Greetings: 18 FEB 2020, Tuesday

Current Position Summary:

I sold a MAY20 Crude Oil short strangle on 11th FEB, a week ago: I sold the 65-strike CALL for 0.10 ($100) and I sold the 37-strike PUT for 0.15 ($150) for a total premium credit of $250. You can see the details by clicking the TRADE ORIGINATION banner below:

That short strangle is trading (ask) at 0.08 for each leg, a total of 0.16. Since it was sold for $250, it now has an unrealized gain of ($250 minus 160) = $90 (excluding comm.) I can totally understand why traders of this position could simply “take the money” as it is a great return of 10% in only a week. Remember, as volatile as the market is – this unrealized profit is at risk. If one does take a profit now, there could be another opportunity to sell the same trade or a similar trade in a short time from now. Crude is trading (mid morning Tuesday, 18th FEB, today) at $52.03, down by 0.56 basis the MAY2020 underlying (futures contract.)

Special greetings to new subscribers.

Comments: As I write this line 11:22 AM ET: The stock market DJIA is down 218 points and the reason’s cited are the Corona virus news and also the fact that Apple (AAPL) is trading down almost 8 dollars a share since they announced (a revision) in expected revenue due to the Corona shutdown of factories in China.

As I mentioned last week, I want to sell some Gold options. Since gold is up over $21 an ounce this morning, I will postpone selling Gold options because: The uncertainty of the propagation of Corona. Other companies may follow AAPL’s example and that could make for more volatility. There is a good trade coming on gold – and I am going to be patient. For example: IF there is a huge stock market plunge, gold prices will spike and the options would suddenly become more expensive (good news for those who are shopping to sell options.)

For those not yet familiar: Gold prices often soar upward during stock market sell offs; this is called the ‘safe haven effect.’ It is when stock investors take profits and use the proceeds to buy gold (precious metals). Often when you check in to see what’s happening in trading, IF you find gold prices up markedly (over 10 to 15 dollars), this can be an indicator the DOW will fall or trade weakly that day.

The Style and Efficacy of Selling Commodity Options

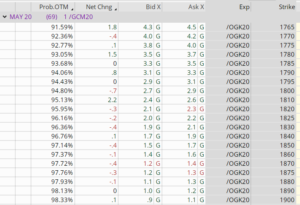

I wish to iterate a few points about this trading we do here: I only have one position on — and have gone recently for a couple of weeks with NO trades. My positions, when placed, typically are high probability (95% down to %90) and a nice return percentage. A volatile market, as the one we have now, always presents trading opportunities. An example: With the MAY2020 gold futures trading $1605.50 per ounce, up almost $20 today– a more aggressive trader might check to see if CALLs around $200 above the current price could be sold. Here’s is a screenshot of the far OTM MAY2020 Gold CALLs:

Of the MAY2020 options CLASS, (above) one can see the 1800-strike is bid/ask: 2.7 / 2.9 ($270 and $290, respectively. You also can see while gold is up $20 /ounce, this CALL actually decreased in value by .7 ($70) today. This is the ‘opposite’ of what one might expect (that this CALL would go UP in price as the underlying goes UP.) This option has been and is – expensive, and has about a 94% chance of expiring worthless in 69 days out.

Selling an option such as this – is at-risk of the stock market crashing. There could be actually two ‘plays’ here that could entice a trader: First, the option is expensive, very expensive – yet still has a high probability of expiring worthless in only a little over two months.

Secondly, if the market has a UP week – a ‘rebound’ this week – as it did last week, this gold option might lose another $70 to $100 off its current price very quickly as gold prices decrease. This is a viable scenario, but since the market is at / near all time highs and could correct at any time – this MAY2020 $1800-strike could gain price quickly and it might be very hard to stay in the trade until more time has passed.

