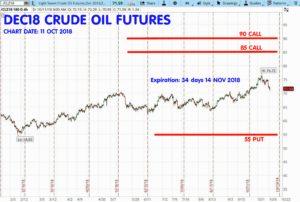

Crude Oil: All the talk of $100 a barrel crude has disappeared. Oil prices were driven up by too much supply disruption premium due to the hurricane Michael, the effectiveness of Iranian sanctions was over estimated, and domestic production had been underestimated. Now, suddenly I almost have to wonder if this ‘reversal’ has any more credence than the bull camp held over the last two weeks. I have to say I’m glad I’m not trying to guess the direction and amplitude of the next price move and am instead – in short strangles. My short 55 PUT, short 85 and 90 strike CALLs for DEC18 crude futures have only 34 days until expiration on 14NOV2018 – and they are likely to remain out of reach of the present 71.40 DEC18 crude price (chart below). I continue to remain short the JAN19 50-strike PUT and the 90-strike CALL that expire in 64 days out on 14DEC2018 (not shown.)

Gold: Today (11 OCT 2018) DEC18 Gold futures up about $30 near $1222/ounce. I remain short the 1400 CALL and 1050 PUT and expiration is 47 days out on 27 NOV 2018 (shown in chart below). And I continue to hold a very wide short strangle on JAN19’s class of Gold options, the 1500 CALL and 1000 PUT. If you look at the newsletter’s Trade Summary sheet September 9, 2018, I sold this JAN19 strangle for $140 each (not shown here.)

Gold’s recent positive price bounce is attributed to international tensions, a rapid stock market correction that is unexpectedly deeper than anticipated, and a pause in the $US dollar Index climb precipitated by rising FED rates in the United States. Today’s +$30 gain is = 2.4%.

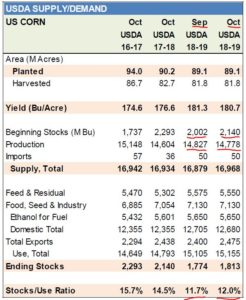

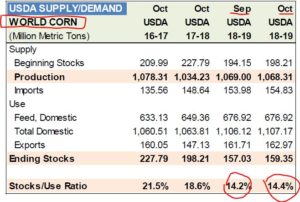

Corn: The USDA/ WASDE report today reduced the crop (United States) yield for 2018-2019 from last month’s 181.3 bu/acre down to 180.7 bu/acre in the October report. This was a 59 million bushel reduction in yield, and I have to say out of total production of 14.778 billion bushels, this is virtually no difference at all. 59/14778 is only .4% change. The DEC18 futures bounced up 6.00 cents today, but still the price of the DEC18 futures at 369.00 is probably safely below the $4.00-strike CALLs on this contract. I will still be watching these 400-strikes (and other strikes) closely; it is not out of the question that today’s report that lowered yield, could portend further reductions as the harvest progresses. I have taken notice that while DEC18 corn prices have not risen, they also have not gone down – as is the normal seasonal pattern. You recall that rains last week in North America delayed the harvest. The impact of today’s report on WORLD (not just USA) is even smaller, as you will see by the table(s) below. You can download today’s WASDE report here: https://www.usda.gov/oce/commodity/wasde/

source: CME

As you will see on the recent TRADE SUMMARY sheet in the most recent newsletter, I sold the 400 DEC18 Corn CALL at 1.125 and then exited near 2.25 cents with a -$56.25 loss on those. Now (only with the genius of hindsight), I can see I probably should have held them, but with the information I had at the time, I felt the risk was not worth the small amount of premium I collected. All of us, of course, would be better investors with ‘the genius of hindsight.’ This is not an uncommon thing to happen at all. We all make our individual decisions with the information we have at the time we make decisions. My decision, at the time I exited these — was “not to risk several hundred dollars, while trying to make only $56.25.” I don’t regret my decision, but I never quite like a losing trade even if it wasn’t much. What I definitely would have regretted is losing a lot while trying to make so little. This is the nature of trading. Our goal is to survive to make money, not to be 100% correct on every decision (an impossible goal for any of us.)

