short soybean MAR19 1100-strike CALL is also fine.

I am again shopping for short strangles on APR19 Crude Oil. I want to wait until AFTER the OPEC meeting this week. It’s better to not try and guess the market and just wait until the news to see if anything significant or unexpected happens. I’d like to get that event priced into the market – and then determine which strikes in APR19 crude oil, I’ll might choose to sell. This morning, I’m shopping some strikes for a short strangle, basis APR19 option class, in the 80 CALL and 30 PUT areas. What I do not want to do is to sell them now, and then have a surprise from the OPEC meeting.

Corn and Soybeans: Yesterday, the Monday after G 20 weekend meetings – soybeans got a short price bounce UP and today the MAR19 soybeans are 920.50, + only 2.5 cents for the day. There were some news stories around this morning that those near-term buys of ag products from China that were announced over the weekend, might not be as instant as first thought – so the bean market is just trading flat today.

This brings me to Corn: As I have discussed in previous posts, I have my eye on selling a Corn MAR19 or MAY19 PUT. I am also considering a Vertical Credit spread and I’ll be shopping those later this week. Vertical Credit spreads are less risky than a naked option and also less profit (lower ROI).

The last two weeks have been very volatile with those giant moves in energy (NG and CL), the G 20 tariff news, and even though most of the commodity markets will be open tomorrow WED, there could be limited trading especially since it is one day before the OPEC meeting. As a seller of options, I’d rather be a little patient and get past the next couple of days, let the dust clear and then choose some strikes and get back into the oil and corn markets and look forward into the first half of calendar 2019 for some premium to sell.

Charts: I’ll post charts here for beans and corn.

That is all today. Thank you – Don

Don A. Singletary

National Day of Mourning: Closure of its U.S.-based equity – NYSE & NASDAQ – and interest rate futures and options products on Wednesday, Dec. 5, 2018, the national day of mourning to honor the death of President Bush (41). All other markets on CME Globex, CME ClearPort and the trading floor will remain open for regular trading hours on Dec. 5

OPEC Meeting this Thursday, 06 December 2018:

I wanted to post a new Trade Commentary today because after all the energy volatility, the holiday week for Thanksgiving, the G20 meeting last weekend, and now one more possibly major event this week, the OPEC meeting – it’s been a while since I placed any new trades. The short APR19 Crude oil $90-strike CALL I hold is doing well, the two short gold strangles: The FEB19 1500C/1100P and the short APR19 1600C/1100P are doing well, and my short soybean MAR19 1100-strike CALL is also fine.

I am again shopping for short strangles on APR19 Crude Oil. I want to wait until AFTER the OPEC meeting this week. It’s better to not try and guess the market and just wait until the news to see if anything significant or unexpected happens. I’d like to get that event priced into the market – and then determine which strikes in APR19 crude oil, I’ll might choose to sell. This morning, I’m shopping some strikes for a short strangle, basis APR19 option class, in the 80 CALL and 30 PUT areas. What I do not want to do is to sell them now, and then have a surprise from the OPEC meeting.

Corn and Soybeans: Yesterday, the Monday after G 20 weekend meetings – soybeans got a short price bounce UP and today the MAR19 soybeans are 920.50, + only 2.5 cents for the day. There were some news stories around this morning that those near-term buys of ag products from China that were announced over the weekend, might not be as instant as first thought – so the bean market is just trading flat today.

This brings me to Corn: As I have discussed in previous posts, I have my eye on selling a Corn MAR19 or MAY19 PUT. I am also considering a Vertical Credit spread and I’ll be shopping those later this week. Vertical Credit spreads are less risky than a naked option and also less profit (lower ROI).

The last two weeks have been very volatile with those giant moves in energy (NG and CL), the G 20 tariff news, and even though most of the commodity markets will be open tomorrow WED, there could be limited trading especially since it is one day before the OPEC meeting. As a seller of options, I’d rather be a little patient and get past the next couple of days, let the dust clear and then choose some strikes and get back into the oil and corn markets and look forward into the first half of calendar 2019 for some premium to sell.

Charts: I’ll post charts here for beans and corn.

That is all today. Thank you – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.