Greetings:

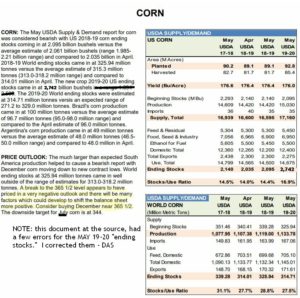

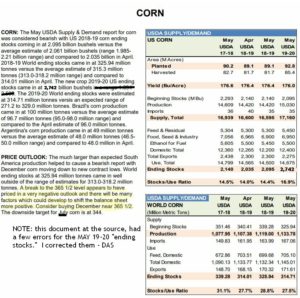

The USDA’s WASDE (World Ag Supply/Demand Estimates) monthly came out Friday. The news for corn was bearish. Here a table from CME (The Chicago Merc exchange) with the most recent WASDE number installed:

source: https://www.cmegroup.com/trading/agricultural/files/ht_charts/snd_cbt.pdf

I suspect the DEC19 Corn has already absorbed most or all of the bearish news now, although these days anything can happen. I, for now, am holding my short DEC19 330-strike PUTs. They are a little over the 200% rule but I want to see what happens the next couple of days and I’m willing to risk a little more to find out. This is risky but plantings (some) have been delayed, and the major part of the growing season for the new crop is ahead not behind. Any positive news with trade, dry or floods – would be enough to keep the DEC19 (new crop) corn prices up for a while. Much of the new crop corn has been late to get into the ground; this means a shorter growing season and that usually causes a lower yield. As I mentioned last week, the USDA does NOT put this into their WASDE this early in the season. I’m saying I think production figures may be higher now than later. (and that would support prices basis DEC19 and beyond.

Some Possible Profit-taking this week: I’m watching the JUL19 75-strike Crude Oil I sold at 0.11, it closed Friday at 0.07 and if crude drops again, I’m thinking I might close it our for about 0.04 to 0.06 area, TBD (to be determined.)

I also may close my NOV19 soybean 1200-strike CALLS; they closed Friday at .75 cents. I sold these for 2.125, so probably no reason to continue to hold it much longer – although I do not feel urgency about this since beans are so bearish right now.

I am also mindful that my Gold short SEP19 1160-strike PUT is trading 0.40 and, depending on how gold does this week, I could do a profit-taking closing purchase on this one. I sold it for 0.11.

Just so you know: I sold the Gold SEP19 short strangle on May 2, 2019, only 11 days ago. The initial net margin for selling both was about $580. If I closed the 1160-PUT SEP19 at 0.04, that would be a $50 profit. This really sounds like small-potatoes but wait – let’s do the math: If I use half the margin and figure the ROI (return on investment): That’s $40 profit on $270 in 11 days. If I paid commissions of $10 ($5 each way), the net profit = ~ $30 on $270 = 11.1% in eleven days (the two 11’s are just a coincidence.) Is this worth it? The annualized ROI would come out to some really high figure.. (365/11) * 11.1% = 368%, a ridiculously high figure and not practical at all to assume we could make that. But hey, 11.1% in 11 days is ok with me, even though I wish it were more. Note: I still have to maintain a full margin with only one-side of that strangle still working. I always list my positions as a quantify of one, to make it easy for subscribers to make their own computations. I actually traded 10 of the strangles, and I should make a nice return on both sides of this strangle. We’ll see. I am considering using a quantity of 10 for my trade illustrations. I might make that change soon. (Any comments on this: yes, no, make no difference?) If you have an opinion just email me please: Don@WriteThisDown.com

Gold: The $US Dollar has, for now at least, lost some of its save-haven attraction, so could drift down a little in price from here. Usually when the $US dollar falls, the price of Gold goes up. My strikes (see chart below) seem to be far enough OTM that they can tolerate some volatility in Gold prices.

Soybeans: No surprises on WASDE with this one.

https://www.cmegroup.com/trading/agricultural/files/ht_charts/snd_cbt.pdf

Comments Continued:

In case you are new to all this trading and commentary, I should tell you that for this week and the last few months, I would not call market conditions, for this kind of trading, normal by any means. Oh, it’s normal to be making money, but harder to seek out trades that are not affected by trade talks, the political volatile environment. These sorts of things, as we all can clearly see, are breeding unexpected and very large moves in the stock and commodity markets.

Have a great week. My intention is to update these market comments at mid-week, probably Wednesday. Thank you. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings:

The USDA’s WASDE (World Ag Supply/Demand Estimates) monthly came out Friday. The news for corn was bearish. Here a table from CME (The Chicago Merc exchange) with the most recent WASDE number installed:

source: https://www.cmegroup.com/trading/agricultural/files/ht_charts/snd_cbt.pdf

I suspect the DEC19 Corn has already absorbed most or all of the bearish news now, although these days anything can happen. I, for now, am holding my short DEC19 330-strike PUTs. They are a little over the 200% rule but I want to see what happens the next couple of days and I’m willing to risk a little more to find out. This is risky but plantings (some) have been delayed, and the major part of the growing season for the new crop is ahead not behind. Any positive news with trade, dry or floods – would be enough to keep the DEC19 (new crop) corn prices up for a while. Much of the new crop corn has been late to get into the ground; this means a shorter growing season and that usually causes a lower yield. As I mentioned last week, the USDA does NOT put this into their WASDE this early in the season. I’m saying I think production figures may be higher now than later. (and that would support prices basis DEC19 and beyond.

Some Possible Profit-taking this week: I’m watching the JUL19 75-strike Crude Oil I sold at 0.11, it closed Friday at 0.07 and if crude drops again, I’m thinking I might close it our for about 0.04 to 0.06 area, TBD (to be determined.)

I also may close my NOV19 soybean 1200-strike CALLS; they closed Friday at .75 cents. I sold these for 2.125, so probably no reason to continue to hold it much longer – although I do not feel urgency about this since beans are so bearish right now.

I am also mindful that my Gold short SEP19 1160-strike PUT is trading 0.40 and, depending on how gold does this week, I could do a profit-taking closing purchase on this one. I sold it for 0.11.

Gold: The $US Dollar has, for now at least, lost some of its save-haven attraction, so could drift down a little in price from here. Usually when the $US dollar falls, the price of Gold goes up. My strikes (see chart below) seem to be far enough OTM that they can tolerate some volatility in Gold prices.

Soybeans: No surprises on WASDE with this one.

https://www.cmegroup.com/trading/agricultural/files/ht_charts/snd_cbt.pdf

Comments Continued:

In case you are new to all this trading and commentary, I should tell you that for this week and the last few months, I would not call market conditions, for this kind of trading, normal by any means. Oh, it’s normal to be making money, but harder to seek out trades that are not affected by trade talks, the political volatile environment. These sorts of things, as we all can clearly see, are breeding unexpected and very large moves in the stock and commodity markets.

Have a great week. My intention is to update these market comments at mid-week, probably Wednesday. Thank you. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.