The FOMC meeting is Wednesday this week (19DEC2018) and if they pause interest rate hikes – there could be a rally in stocks. Just as importantly, this will be a chance for the FED to suggest a guidance for some moderation in the possibilities of rate hikes during calendar 2019. FOMC (aka:”the FED”) is the Federal Open Market Committee. Usually, no-rate-hike is good for commodity prices in general and would weaken the $US dollar – which in turn results in lower cost for importers of USA products.

Gold: A lower (weaker) $US dollar – during current times – usually means a gain in Gold prices; this inverse correlation is usually illustrated daily when one compares the $US dollar to Gold futures. The FEB19 1500-strike CALL (a part of my FEB19 gold short 1500C/1100P stangle) now has a value of only 0.10. I sold it for about 0.70, so I will put in a GTC (good till canceled) order at 0.10 to close it out for a profit. I will also put in a GTC to close out the FEB19 1100-PUT at 0.10. I have chosen not to put those orders in as a single order because there is no reason to delay one side’s profits to capture the other side’s profits – as gold fluctuates up and down daily. The 1100 PUT is last traded at 0.02.

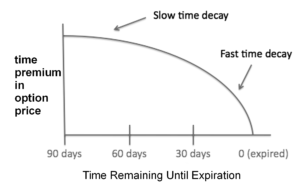

I will also be watching my short APR19 Gold short strangle 1600C/1100P. I sold it for 2.30 and it is now trading at 1.30, most of the unrealized profit is in the 1100 PUT side – so it has a nice profit and I do not want to allow that to disappear. This decision to continue holding that 1100 PUT is a sort of balance. A trader doesn’t want to leave more profit on the table – and neither does she/he want to allow the market to reclaim the made progress. I will be watching it – but for now I’m keeping it open. Since it still has 99 days until expiration, the daily time-decay rate (theta) is rather slow yet. (The 30-days prior to an option’s expiration has the fastest time-decay.)

Silver: Not sure what I’ll do yet, but I’m shopping Silver PUTS at $12 and lower PUT strikes. Caution: Some of the silver options trade very low OI and daily volume. Experienced traders will know that this ‘thin trading’ can result in inefficient (“unfair”) prices and can make getting out of a position precarious. Whatever strikes I consider in their respective classes (named months), I will be sure to notice the OI (open interests) and Volume of trading. When I have a trade like this under consideration, I make it a regular habit to get familiar with these parameters as well as the normal daily-price-range. Also, the longer you follow a commodity, the more likely you are to know when things get ‘overdone’ (oversold/overbought/price swing reactions to news, etc.) Sometimes these over-done circumstances can offer a better than normal trading opportunity.

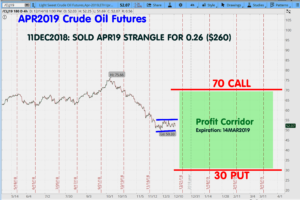

Crude Oil: The recent OPEC meeting announced a weekly reduction of 1.2 million bpd and the market seemed to have little or no reaction to the news. Stocks of oil remain historically high as noted in a recent commentary. Since early October 2018, crude oil prices have fallen from about $79 per barrel (basis the DEC18 contract) down over 30% to near $50. This chart (below) is the APR2019 Futures. You can see prices have traded in a channel from a little over $50 up to near $55. This past week (see 11DEC2018 newsletter) I sold the APR2019 short strangle, the $70CALL/ $30PUT for 2.60 ($260.)

Of course our job, as sellers of commodity options, is to try and determine “where prices are not likely to go” and sell strikes there. This chart (below) illustrates the recent 30-day range and also the $70/$30 strangles I sold last week.

The Grains and WASDE: Tuesday of last week (11DEC2018), the USDA’s monthly supply-demand revisions were announced. As expected, there was virtually no change for soybean production or stocks and corn stocks (ending stocks that is) were increased a very small amount (about 50 million bushels) from last month’s numbers.

