Greetings: Two New Trades Today 05 September 2019 THURSDAY

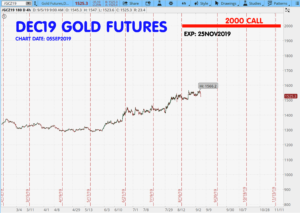

I sold the DEC19 Gold $2000-strike CALLs for 1.40 ($140)

Initial net margin: $763

Expiration: 81 days out Date EXP: 25NOV2019

Prob OTM: 98.7%

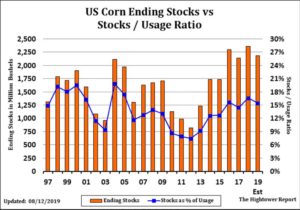

I sold the DEC19 Corn 320-strike PUTs for 1.50 cents ($75.00)

Initial net margin: $752

Expiration: 78 days out Date EXP: 22NOV2019

Prob OTM: 90%

Here are the charts for today’s new trades. See commentary below (scroll down.)

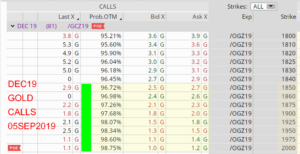

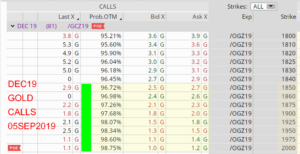

Commentary: Sometimes traders get lucky. That happened to me this morning. I sold this DEC19 Gold $2000-strike CALL for $140 early today. Gold was already down $20, and since I sold the call, it is now down -$35.50 at 10:43 AM ET. My reason for selling the $2000 is what I discussed in this Tuesday’s commentary, that Gold was UP so much, I’d rather sell a CALL than a PUT – for fear Gold could drop rapidly. This morning’s headlines are all about China/USA resuming trade talks and the stock market has zoomed up again on only a headline. And this is just one more volatile day – and today’s gains could come un-done at any time. There is no predicting this market from day-to-day. I sold this short Gold CALL that expires in late NOV19, about 81 days out. Gold could reach $2000 per ounce, I just don’t think it is likely at all to do it in this relatively short time frame. The 2000-strike I sold for 1.4 earlier today is now at 1.10, so I’m up $30 per option. I’ve put the DEC19 CALL class option matrix here in this graphic (below.) I put this up because I wanted to illustrate some of the strikes in this class I was shopping. I’ve marked the strikes from 1850 up to 2000 in this graphic. As you can see, in this range, they all have about a 97% chance of expiring worthless. Of course the lower the strike, the greater the risk. What, if anything, you trade is of course up to you. There would have been more premium to collect had I shopped farther out in time in the first quarter of calendar 2020, but with the volatility in the markets just now – I chose to stay lower risk with the fairly short time until expiration of the DEC19 class.

Corn chart and Commentary:

I looked back at historical charts for the DEC18 (2018) Corn – and last year this contract got down (contract low mark) to around $3.42 the first week of September. If any surprises are coming to boost corn prices, it will probably be some trade deal is reached and China would buy. I don’t necessarily think that will happen quickly, but it would be good for this trade if it did. There is also a good chance that the USDA’s next WASDE (supply -demand) could lower corn yield (production in this new crop 2019-2020) and that could support prices. As I mentioned in this week’s (Tues) commentary, the harvest for Corn in North America begins in only a couple of weeks now. The seasonal price tendency is to go down at harvest time, but corn prices (I think) have already been hit hard due to the higher acreage used in the last USDA/ WASDE report last month and the ag tariffs in place. (more comments below chart.)

You can see (below) that the August USDA/ WASDE had the new corn crop ending stocks up at about 2.2 billion bushels. This number is being debated because the USDA report in August did not take into account a lot of ‘prevent plant’ acres, less than stellar yields due to late plantings – and other factors. I’m not “trying to bet” that Corn prices will go UP, just that they probably won’t go down very much from where they are now.

The next USDA/WASDE crop report with supply-demand is coming up next a week from today, September 12th at 12 noon Eastern time. Here’s the link: https://www.usda.gov/oce/commodity/wasde/

Summary of positions as of 05 SEP 2019:

Today’s two new positions, plus the one below:

Crude DEC19 short strangles 75 CALL/ 35 PUT strikes. You can see the origination of that trade here:

That is all for today. I expect markets to continue to be volatile. (Who doesn’t?) I am being a little more selective (careful) than usual due to all the volatility as the latest news-cycle-headline seems to drive the markets.