The point I’m trying to make here is that although I see trading opportunities for sure, they are way more risky than most of the trades I post here. By the way, the 1900-strike is 98% Prob. OTM and is bid/ask at 0.9 to 1.00 ($90 to $100) while the initial margin requirement is only: $781 (corrected.) So the potential return is good: $90/$781 = 11.8% For small accounts, this could be a kamakazi play: Scenario: Market crashes, gold zooms up and you get a margin call you can’t cover. All the time investors are lured into very high return trades, and get busted out. For a large account, this trade could be held since the larger account would have the money to meet the increases margin requirements (if needed.) The MAY 2020 Gold CALL with the 2000-strike (NOT shown in the above table) has a 99% chance of expiring worthless. Why so high? because that is a projection based on current volatility, and just because that”99%” is high, it does NOT include the risk of Corona, war, or other factors. The 99% OTM is strictly the math based on current volatility – based on a derivative of Black-Scholes– (this Prob OTM) does NOT figure in market risks, it only used current stats to make this ‘projection.’

That is all today. Be sure I am checking for trades everyday. This is an unusual time and there’s a lot of unknowns at present, so I am being very conservative. No doubt, in a few weeks with the “genius of hindsight” I will be able to find flaw with my decision today — this is just the nature of trading, no matter what you trade or when.

So if you sold the same short strangle I did, you may decide to exit at any time now — or risk the current unrealized profit of $90 to the whims of the market. Good luck with that.

I will send out an email when/if I see a trade, so check your email for updates. -Don

Don A. Singletary

For more info on these books available w/ free prime shipping, please touch or click the cover photo. thanks.

I do a lot of my own trading with TastyWorks because I like the easy-to-use platform and they have lower commissions than most. The customer service is outstanding. I have an affiliate link and recommend them often for months now and I’ve never had any negative feedback. They also have excellent free mobile apps that are easy to use- and they have ACH free money transfers to-and-from you bank account (usually one day free service.) TastyWorks has just joined Schwab, ThinkOrSwim, and other brokers and introduced NO Commission stock trading and $1.00 stock option trading.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers.

Read more about TastyWorks at this link please: http://daytradingmicros.com/brokers/

***************

***************

TastyWorks also has commissions on the new Micro e-Mini futures at only 85 cents.

Have any interest in day trading the new Micro E-mini stock index futures? If so, please consider my new book on the subject available on Amazon: (read more at this link)

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: 18 FEB 2020, Tuesday

Current Position Summary:

I sold a MAY20 Crude Oil short strangle on 11th FEB, a week ago: I sold the 65-strike CALL for 0.10 ($100) and I sold the 37-strike PUT for 0.15 ($150) for a total premium credit of $250. You can see the details by clicking the TRADE ORIGINATION banner below:

That short strangle is trading (ask) at 0.08 for each leg, a total of 0.16. Since it was sold for $250, it now has an unrealized gain of ($250 minus 160) = $90 (excluding comm.) I can totally understand why traders of this position could simply “take the money” as it is a great return of 10% in only a week. Remember, as volatile as the market is – this unrealized profit is at risk. If one does take a profit now, there could be another opportunity to sell the same trade or a similar trade in a short time from now. Crude is trading (mid morning Tuesday, 18th FEB, today) at $52.03, down by 0.56 basis the MAY2020 underlying (futures contract.)

Special greetings to new subscribers.

Comments: As I write this line 11:22 AM ET: The stock market DJIA is down 218 points and the reason’s cited are the Corona virus news and also the fact that Apple (AAPL) is trading down almost 8 dollars a share since they announced (a revision) in expected revenue due to the Corona shutdown of factories in China.

As I mentioned last week, I want to sell some Gold options. Since gold is up over $21 an ounce this morning, I will postpone selling Gold options because: The uncertainty of the propagation of Corona. Other companies may follow AAPL’s example and that could make for more volatility. There is a good trade coming on gold – and I am going to be patient. For example: IF there is a huge stock market plunge, gold prices will spike and the options would suddenly become more expensive (good news for those who are shopping to sell options.)

For those not yet familiar: Gold prices often soar upward during stock market sell offs; this is called the ‘safe haven effect.’ It is when stock investors take profits and use the proceeds to buy gold (precious metals). Often when you check in to see what’s happening in trading, IF you find gold prices up markedly (over 10 to 15 dollars), this can be an indicator the DOW will fall or trade weakly that day.

