Trade Commentary MONDAY

May 6, 2019

Greetings:

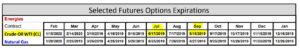

Crude Oil: The wheels sort of came off the “oil rally” recently. Television news, including financial channels, must depend on our short attention span and short memory. I see the same hosts that were discussing $85/ barrel oil 8 days ago, and now the stories (with those same hosts) this weekend are how Russian crude production is exceeding OPEC targets, inventories are up, and the tilt has suddenly turned to a more bearish direction. I suspect all this “news” will continue to flip-flop over the next few months. As you know, I hold two short strangles in crude: the JUL19 75C/50P and the SEP19 80C/45P. Those JUL19 short strangles expire only 42 days (see below.) I plan on more Crude short strangles a little farther out soon.

You can download the whole sheet of expiration dates here: https://sellingcommodityoptions.com/SFOE.pdf

You can download the whole sheet of expiration dates here: https://sellingcommodityoptions.com/SFOE.pdf

Gold: The two factors that seem mostly likely to change the value of gold are the equities markets and the $US Dollar. Last week the USA “FED” said no reduction of interest rates will happen – and this implied there won’t be an increase either. So long as the stock market(s) keep their attraction to capital, the price of gold has a limited upside. The USA employment numbers and economy got good news in reports last week. Although always subject to change – that is the prevalent consensus. I was glad to be able to sell that SEP19 1500C and especially, the 1160 PUT recently. We option-sellers play the game of guessing where prices will NOT go. Still, we should not get complacent about “playing on the train track,” as we seemingly always live with the possibility that things can change fast. I have gold lassoed into a range $340 wide (1500 minus 1160), but keep in mind if we use the “200% rule”, that range gets considerably more narrow. So long as we are good money-risk managers, we seem to have good chances at profits.

Curious thing about gold. I heard Warren Buffett in some interview once talking about gold and he said (paraphrasing here): “If you took all the gold in the world and put it in one place, it would make a cube that is only 68 feet on each side. It just sits there, it doesn’t produce anything, and it doesn’t do anything.”

Soybeans and Corn:

I saw an article last week on an ag website that headlined: $6 Soybeans could become a Reality It seems to me the most useless phrase in the English language is when someone says: “Anything could happen.” As we have discussed on the website here, bean stocks are extremely burdensome. That is why I am comfortable holding my short NOV19 soybean 1200-strike and 1100-strike CALL options. I sold the 1200-CALL back in April. Here’s a link to the post that day: short 1200 bean call

Soybean stocks were going to be large anyway, and then came the tariffs and what followed was a 40% reduction of soybean shipments to the USA’s largest customer, China. This made already huge stocks even larger – and the result was an even more bearish picture for bean prices this year. Some speculate that since China has sourced more beans from our competitors (like Brazil) that the USA might never get back the huge market share we had prior to the tariffs. Even if there is some progress this week with what are called “trade negotiations” any good news won’t make much difference to the soybean market. There is, however, the potential for the negotiations to have a huge impact on corn prices. The MAY WASDE report might have more acres shifted from corn to soybean production, due to shorter maturity (possibly lower corn yields) due to planting schedules affected by wet weather.

Since the COT (commitment of traders) reports show a huge short position, there is always a possibility of short-covering to happen fast if there is a swift and helpful resolution that would result in China buying huge amounts of USA corn. This, as I mentioned recently, is why I am not presently short CORN CALLs. I intend to sell corn CALLs but there is plenty of time and I want to just stand aside on that for now and see what happens.

You can see the soybean prices here in NOV19’s chart:

Just so you know: The Seasonal Trend for the NOV soybean prices is for HIGHER prices in growing season (N. American Summer.) This year, that is NOT happening, so we have a “counter-seasonal” year. Events like this can skew average seasonal price charts to some degree. I do have a book out with seasonal average price charts for 14 different commodity contracts; it’s listed on Amazon at: http://bit.ly/SCCharts

free Prime shipping

Back to Corn for just a moment: It will take some really strong and good export news to get corn prices to stay at over a $4.00 level. Just so you get a more ‘balanced’ view, I’m putting a link here to a story by Anna-Lisa Laca “Weather Worries Could Help Corn Break $4 Price” The article is at AgWeb.com.

https://www.agweb.com/article/weather-worries-could-help-corn-break-4-price/

Just so you know: The main audience for the material at AgWeb.com is the producer, the farmers of all sizes. Everyone of these farmers would love to hear of $4 Corn Prices or higher. Over the years – farmers have had to develop a strong resilience in order to face many hardships and uncertainty. Perhaps this is the source of the abundant amount of optimism among them.

There’s another article at AgWeb by Tyne Morgan titled: Wiesemeyer: Presidents Trump, Xi Need a Trade Deal Win

Although a 100 member delegation party from China will be in D. C. this week, the Chinese President Xi is not scheduled to come to Washington DC until the second or third week of June. The jest of the above article is that we probably won’t have any trade announcements until the June meetings between Presidents. For me, personally, it will be interesting to see if news bits this week of all the meetings in progress will influence Corn prices. There have already been so many positive posturing moves, we are all getting immune to them.

The next USDA WASDE (Dept. of Ag World Ag Supply-Demand Estimates will be at 12 noon, this Friday, May 10th, 2019.

