The stock market volatility is often likened to a roller coaster ride. On Friday, one of the analyst said the action lately probably belonged in an amusement park.

- Also in last week’s news: The U.S. trade deficit widened to USD 55.5 billion in October of 2018 from an upwardly revised USD 54.6 billion in the previous month and compared with market expectations of a USD 54.9 billion gap. It is the highest deficit in ten years (since October of 2008) as lower soybean sales weighed down on exports and imports reached a new record high.

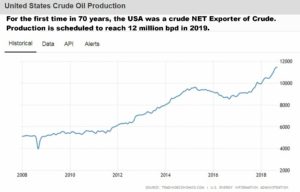

- For the first time in 70 years, the United States became a net exporter of crude oil.

- Late on Friday, news was released that OPEC (along with a few other nations) would cut crude oil production by 1.2 million bpd (barrels per day) – although some of the details were not clearly stated.

Gold: Since the FED has hinted any new hikes might be few and potentially far away and the stock markets are not showing any tendency to stabilize – there could be some continued rally in gold futures prices. I’m inclined to shop for PUTS to sell at present – more than CALLs, although I hope for a chance to SELL more CALLS in the not too distant future to form more short strangles in 2019.

Crude: With the major oil producers agreeing to cut 1.2 million bpd off production and the United States now being a net exporter for he first time in 70 years, this could be enough to slow the decline in oil prices for a while. Still, there is no denying that plenty of supplies and stocks are available. Should the world economy weaken with slow downs, it will probably be very difficult for crude to make it back up to above US$ 65 per barrel and / or anything close to the October peak prices of near $79. I expect to be making some trades this week in crude and will discuss them in a newsletter when/if that happens.

Soybeans: As you know, I am short the MAR19 1100-strike soybean CALLs at 3.0 cents and I have a GTC order to buy this trade back to close it at 1.5 cents. Whether I am able to get this GTC order filled or not, I expect that if China buys beans sometime soon (like the next two weeks) that soybean prices will rise a little more on that news. My opinion is that any rises in soybean prices might be limited and temporary. The market fundamentals just don’t support higher prices and the Brazil harvest begins in only three weeks. After this week’s WASDE (see below,) I will be shopping for more soybean CALLS to sell.

WASDE Report: This week on December 11th, Tuesday at noon (New York time)- the USDA’s WASDE (WAS’-dee) World Ag Supply & Demand Estimates will be issued. The link to this report is on this website at the Resource: Links Library tab under USDA. For some time now, I’ve posted the fundamental info that soybeans have mutli-year high burdensome stocks/supplies – while USA Corn supplies are projected to be a multi-year low stocks. The WASDE report this Tuesday is almost certainly going to re-confirm these numbers. In the United States the rain and snowy weather came at the tail end of the soybean and corn harvesting -and won’t have much if any effect on the overall numbers. If I can get enough premium, I expect to be shopping to sell more soybean CALLS and will be looking to SELL corn PUT options (with expirations inside JUL2019.)

I’ll be posting futures charts as I place these trades in the newsletters. I’ll be listening and watching this week for some reasons to confirm a crude oil price range that would contain prices to above $40 and below $70 to $75 a barrel. As I make these trades, I will also include the 15-year price behavior (aka: seasonal patterns) charts. Seasonal charts are of course a great help, but we must always keep in mind that any markets fundamentals can swamp (vary) these patterns in any given season.

One of the advantages of commodity options over stock options is that, while stocks trade for a multiple of projected earnings, physical commodities will trade based on the supply-demand fundamentals for the actual product’s value. Selling commodity options has the goal of shorting options with strikes at prices that are NOT likely to be reached, not trying to guess the direction and amplitude of prices as would be required by option buyers.

There should be illustration-chart updates this week on the estimated price versus the ending stocks from KSU Kansas State University (for soybeans and corn) after the WASDE report.. Here’s the links to each of these charts: (Don’t forget to refresh your browser to get the latest versions. It sometimes is a day or two after the WASDE report before they are updated.)

KSU Chart – Soybean Price vs. STU: LINK

KSU Chart – Corn Price vs. STU: LINK

The Resource: Links Library tab on this website has many helpful links to research items on various commodities. Also listed there is a blank Excel sheet to track your trades, a list of commodity option expiration dates, a list of symbols and contract specifications for popularly traded commodities, and much more.

As you may know, the last week of December often has slower trading since many people are on holidays with friends and family, vacation, and travel plans. I expect to be able to find and place trades for this month very soon, and I doubt there will be much activity between December 24 and January 2nd.

That is all for today. Thank you – Don

Please consider this idea for a low-cost and very thoughtful gift, always suitable for young people and young families:

Thank you.- Don

I publish several personal finance books, but there is one of them that I enjoyed writing the most. I sell it for less than $10 w/ free prime shipping – for as low a price as I can because it both motivates and educates young people how to start out investing – so they won’t have to spend a lifetime concerned with their with day-to-day personal financial challenges.

It is a very plain language and fun book, very different than most of the “stock market for beginners” titles out there. In the first chapter, they learn how to choose good stocks and to automatically reinvest the dividends to buy more of it. This book is very deliberately motivating and full of quotes and stories from people like Warren Buffett and Peter Lynch. Every opportunity and idea in this read aims to encourage the reader to start investing as soon as possible. Most importantly, it points the reader to the fun idea of creating a second income to use their entire lives, not just retirement. It illustrates an easy way to mark their progress in making the financial side of life a realistic and enjoyable goal. Personal investing is not about doing without things; it is about making the most of what you have over an entire lifetime.