The Style and Efficacy of Selling Commodity Options

I wish to iterate a few points about this trading we do here: I only have one position on — and have gone recently for a couple of weeks with NO trades. My positions, when placed, typically are high probability (95% down to %90) and a nice return percentage. A volatile market, as the one we have now, always presents trading opportunities. An example: With the MAY2020 gold futures trading $1605.50 per ounce, up almost $20 today– a more aggressive trader might check to see if CALLs around $200 above the current price could be sold. Here’s is a screenshot of the far OTM MAY2020 Gold CALLs:

Of the MAY2020 options CLASS, (above) one can see the 1800-strike is bid/ask: 2.7 / 2.9 ($270 and $290, respectively. You also can see while gold is up $20 /ounce, this CALL actually decreased in value by .7 ($70) today. This is the ‘opposite’ of what one might expect (that this CALL would go UP in price as the underlying goes UP.) This option has been and is – expensive, and has about a 94% chance of expiring worthless in 69 days out.

Selling an option such as this – is at-risk of the stock market crashing. There could be actually two ‘plays’ here that could entice a trader: First, the option is expensive, very expensive – yet still has a high probability of expiring worthless in only a little over two months.

Secondly, if the market has a UP week – a ‘rebound’ this week – as it did last week, this gold option might lose another $70 to $100 off its current price very quickly as gold prices decrease. This is a viable scenario, but since the market is at / near all time highs and could correct at any time – this MAY2020 $1800-strike could gain price quickly and it might be very hard to stay in the trade until more time has passed.

The point I’m trying to make here is that although I see trading opportunities for sure, they are way more risky than most of the trades I post here. By the way, the 1900-strike is 98% Prob. OTM and is bid/ask at 0.9 to 1.00 ($90 to $100) while the initial margin requirement is only: $781 (corrected.) So the potential return is good: $90/$781 = 11.8% For small accounts, this could be a kamakazi play: Scenario: Market crashes, gold zooms up and you get a margin call you can’t cover. All the time investors are lured into very high return trades, and get busted out. For a large account, this trade could be held since the larger account would have the money to meet the increases margin requirements (if needed.) The MAY 2020 Gold CALL with the 2000-strike (NOT shown in the above table) has a 99% chance of expiring worthless. Why so high? because that is a projection based on current volatility, and just because that”99%” is high, it does NOT include the risk of Corona, war, or other factors. The 99% OTM is strictly the math based on current volatility – based on a derivative of Black-Scholes– (this Prob OTM) does NOT figure in market risks, it only used current stats to make this ‘projection.’

That is all today. Be sure I am checking for trades everyday. This is an unusual time and there’s a lot of unknowns at present, so I am being very conservative. No doubt, in a few weeks with the “genius of hindsight” I will be able to find flaw with my decision today — this is just the nature of trading, no matter what you trade or when.

So if you sold the same short strangle I did, you may decide to exit at any time now — or risk the current unrealized profit of $90 to the whims of the market. Good luck with that.

I will send out an email when/if I see a trade, so check your email for updates. -Don

Don A. Singletary

For more info on these books available w/ free prime shipping, please touch or click the cover photo. thanks.

I do a lot of my own trading with TastyWorks because I like the easy-to-use platform and they have lower commissions than most. The customer service is outstanding. I have an affiliate link and recommend them often for months now and I’ve never had any negative feedback. They also have excellent free mobile apps that are easy to use- and they have ACH free money transfers to-and-from you bank account (usually one day free service.) TastyWorks has just joined Schwab, ThinkOrSwim, and other brokers and introduced NO Commission stock trading and $1.00 stock option trading.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers.

Read more about TastyWorks at this link please: http://daytradingmicros.com/brokers/

TastyWorks also has commissions on the new Micro e-Mini futures at only 85 cents.

Have any interest in day trading the new Micro E-mini stock index futures? If so, please consider my new book on the subject available on Amazon: (read more at this link)

Free prime shipping on Amazon

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.