The promise from China to buy more USA soybeans was partially fulfilled as a large order was entered. Some farmers and traders were expecting soybean prices to rise on this news, but this did not happen. In fact the next day soybeans went down over 10 cents a bushel. Some call this buying “too little too late.” As I’ve stated on several occasions recently, the extremely large supplies of soybeans will probably continue to hold prices down in the months ahead – and add to that fact Brazil’s harvest begins in only two weeks. This illustration from Kansas State Univ website maps the USDA’s recent reports (the report in this illustration is NOV18, the DEC18 isn’t posted yet but it will look the same as there was no significant changes in the recent report from last month’s.) Links to WASDE, USDA, Kansas State and other resources are on this website at the Resource: Links Library tab. The updated version will probably be posted this week. You can check for it at: KSU Soybean Price vs. STU

Corn: I’ve been talking for some time about selling a Corn PUT(s) in the MAR19 or MAY19 option classes. So far I have not seen enough premium at safe strikes in the PUT columns. The fundamental set up at present is somewhat bullish for the new crop (North America.) With soybean prices so low, a lot of ‘soybean acres’ might plant the more-profitable ‘corn acres’ in 2019. The USDA does put out an early-year estimate of the projected number of acres to be planted, but that information is still a few months away. Obviously, if a great many acres are planted in corn instead of soybeans- this would be less-bullish for 2019 corn futures. This is the cause of my hesitation to sell corn PUTs for now. This item is on my list of things to follow in the coming weeks.

Other thoughts: When I am able (soon I hope) to close out my FEB19 Gold options, I will be shopping for more short strangles in gold for the first half of calendar 2019 and beyond. I am also watching the DOW averages and the S&P 500 futures as the wild volatility runs on in the stock market. I rarely trade those futures, my interest is to watch for reactions in commodity prices that might create any unusual opportunities to explore.

Useful Tip: If you are new to selling commodity options, I suggest you watch the $US dollar’s daily variations (symbol $DXY) and compare it to gold futures, and also to grain prices; you should learn to watch this (inverse) relationship between $US dollar and these commodities. You might want to put these in your favorite watch-list in your trading platform.

Remember, between about December 23, 2018 until January 2, 2019 is a time for holidays and it is very, very normal for trading to slow down and be very light (low volume) during this time. I doubt that I’ll be trading much during that time period.

– That is all today. – Thank you – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

The FOMC meeting is Wednesday this week (19DEC2018) and if they pause interest rate hikes – there could be a rally in stocks. Just as importantly, this will be a chance for the FED to suggest a guidance for some moderation in the possibilities of rate hikes during calendar 2019. FOMC (aka:”the FED”) is the Federal Open Market Committee. Usually, no-rate-hike is good for commodity prices in general and would weaken the $US dollar – which in turn results in lower cost for importers of USA products.

Gold: A lower (weaker) $US dollar – during current times – usually means a gain in Gold prices; this inverse correlation is usually illustrated daily when one compares the $US dollar to Gold futures. The FEB19 1500-strike CALL (a part of my FEB19 gold short 1500C/1100P stangle) now has a value of only 0.10. I sold it for about 0.70, so I will put in a GTC (good till canceled) order at 0.10 to close it out for a profit. I will also put in a GTC to close out the FEB19 1100-PUT at 0.10. I have chosen not to put those orders in as a single order because there is no reason to delay one side’s profits to capture the other side’s profits – as gold fluctuates up and down daily. The 1100 PUT is last traded at 0.02.

I will also be watching my short APR19 Gold short strangle 1600C/1100P. I sold it for 2.30 and it is now trading at 1.30, most of the unrealized profit is in the 1100 PUT side – so it has a nice profit and I do not want to allow that to disappear. This decision to continue holding that 1100 PUT is a sort of balance. A trader doesn’t want to leave more profit on the table – and neither does she/he want to allow the market to reclaim the made progress. I will be watching it – but for now I’m keeping it open. Since it still has 99 days until expiration, the daily time-decay rate (theta) is rather slow yet. (The 30-days prior to an option’s expiration has the fastest time-decay.)