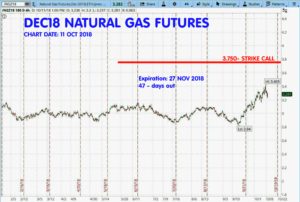

Natural Gas: Today’s report, see: https://www.eia.gov/naturalgas/weekly/ held no surprises. I remain short my 3.75 DEC18 Natural Gas CALL -strike. NG prices did spike with some rig shutdowns temporarily cause by hurricane Michael and that threat is long passed now. I expect more price moderation ahead; the seasonal tendency pattern is down for the DEC contract. The Winter Fuels Outlook from EIA today (see: https://www.eia.gov/outlooks/steo/special/winter/2018_winter_fuels.pdf ) had this summary:

EIA expects that average household bills for most major energy sources of home heating will rise this winter because of higher forecast energy prices. Temperatures are expected to be roughly the same as last winter in much of the country. Forecast winter home heating expenditure changes vary significantly by both fuel and region. On average, EIA expects natural gas bills to rise by 5%, home heating oil by 20%, and electricity by 3%. However, expenditures for homes that use propane are expected to be about the same as last winter. Although the increased expenditures largely reflect higher energy prices rather than colder temperatures, a warmer than-average winter would see smaller increases in expenditures and a colder-than-average winter would see larger increases in expenditures compared with last winter.

Truth be told, weather forecasters are never very good at long-range seasonal predictions. I really doubt this (above) report today has much bearing on anything. Very often the coldest of individual days are during what is -on the average- called a “warmer than expected” winter season. Mark Twain was not a fan of statistics and is quoted as saying, “A man with one foot in a fire and the other foot in a bucket of ice is, on the average, doing very well.”

I don’t expect to be doing any new trading tomorrow (Friday 12 OCT 2018.) I am looking at selling some Crude Oil strangles in the April 2019 class of options, and I will have some ThinkOrSwim option “Analysis” charts in Monday’s Trade Commentary for you to consider. Going all the way out to April 2019, I feel, will allow me to place some very “wide” short strangles, which is key to finding low-risk trades. While it often takes more time to make money in father out trades, the safety gained with using wider strangles can make up for that. I hope to illustrate that in the Trade Commentary this Monday. I am also working on an article to place in the Selling Commodity Options blog for next week that discusses some points on managing money in a trading account, specifically with comments on account size versus draw-down percentages. I will notify you when I post that article and put the link here, so you can find it easily.

Good trading to all of you. It will be interesting to watch Crude Oil price behavior and the NG next week. Thank you all for your support. If you have a friend interested in the type of trading we do, please download this Patterns for Profits – An Intro to Seasonal Commodity Trading booklet and send it to them. It has lot of pictures and charts to help explain what we do.

Have a great weekend. – Don

Don A. Singletary

Download a list of futures symbols and months / month codes and download a list of option expiration dates on the

Resource: Links Library

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Crude Oil: All the talk of $100 a barrel crude has disappeared. Oil prices were driven up by too much supply disruption premium due to the hurricane Michael, the effectiveness of Iranian sanctions was over estimated, and domestic production had been underestimated. Now, suddenly I almost have to wonder if this ‘reversal’ has any more credence than the bull camp held over the last two weeks. I have to say I’m glad I’m not trying to guess the direction and amplitude of the next price move and am instead – in short strangles. My short 55 PUT, short 85 and 90 strike CALLs for DEC18 crude futures have only 34 days until expiration on 14NOV2018 – and they are likely to remain out of reach of the present 71.40 DEC18 crude price (chart below). I continue to remain short the JAN19 50-strike PUT and the 90-strike CALL that expire in 64 days out on 14DEC2018 (not shown.)

Gold: Today (11 OCT 2018) DEC18 Gold futures up about $30 near $1222/ounce. I remain short the 1400 CALL and 1050 PUT and expiration is 47 days out on 27 NOV 2018 (shown in chart below). And I continue to hold a very wide short strangle on JAN19’s class of Gold options, the 1500 CALL and 1000 PUT. If you look at the newsletter’s Trade Summary sheet September 9, 2018, I sold this JAN19 strangle for $140 each (not shown here.)

