(all the pages on this website are available in AMP (Accelerated Mobile Pages) for easy reading on smart phones. See your browser settings or just ad /amp to the URL for this easy-to-read, faster loading format. iOS devices have a tap toggle just to the left of the URL in Safari)

Gold: With the (United States mid-term) elections now over, many suspect the stock market might continue both volatility and more bullish moves ahead. The (USA) Fed chose NOT to raise interest rates in November – taken as a sign of a good economy without excessive inflation. The market mavens still think there are four small rate hikes coming in the next year. Those hikes and the USA election results, are taken to posture more weakness in the the $US Dollar. The majority opinion is that a falling dollar will allow gold to continue an uptrend, at least over the short-term. I take this “short-term” to mean the next two to six months.

Crude Oil: Three of the top weekly commodity market letters all agree on the short-term outlook for oil prices. They all agree that (paraphrased here) “..without production cutbacks, oil prices could be limited.” About the only thing I can draw from this common-denominator comment is that they are not bullish, and by implication, neither are they very bearish. The United States has increased its crude oil output to a record of about 11.6 million barrels per day (bpd.) Other nations including Russia and Saudi Arabia, increased production recently to counteract what had been thought of as a shortage due to Iranian oil sanctions. The result has been no shortage but an unexpected surge in crude oil supplies in the world resulting in lower prices.

I am of course short the DEC18 55-strike PUT that expires in two days on Wednesday of this week (14NOV) with the underlying DEC18 closed at 59.87 -.80 at close on Friday. I am also short the 50-strike Crude Oil PUTs in both JAN19 and APR19 classes.

Soybeans & Corn: For those of us who chose to short MAR19 soybean CALLs, the trade is working very well. The USDA/WASDE report last week 08NOV, reaffirmed the burdensome overstocks. MAR19 soybeans closed Friday at 898.75.

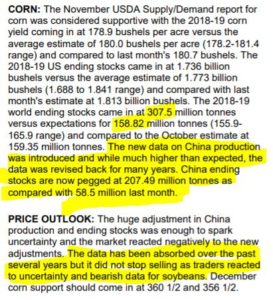

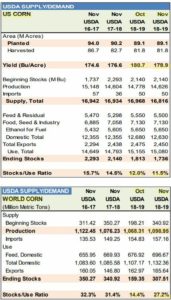

There was a real surprise and an unpredictable reveal in this report for Corn. One part of the Corn WASDE numbers was no surprise: USDA reported another reduction in the yield (bushels per acre) from 180.7 all the way down to 178.9. The would have been bullish for US Corn. Then came the surprise: the WASDE report unexpectedly made a huge adjustments on Chinese stocks (see table below) of corn that brought UP world supply stocks data. Investors in the face of very bearish soybean news, became afraid of corn prices due to the huge Chinese stocks adjustments. The USDA not only adjusted this month’s figures but made retroactive adjustments to years of Chinese stocks information. China does not have the open-reporting methods that are in the USDA domestic figures. There was a determination (for unspecified reasons) that the previous China numbers reported have been inaccurate. This is a rare thing to happen.

You can see in this table (below), while the US Corn STU went down, the WORLD Corn STU almost doubled due to the USDA’s adjustment to this year and previous year changes. A change of this magnitude surprised everyone.

source of the two (above tables) is: CME Group at: https://www.cmegroup.com/trading/agricultural/corn-reports.html

source of the two (above tables) is: CME Group at: https://www.cmegroup.com/trading/agricultural/corn-reports.html

Unrelated, but in a similar news story, some financial analyst have hinted they think China is down-playing their slowdown in economic growth (they suspect China has slowed down more than has been reported by state agencies from there.)

If soybeans should suddenly sell off in the coming week or two, there could be a chance I will take profits on my short MAR19 1100 soybean CALLs. I’ll be watching for this.

The Meats: Cattle Hogs – I had planned to try and trade some meat options this fall. After examining the options and finding very low open interest on the cattle and hog options, I have put this idea on the back burner at least until the first of the year 2019.

The Softs: Many brokers are reluctant to allow customers to trade options in some markets due to very low open interests. These would include orange juice (FCOJ/frozen concentrate OJ), lumber, and cocoa. The other softs of cotton, sugar, and coffee while most of the time – have the OI to trade, but there is another problem. All of these markets are traded ONLY at the ICE (the InterContinental Exchange headquartered in Atlanta, GA.) In the United States, the ICE has a policy of charging individual investors $1350 a year for live quotes. Most exchanges will allow delayed quotes FREE, but ICE strictly prohibits ANY and ALL brokers from supplying delayed quotes at any price to all investors. The ICE has made itself unique. Most other exchanges only charge $5 to $25 a month for live quotes and supply delayed data free– most brokers can and do absorb these small fees and offer quotes free to their customers. Due to the unreasonable fees charged by ICE, and their choice not to provide lesser cost delayed quotes at all, I will not be trading these markets at this time. I imagine if they would open up and provide fees at a reasonable cost, their OI and liquidity would also increase.

Just so you know (in case you ever wondered): There are markets for eggs, milk, rice, and many other lesser traded commodities that very, very few individual investors trade due to the very thinly traded characteristics of those markets.

Summary: So I’ll be watching Crude Oil carefully this week. Hightower’s weekly market letter refers to oil as: “Technical Trade: Deeply Oversold Crude Oil” in an article on Friday. They point out, as many of us have been thinking that the 22% decline in the last six weeks should result in a market that is extremely oversold. Maybe we’ll find out if this selling is at or near exhaustion this week.

I’m watching for more selling in soybeans, so I can take a profit on my short MAR19 1100-strike CALLs.

