Greetings: cinco de mayo 05 MAY 2020 TUESDAY

In the news this week is the relief of stay at home orders across the country to varying degrees. The process of re-starting many facets of the economy has begun. With this news, the United States covid-19 death toll estimates through August 2020 has gone up from under 100k to near or over 200,000 deaths (depending on which computer model is used.) Crude Oil this morning returned to over $25 a barrel.

The path of recovery (USA) will remain measured for months and both advances and setbacks during this time will almost certainly happen. I had wanted to sell CALL options at higher strike on Crude Oil for several weeks but felt I could not do so with some rebound imminently in the works after the anomaly of the MAY contract going to negative values. For the JUN20 Crude this could happen again. With millions of barrels circling around the oceans and nowhere to land and storage space short, this cannot be ruled out.

Looking out over the next six months, crude oil demand will continue to be relatively weak – as airline traffic is down, gasoline demand is down, and the prospects for some fast recovery that could drive crude prices back up over $40 a barrel seem limited. Having said that I decided to sell the AUG20 $40.00-strike Crude Oil CALL for 0.36 ($360 credit):

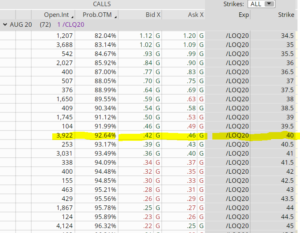

Here’s the option matrix for the AUG20 CALLS:

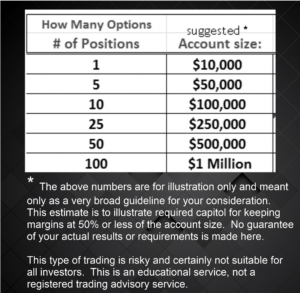

NEW TRADE: Sell 40-strike AUG20 Crude Oil CALL for 0.36 ($360 credit). Initial margin requirement, due to high volatility is $6775. There is a Prob. OTM of 93.75%. Possible return: 360/6775 = 5.3% with expiration in 72 days on 16 JULY 2020.

Here’s the chart:

Comments: I am also watching to sell some Gold strangles. The extremely high volatility may offer some opportunity for extremely high and low strikes. I want to wait another week or two to see what reactions to the new projection adjustments of death tolls in the USA unfold.

Corn: Normally, the JULY futures of corn reach highs about this time of the year. With meat packing plants closing and the media touting ‘possible shortages’, demand for feed corn (that use about 1/3 of USA corn production) may go down. Also with lower fuel prices, the demand for corn to make ethanol – as well as lower gasoline demand over the coming months, I expect corn has the potential for lower prices ahead. I’ll be watching for this to develop.

For the first time in a very long time (years), I will be checking prices on the E-Mini S&P500 options, with eyes toward selling a very high-strike CALL. Though the corn and S&P500 emini option trades may not materialize immediately, I’ll start watching those and will have comments in next week’s post about those.

I’m glad to see some opportunities in selling options but am moving slowly as these are very risky times, when daily headlines can and do influence markets unexpectedly.

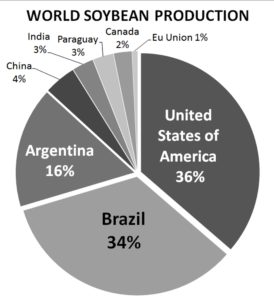

Soybeans: Though agricultural writers are expecting substantially reduced availability of beans this fall, the high tariffs, very low prices, and poor relations for China trade prospects, along with plentiful supplies of beans from the southern hemisphere (mostly Brazil) are very likely to depress prices. There may be opportunities to sell PUTs soon, and then possibly leg into short CALLS near harvest time.

That is all today. Stay well and if you choose any trades – watch them closely. -Don

If you have never traded the E-mini or the new Micro E-minis (1/10th the size of the regular e-minis), please check out this book on Amazon. You can click the book cover icon, then click “LOOK INSIDE” to see the Table of Contents:

Also, there are now over 27 videos on my YouTube Channel that is dedicated exclusively to teaching HOME INVESTORS how to Day Trade the new Micro E-mini Stock Index Futures: Here’s the link to the channel: MICRO E-MINI CHANNEL.

all the best wishes to everyone . -Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: cinco de mayo 05 MAY 2020 TUESDAY

In the news this week is the relief of stay at home orders across the country to varying degrees. The process of re-starting many facets of the economy has begun. With this news, the United States covid-19 death toll estimates through August 2020 has gone up from under 100k to near or over 200,000 deaths (depending on which computer model is used.) Crude Oil this morning returned to over $25 a barrel.

The path of recovery (USA) will remain measured for months and both advances and setbacks during this time will almost certainly happen. I had wanted to sell CALL options at higher strike on Crude Oil for several weeks but felt I could not do so with some rebound imminently in the works after the anomaly of the MAY contract going to negative values. For the JUN20 Crude this could happen again. With millions of barrels circling around the oceans and nowhere to land and storage space short, this cannot be ruled out.

Looking out over the next six months, crude oil demand will continue to be relatively weak – as airline traffic is down, gasoline demand is down, and the prospects for some fast recovery that could drive crude prices back up over $40 a barrel seem limited. Having said that I decided to sell the AUG20 $40.00-strike Crude Oil CALL for 0.36 ($360 credit):

Here’s the option matrix for the AUG20 CALLS:

NEW TRADE: Sell 40-strike AUG20 Crude Oil CALL for 0.36 ($360 credit). Initial margin requirement, due to high volatility is $6775. There is a Prob. OTM of 93.75%. Possible return: 360/6775 = 5.3% with expiration in 72 days on 16 JULY 2020.

Here’s the chart:

Comments: I am also watching to sell some Gold strangles. The extremely high volatility may offer some opportunity for extremely high and low strikes. I want to wait another week or two to see what reactions to the new projection adjustments of death tolls in the USA unfold.

Corn: Normally, the JULY futures of corn reach highs about this time of the year. With meat packing plants closing and the media touting ‘possible shortages’, demand for feed corn (that use about 1/3 of USA corn production) may go down. Also with lower fuel prices, the demand for corn to make ethanol – as well as lower gasoline demand over the coming months, I expect corn has the potential for lower prices ahead. I’ll be watching for this to develop.

For the first time in a very long time (years), I will be checking prices on the E-Mini S&P500 options, with eyes toward selling a very high-strike CALL. Though the corn and S&P500 emini option trades may not materialize immediately, I’ll start watching those and will have comments in next week’s post about those.

I’m glad to see some opportunities in selling options but am moving slowly as these are very risky times, when daily headlines can and do influence markets unexpectedly.

Soybeans: Though agricultural writers are expecting substantially reduced availability of beans this fall, the high tariffs, very low prices, and poor relations for China trade prospects, along with plentiful supplies of beans from the southern hemisphere (mostly Brazil) are very likely to depress prices. There may be opportunities to sell PUTs soon, and then possibly leg into short CALLS near harvest time.

That is all today. Stay well and if you choose any trades – watch them closely. -Don

If you have never traded the E-mini or the new Micro E-minis (1/10th the size of the regular e-minis), please check out this book on Amazon. You can click the book cover icon, then click “LOOK INSIDE” to see the Table of Contents:

Also, there are now over 27 videos on my YouTube Channel that is dedicated exclusively to teaching HOME INVESTORS how to Day Trade the new Micro E-mini Stock Index Futures: Here’s the link to the channel: MICRO E-MINI CHANNEL.

all the best wishes to everyone . -Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.