Gold’s recent positive price bounce is attributed to international tensions, a rapid stock market correction that is unexpectedly deeper than anticipated, and a pause in the $US dollar Index climb precipitated by rising FED rates in the United States. Today’s +$30 gain is = 2.4%.

Corn: The USDA/ WASDE report today reduced the crop (United States) yield for 2018-2019 from last month’s 181.3 bu/acre down to 180.7 bu/acre in the October report. This was a 59 million bushel reduction in yield, and I have to say out of total production of 14.778 billion bushels, this is virtually no difference at all. 59/14778 is only .4% change. The DEC18 futures bounced up 6.00 cents today, but still the price of the DEC18 futures at 369.00 is probably safely below the $4.00-strike CALLs on this contract. I will still be watching these 400-strikes (and other strikes) closely; it is not out of the question that today’s report that lowered yield, could portend further reductions as the harvest progresses. I have taken notice that while DEC18 corn prices have not risen, they also have not gone down – as is the normal seasonal pattern. You recall that rains last week in North America delayed the harvest. The impact of today’s report on WORLD (not just USA) is even smaller, as you will see by the table(s) below. You can download today’s WASDE report here: https://www.usda.gov/oce/commodity/wasde/

source: CME

As you will see on the recent TRADE SUMMARY sheet in the most recent newsletter, I sold the 400 DEC18 Corn CALL at 1.125 and then exited near 2.25 cents with a -$56.25 loss on those. Now (only with the genius of hindsight), I can see I probably should have held them, but with the information I had at the time, I felt the risk was not worth the small amount of premium I collected. All of us, of course, would be better investors with ‘the genius of hindsight.’ This is not an uncommon thing to happen at all. We all make our individual decisions with the information we have at the time we make decisions. My decision, at the time I exited these — was “not to risk several hundred dollars, while trying to make only $56.25.” I don’t regret my decision, but I never quite like a losing trade even if it wasn’t much. What I definitely would have regretted is losing a lot while trying to make so little. This is the nature of trading. Our goal is to survive to make money, not to be 100% correct on every decision (an impossible goal for any of us.)

Natural Gas: Today’s report, see: https://www.eia.gov/naturalgas/weekly/ held no surprises. I remain short my 3.75 DEC18 Natural Gas CALL -strike. NG prices did spike with some rig shutdowns temporarily cause by hurricane Michael and that threat is long passed now. I expect more price moderation ahead; the seasonal tendency pattern is down for the DEC contract. The Winter Fuels Outlook from EIA today (see: https://www.eia.gov/outlooks/steo/special/winter/2018_winter_fuels.pdf ) had this summary:

Truth be told, weather forecasters are never very good at long-range seasonal predictions. I really doubt this (above) report today has much bearing on anything. Very often the coldest of individual days are during what is -on the average- called a “warmer than expected” winter season. Mark Twain was not a fan of statistics and is quoted as saying, “A man with one foot in a fire and the other foot in a bucket of ice is, on the average, doing very well.”

I don’t expect to be doing any new trading tomorrow (Friday 12 OCT 2018.) I am looking at selling some Crude Oil strangles in the April 2019 class of options, and I will have some ThinkOrSwim option “Analysis” charts in Monday’s Trade Commentary for you to consider. Going all the way out to April 2019, I feel, will allow me to place some very “wide” short strangles, which is key to finding low-risk trades. While it often takes more time to make money in father out trades, the safety gained with using wider strangles can make up for that. I hope to illustrate that in the Trade Commentary this Monday. I am also working on an article to place in the Selling Commodity Options blog for next week that discusses some points on managing money in a trading account, specifically with comments on account size versus draw-down percentages. I will notify you when I post that article and put the link here, so you can find it easily.

Good trading to all of you. It will be interesting to watch Crude Oil price behavior and the NG next week. Thank you all for your support. If you have a friend interested in the type of trading we do, please download this Patterns for Profits – An Intro to Seasonal Commodity Trading booklet and send it to them. It has lot of pictures and charts to help explain what we do.

Have a great weekend. – Don

Don A. Singletary

Download a list of futures symbols and months / month codes and download a list of option expiration dates on the

Resource: Links Library

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.