Silver: Not sure what I’ll do yet, but I’m shopping Silver PUTS at $12 and lower PUT strikes. Caution: Some of the silver options trade very low OI and daily volume. Experienced traders will know that this ‘thin trading’ can result in inefficient (“unfair”) prices and can make getting out of a position precarious. Whatever strikes I consider in their respective classes (named months), I will be sure to notice the OI (open interests) and Volume of trading. When I have a trade like this under consideration, I make it a regular habit to get familiar with these parameters as well as the normal daily-price-range. Also, the longer you follow a commodity, the more likely you are to know when things get ‘overdone’ (oversold/overbought/price swing reactions to news, etc.) Sometimes these over-done circumstances can offer a better than normal trading opportunity.

Crude Oil: The recent OPEC meeting announced a weekly reduction of 1.2 million bpd and the market seemed to have little or no reaction to the news. Stocks of oil remain historically high as noted in a recent commentary. Since early October 2018, crude oil prices have fallen from about $79 per barrel (basis the DEC18 contract) down over 30% to near $50. This chart (below) is the APR2019 Futures. You can see prices have traded in a channel from a little over $50 up to near $55. This past week (see 11DEC2018 newsletter) I sold the APR2019 short strangle, the $70CALL/ $30PUT for 2.60 ($260.)

Of course our job, as sellers of commodity options, is to try and determine “where prices are not likely to go” and sell strikes there. This chart (below) illustrates the recent 30-day range and also the $70/$30 strangles I sold last week.

The Grains and WASDE: Tuesday of last week (11DEC2018), the USDA’s monthly supply-demand revisions were announced. As expected, there was virtually no change for soybean production or stocks and corn stocks (ending stocks that is) were increased a very small amount (about 50 million bushels) from last month’s numbers.

The promise from China to buy more USA soybeans was partially fulfilled as a large order was entered. Some farmers and traders were expecting soybean prices to rise on this news, but this did not happen. In fact the next day soybeans went down over 10 cents a bushel. Some call this buying “too little too late.” As I’ve stated on several occasions recently, the extremely large supplies of soybeans will probably continue to hold prices down in the months ahead – and add to that fact Brazil’s harvest begins in only two weeks. This illustration from Kansas State Univ website maps the USDA’s recent reports (the report in this illustration is NOV18, the DEC18 isn’t posted yet but it will look the same as there was no significant changes in the recent report from last month’s.) Links to WASDE, USDA, Kansas State and other resources are on this website at the Resource: Links Library tab. The updated version will probably be posted this week. You can check for it at: KSU Soybean Price vs. STU

Corn: I’ve been talking for some time about selling a Corn PUT(s) in the MAR19 or MAY19 option classes. So far I have not seen enough premium at safe strikes in the PUT columns. The fundamental set up at present is somewhat bullish for the new crop (North America.) With soybean prices so low, a lot of ‘soybean acres’ might plant the more-profitable ‘corn acres’ in 2019. The USDA does put out an early-year estimate of the projected number of acres to be planted, but that information is still a few months away. Obviously, if a great many acres are planted in corn instead of soybeans- this would be less-bullish for 2019 corn futures. This is the cause of my hesitation to sell corn PUTs for now. This item is on my list of things to follow in the coming weeks.

Other thoughts: When I am able (soon I hope) to close out my FEB19 Gold options, I will be shopping for more short strangles in gold for the first half of calendar 2019 and beyond. I am also watching the DOW averages and the S&P 500 futures as the wild volatility runs on in the stock market. I rarely trade those futures, my interest is to watch for reactions in commodity prices that might create any unusual opportunities to explore.

Useful Tip: If you are new to selling commodity options, I suggest you watch the $US dollar’s daily variations (symbol $DXY) and compare it to gold futures, and also to grain prices; you should learn to watch this (inverse) relationship between $US dollar and these commodities. You might want to put these in your favorite watch-list in your trading platform.

Remember, between about December 23, 2018 until January 2, 2019 is a time for holidays and it is very, very normal for trading to slow down and be very light (low volume) during this time. I doubt that I’ll be trading much during that time period.

– That is all today. – Thank you – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.