I’m finishing this up – so I can get it out/ posted quickly. Good trading to all. – Don

BTW: here’s the link to the expiration dates (up-dated) for commodity options:

https://sellingcommodityoptions.com/SFOE.pdf

That- and many other links are on this website under the “Resource: Links Library” tab https://www.timefarming.com/blog/home/res

If you are a new subscriber, also check out the Video Training on this site at: https://www.timefarming.com/blog/home/vl/

Both are on the HOME page of this website.

Don A. Singletary

(end of post)

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: Two New Trades Today 05 September 2019 THURSDAY

I sold the DEC19 Gold $2000-strike CALLs for 1.40 ($140)

Initial net margin: $763

Expiration: 81 days out Date EXP: 25NOV2019

Prob OTM: 98.7%

I sold the DEC19 Corn 320-strike PUTs for 1.50 cents ($75.00)

Initial net margin: $752

Expiration: 78 days out Date EXP: 22NOV2019

Prob OTM: 90%

Here are the charts for today’s new trades. See commentary below (scroll down.)

Commentary: Sometimes traders get lucky. That happened to me this morning. I sold this DEC19 Gold $2000-strike CALL for $140 early today. Gold was already down $20, and since I sold the call, it is now down -$35.50 at 10:43 AM ET. My reason for selling the $2000 is what I discussed in this Tuesday’s commentary, that Gold was UP so much, I’d rather sell a CALL than a PUT – for fear Gold could drop rapidly. This morning’s headlines are all about China/USA resuming trade talks and the stock market has zoomed up again on only a headline. And this is just one more volatile day – and today’s gains could come un-done at any time. There is no predicting this market from day-to-day. I sold this short Gold CALL that expires in late NOV19, about 81 days out. Gold could reach $2000 per ounce, I just don’t think it is likely at all to do it in this relatively short time frame. The 2000-strike I sold for 1.4 earlier today is now at 1.10, so I’m up $30 per option. I’ve put the DEC19 CALL class option matrix here in this graphic (below.) I put this up because I wanted to illustrate some of the strikes in this class I was shopping. I’ve marked the strikes from 1850 up to 2000 in this graphic. As you can see, in this range, they all have about a 97% chance of expiring worthless. Of course the lower the strike, the greater the risk. What, if anything, you trade is of course up to you. There would have been more premium to collect had I shopped farther out in time in the first quarter of calendar 2020, but with the volatility in the markets just now – I chose to stay lower risk with the fairly short time until expiration of the DEC19 class.

Corn chart and Commentary:

I looked back at historical charts for the DEC18 (2018) Corn – and last year this contract got down (contract low mark) to around $3.42 the first week of September. If any surprises are coming to boost corn prices, it will probably be some trade deal is reached and China would buy. I don’t necessarily think that will happen quickly, but it would be good for this trade if it did. There is also a good chance that the USDA’s next WASDE (supply -demand) could lower corn yield (production in this new crop 2019-2020) and that could support prices. As I mentioned in this week’s (Tues) commentary, the harvest for Corn in North America begins in only a couple of weeks now. The seasonal price tendency is to go down at harvest time, but corn prices (I think) have already been hit hard due to the higher acreage used in the last USDA/ WASDE report last month and the ag tariffs in place. (more comments below chart.)

You can see (below) that the August USDA/ WASDE had the new corn crop ending stocks up at about 2.2 billion bushels. This number is being debated because the USDA report in August did not take into account a lot of ‘prevent plant’ acres, less than stellar yields due to late plantings – and other factors. I’m not “trying to bet” that Corn prices will go UP, just that they probably won’t go down very much from where they are now.

The next USDA/WASDE crop report with supply-demand is coming up next a week from today, September 12th at 12 noon Eastern time. Here’s the link: https://www.usda.gov/oce/commodity/wasde/

Summary of positions as of 05 SEP 2019:

Today’s two new positions, plus the one below:

Crude DEC19 short strangles 75 CALL/ 35 PUT strikes. You can see the origination of that trade here:

That is all for today. I expect markets to continue to be volatile. (Who doesn’t?) I am being a little more selective (careful) than usual due to all the volatility as the latest news-cycle-headline seems to drive the markets.

I’m finishing this up – so I can get it out/ posted quickly. Good trading to all. – Don

BTW: here’s the link to the expiration dates (up-dated) for commodity options:

https://sellingcommodityoptions.com/SFOE.pdf

That- and many other links are on this website under the “Resource: Links Library” tab https://www.timefarming.com/blog/home/res

If you are a new subscriber, also check out the Video Training on this site at: https://www.timefarming.com/blog/home/vl/

Both are on the HOME page of this website.

Don A. Singletary

(end of post)

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.