My position in Gold, short strangles: are all very wide 1100 on the low PUT-strikes – and 1500 and 1600 dollar per ounce in the high strike short CALLs. If the analysts are correct about a weaker $US Dollar ahead, gold could head back up soon. And don’t forget when/if the stock market has those huge dips and more volatile prices, the price of gold usually will go UP as some investors seek a ‘safe haven’ for funds.

Have a great week and thank you – Don

If you are a new reader on the free trial, please consider the very discounted annual rate will save you $90 over the monthly rate; please see: SUBSCRIBE PAGE for details.

Don A. Singletary

Gold: With the (United States mid-term) elections now over, many suspect the stock market might continue both volatility and more bullish moves ahead. The (USA) Fed chose NOT to raise interest rates in November – taken as a sign of a good economy without excessive inflation. The market mavens still think there are four small rate hikes coming in the next year. Those hikes and the USA election results, are taken to posture more weakness in the the $US Dollar. The majority opinion is that a falling dollar will allow gold to continue an uptrend, at least over the short-term. I take this “short-term” to mean the next two to six months.

Crude Oil: Three of the top weekly commodity market letters all agree on the short-term outlook for oil prices. They all agree that (paraphrased here) “..without production cutbacks, oil prices could be limited.” About the only thing I can draw from this common-denominator comment is that they are not bullish, and by implication, neither are they very bearish. The United States has increased its crude oil output to a record of about 11.6 million barrels per day (bpd.) Other nations including Russia and Saudi Arabia, increased production recently to counteract what had been thought of as a shortage due to Iranian oil sanctions. The result has been no shortage but an unexpected surge in crude oil supplies in the world resulting in lower prices.

I am of course short the DEC18 55-strike PUT that expires in two days on Wednesday of this week (14NOV) with the underlying DEC18 closed at 59.87 -.80 at close on Friday. I am also short the 50-strike Crude Oil PUTs in both JAN19 and APR19 classes.

Soybeans & Corn: For those of us who chose to short MAR19 soybean CALLs, the trade is working very well. The USDA/WASDE report last week 08NOV, reaffirmed the burdensome overstocks. MAR19 soybeans closed Friday at 898.75.

There was a real surprise and an unpredictable reveal in this report for Corn. One part of the Corn WASDE numbers was no surprise: USDA reported another reduction in the yield (bushels per acre) from 180.7 all the way down to 178.9. The would have been bullish for US Corn. Then came the surprise: the WASDE report unexpectedly made a huge adjustments on Chinese stocks (see table below) of corn that brought UP world supply stocks data. Investors in the face of very bearish soybean news, became afraid of corn prices due to the huge Chinese stocks adjustments. The USDA not only adjusted this month’s figures but made retroactive adjustments to years of Chinese stocks information. China does not have the open-reporting methods that are in the USDA domestic figures. There was a determination (for unspecified reasons) that the previous China numbers reported have been inaccurate. This is a rare thing to happen.

You can see in this table (below), while the US Corn STU went down, the WORLD Corn STU almost doubled due to the USDA’s adjustment to this year and previous year changes. A change of this magnitude surprised everyone.

If soybeans should suddenly sell off in the coming week or two, there could be a chance I will take profits on my short MAR19 1100 soybean CALLs. I’ll be watching for this.

The Meats: Cattle Hogs – I had planned to try and trade some meat options this fall. After examining the options and finding very low open interest on the cattle and hog options, I have put this idea on the back burner at least until the first of the year 2019.

The Softs: Many brokers are reluctant to allow customers to trade options in some markets due to very low open interests. These would include orange juice (FCOJ/frozen concentrate OJ), lumber, and cocoa. The other softs of cotton, sugar, and coffee while most of the time – have the OI to trade, but there is another problem. All of these markets are traded ONLY at the ICE (the InterContinental Exchange headquartered in Atlanta, GA.) In the United States, the ICE has a policy of charging individual investors $1350 a year for live quotes. Most exchanges will allow delayed quotes FREE, but ICE strictly prohibits ANY and ALL brokers from supplying delayed quotes at any price to all investors. The ICE has made itself unique. Most other exchanges only charge $5 to $25 a month for live quotes and supply delayed data free– most brokers can and do absorb these small fees and offer quotes free to their customers. Due to the unreasonable fees charged by ICE, and their choice not to provide lesser cost delayed quotes at all, I will not be trading these markets at this time. I imagine if they would open up and provide fees at a reasonable cost, their OI and liquidity would also increase.

Just so you know (in case you ever wondered): There are markets for eggs, milk, rice, and many other lesser traded commodities that very, very few individual investors trade due to the very thinly traded characteristics of those markets.

Summary: So I’ll be watching Crude Oil carefully this week. Hightower’s weekly market letter refers to oil as: “Technical Trade: Deeply Oversold Crude Oil” in an article on Friday. They point out, as many of us have been thinking that the 22% decline in the last six weeks should result in a market that is extremely oversold. Maybe we’ll find out if this selling is at or near exhaustion this week.

I’m watching for more selling in soybeans, so I can take a profit on my short MAR19 1100-strike CALLs.

My position in Gold, short strangles: are all very wide 1100 on the low PUT-strikes – and 1500 and 1600 dollar per ounce in the high strike short CALLs. If the analysts are correct about a weaker $US Dollar ahead, gold could head back up soon. And don’t forget when/if the stock market has those huge dips and more volatile prices, the price of gold usually will go UP as some investors seek a ‘safe haven’ for funds.

Have a great week and thank you – Don

If you are a new reader on the free trial, please consider the very discounted annual rate will save you $90 over the monthly rate; please see: SUBSCRIBE PAGE for details.

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.