I’m giving 100% of my royalties on this book for all sales in December 2018 to St. Jude’s Children’s Hospital. The book has 100% all five-star reviews and is available on this LINK with free Amazon Prime shipping. (they also have a gift option at checkout and you can send it to any address by prime shipping.) It will cost you less than $10 postage paid to send it out – and they will thank you for it, I promise. Please tell your friends about this offer, if you please to do so. Thank you.

or you can just tap the cover icon below for more information:

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

The stock market volatility is often likened to a roller coaster ride. On Friday, one of the analyst said the action lately probably belonged in an amusement park.

Gold: Since the FED has hinted any new hikes might be few and potentially far away and the stock markets are not showing any tendency to stabilize – there could be some continued rally in gold futures prices. I’m inclined to shop for PUTS to sell at present – more than CALLs, although I hope for a chance to SELL more CALLS in the not too distant future to form more short strangles in 2019.

Crude: With the major oil producers agreeing to cut 1.2 million bpd off production and the United States now being a net exporter for he first time in 70 years, this could be enough to slow the decline in oil prices for a while. Still, there is no denying that plenty of supplies and stocks are available. Should the world economy weaken with slow downs, it will probably be very difficult for crude to make it back up to above US$ 65 per barrel and / or anything close to the October peak prices of near $79. I expect to be making some trades this week in crude and will discuss them in a newsletter when/if that happens.

Soybeans: As you know, I am short the MAR19 1100-strike soybean CALLs at 3.0 cents and I have a GTC order to buy this trade back to close it at 1.5 cents. Whether I am able to get this GTC order filled or not, I expect that if China buys beans sometime soon (like the next two weeks) that soybean prices will rise a little more on that news. My opinion is that any rises in soybean prices might be limited and temporary. The market fundamentals just don’t support higher prices and the Brazil harvest begins in only three weeks. After this week’s WASDE (see below,) I will be shopping for more soybean CALLS to sell.

WASDE Report: This week on December 11th, Tuesday at noon (New York time)- the USDA’s WASDE (WAS’-dee) World Ag Supply & Demand Estimates will be issued. The link to this report is on this website at the Resource: Links Library tab under USDA. For some time now, I’ve posted the fundamental info that soybeans have mutli-year high burdensome stocks/supplies – while USA Corn supplies are projected to be a multi-year low stocks. The WASDE report this Tuesday is almost certainly going to re-confirm these numbers. In the United States the rain and snowy weather came at the tail end of the soybean and corn harvesting -and won’t have much if any effect on the overall numbers. If I can get enough premium, I expect to be shopping to sell more soybean CALLS and will be looking to SELL corn PUT options (with expirations inside JUL2019.)

I’ll be posting futures charts as I place these trades in the newsletters. I’ll be listening and watching this week for some reasons to confirm a crude oil price range that would contain prices to above $40 and below $70 to $75 a barrel. As I make these trades, I will also include the 15-year price behavior (aka: seasonal patterns) charts. Seasonal charts are of course a great help, but we must always keep in mind that any markets fundamentals can swamp (vary) these patterns in any given season.

One of the advantages of commodity options over stock options is that, while stocks trade for a multiple of projected earnings, physical commodities will trade based on the supply-demand fundamentals for the actual product’s value. Selling commodity options has the goal of shorting options with strikes at prices that are NOT likely to be reached, not trying to guess the direction and amplitude of prices as would be required by option buyers.

There should be illustration-chart updates this week on the estimated price versus the ending stocks from KSU Kansas State University (for soybeans and corn) after the WASDE report.. Here’s the links to each of these charts: (Don’t forget to refresh your browser to get the latest versions. It sometimes is a day or two after the WASDE report before they are updated.)

KSU Chart – Soybean Price vs. STU: LINK

KSU Chart – Corn Price vs. STU: LINK

The Resource: Links Library tab on this website has many helpful links to research items on various commodities. Also listed there is a blank Excel sheet to track your trades, a list of commodity option expiration dates, a list of symbols and contract specifications for popularly traded commodities, and much more.

As you may know, the last week of December often has slower trading since many people are on holidays with friends and family, vacation, and travel plans. I expect to be able to find and place trades for this month very soon, and I doubt there will be much activity between December 24 and January 2nd.

That is all for today. Thank you – Don

Please consider this idea for a low-cost and very thoughtful gift, always suitable for young people and young families:

Thank you.- Don

I publish several personal finance books, but there is one of them that I enjoyed writing the most. I sell it for less than $10 w/ free prime shipping – for as low a price as I can because it both motivates and educates young people how to start out investing – so they won’t have to spend a lifetime concerned with their with day-to-day personal financial challenges.

It is a very plain language and fun book, very different than most of the “stock market for beginners” titles out there. In the first chapter, they learn how to choose good stocks and to automatically reinvest the dividends to buy more of it. This book is very deliberately motivating and full of quotes and stories from people like Warren Buffett and Peter Lynch. Every opportunity and idea in this read aims to encourage the reader to start investing as soon as possible. Most importantly, it points the reader to the fun idea of creating a second income to use their entire lives, not just retirement. It illustrates an easy way to mark their progress in making the financial side of life a realistic and enjoyable goal. Personal investing is not about doing without things; it is about making the most of what you have over an entire lifetime.

I’m giving 100% of my royalties on this book for all sales in December 2018 to St. Jude’s Children’s Hospital. The book has 100% all five-star reviews and is available on this LINK with free Amazon Prime shipping. (they also have a gift option at checkout and you can send it to any address by prime shipping.) It will cost you less than $10 postage paid to send it out – and they will thank you for it, I promise. Please tell your friends about this offer, if you please to do so. Thank you.

or you can just tap the cover icon below for more information:

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.