The LINK is here: https://www.usda.gov/oce/commodity/wasde/

On a final note today: My short Crude Oil 75-strike JUL19 CALL that I sold for 0.11 ($110 each) closed Friday at 0.05 ($50). I recall that it was only a few days ago (a week or two) that I was down on this position – for that reason, I will consider taking a profit soon on this one, and then shopping for something safer. I feel sort of “50/50” about this as it expires soon (42 days.) We’ll see. The price of my crude oil short 45-strike SEP19 PUTs (I sold for 0.17) is up – at a close of 0.28 on Friday; I’ll be watching this one closely. I remind myself, this one is still 16 dollars above that 45-strike, a good distance.

I was pondering the fact that being a trader has little room for hubris – since it so easily humbles all of us so often. This had me remembering my dear old Grandmother Mary who played the piano for her church each Sunday for over 30 years. She was a lovely lady but also known for the discipline she so generously gave to her 17 grandchildren. I recall she once quipped at me: “Donald, you must always remember that you are a very unique person……… just like everybody else.”

Have a great week. Thank you – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Trade Commentary MONDAY

May 6, 2019

Greetings:

Crude Oil: The wheels sort of came off the “oil rally” recently. Television news, including financial channels, must depend on our short attention span and short memory. I see the same hosts that were discussing $85/ barrel oil 8 days ago, and now the stories (with those same hosts) this weekend are how Russian crude production is exceeding OPEC targets, inventories are up, and the tilt has suddenly turned to a more bearish direction. I suspect all this “news” will continue to flip-flop over the next few months. As you know, I hold two short strangles in crude: the JUL19 75C/50P and the SEP19 80C/45P. Those JUL19 short strangles expire only 42 days (see below.) I plan on more Crude short strangles a little farther out soon.

Gold: The two factors that seem mostly likely to change the value of gold are the equities markets and the $US Dollar. Last week the USA “FED” said no reduction of interest rates will happen – and this implied there won’t be an increase either. So long as the stock market(s) keep their attraction to capital, the price of gold has a limited upside. The USA employment numbers and economy got good news in reports last week. Although always subject to change – that is the prevalent consensus. I was glad to be able to sell that SEP19 1500C and especially, the 1160 PUT recently. We option-sellers play the game of guessing where prices will NOT go. Still, we should not get complacent about “playing on the train track,” as we seemingly always live with the possibility that things can change fast. I have gold lassoed into a range $340 wide (1500 minus 1160), but keep in mind if we use the “200% rule”, that range gets considerably more narrow. So long as we are good money-risk managers, we seem to have good chances at profits.

Soybeans and Corn:

I saw an article last week on an ag website that headlined: $6 Soybeans could become a Reality It seems to me the most useless phrase in the English language is when someone says: “Anything could happen.” As we have discussed on the website here, bean stocks are extremely burdensome. That is why I am comfortable holding my short NOV19 soybean 1200-strike and 1100-strike CALL options. I sold the 1200-CALL back in April. Here’s a link to the post that day: short 1200 bean call

Soybean stocks were going to be large anyway, and then came the tariffs and what followed was a 40% reduction of soybean shipments to the USA’s largest customer, China. This made already huge stocks even larger – and the result was an even more bearish picture for bean prices this year. Some speculate that since China has sourced more beans from our competitors (like Brazil) that the USA might never get back the huge market share we had prior to the tariffs. Even if there is some progress this week with what are called “trade negotiations” any good news won’t make much difference to the soybean market. There is, however, the potential for the negotiations to have a huge impact on corn prices. The MAY WASDE report might have more acres shifted from corn to soybean production, due to shorter maturity (possibly lower corn yields) due to planting schedules affected by wet weather.

Since the COT (commitment of traders) reports show a huge short position, there is always a possibility of short-covering to happen fast if there is a swift and helpful resolution that would result in China buying huge amounts of USA corn. This, as I mentioned recently, is why I am not presently short CORN CALLs. I intend to sell corn CALLs but there is plenty of time and I want to just stand aside on that for now and see what happens.

You can see the soybean prices here in NOV19’s chart:

free Prime shipping

Back to Corn for just a moment: It will take some really strong and good export news to get corn prices to stay at over a $4.00 level. Just so you get a more ‘balanced’ view, I’m putting a link here to a story by Anna-Lisa Laca “Weather Worries Could Help Corn Break $4 Price” The article is at AgWeb.com.

https://www.agweb.com/article/weather-worries-could-help-corn-break-4-price/

There’s another article at AgWeb by Tyne Morgan titled: Wiesemeyer: Presidents Trump, Xi Need a Trade Deal Win

Although a 100 member delegation party from China will be in D. C. this week, the Chinese President Xi is not scheduled to come to Washington DC until the second or third week of June. The jest of the above article is that we probably won’t have any trade announcements until the June meetings between Presidents. For me, personally, it will be interesting to see if news bits this week of all the meetings in progress will influence Corn prices. There have already been so many positive posturing moves, we are all getting immune to them.

The next USDA WASDE (Dept. of Ag World Ag Supply-Demand Estimates will be at 12 noon, this Friday, May 10th, 2019.

The LINK is here: https://www.usda.gov/oce/commodity/wasde/

On a final note today: My short Crude Oil 75-strike JUL19 CALL that I sold for 0.11 ($110 each) closed Friday at 0.05 ($50). I recall that it was only a few days ago (a week or two) that I was down on this position – for that reason, I will consider taking a profit soon on this one, and then shopping for something safer. I feel sort of “50/50” about this as it expires soon (42 days.) We’ll see. The price of my crude oil short 45-strike SEP19 PUTs (I sold for 0.17) is up – at a close of 0.28 on Friday; I’ll be watching this one closely. I remind myself, this one is still 16 dollars above that 45-strike, a good distance.

Have a great week. Thank you – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.