Greetings: TRADE COMMENTARY 18 MAR 2019

CRUDE OIL: There are some suggestions that the crude oil market could find some price support. The IEA (International Energy Agency) not to be confused with the EIA (United State Energy Information Administration) – has commented that the second quarter of 2019 could shift into a deficit condition. The IEA is based in Paris and has 30 member countries that it allegedly serves with data and information designed to ensure steady product supplies to its membership. Media headlines are reflecting demand expectations and the possible continuation of the OPEC production restraints (to be extended past June19) for the second half of 2019. We option-sellers are fortunate that our strategies do not hang on the day-to-day headlines and price fluctuations. Many of the media headlines are tauting a case for $60 oil prices and citing a reduction of inventory over the most recent four week period, increasing demand from China, OPEC production cuts, and the “fact” that lower prices are discouraging new exploration. I read recent reports from US Energy Information Administration – and while there could be case for $60 oil ahead, I would hardly call the numbers I saw there as being bullish but more neutral. Here is an excerpt from the EIA site: (You really should explore this site, it has so much information and for the most part is not subject to the bias and daily headlines found on most news channels.)

The link is here: https://www.eia.gov/petroleum/weekly/archive/2019/190313/includes/analysis_print.php

This Week in Petroleum

Release date: March 13, 2019 | Next release date: March 20, 2019

EIA forecasts relatively flat crude oil prices despite lower global production growth

In the March 2019 update of its Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) revised its crude oil price forecast to be slightly higher for 2019 because of tighter forecast balances and higher than expected prices during February. EIA forecasts that the Brent crude oil price will average $63 per barrel (b) in 2019 and $62/b in 2020, compared with $71/b in 2018 (Figure 1). EIA expects that West Texas Intermediate (WTI) crude oil prices will average $9/b lower than Brent prices in the first half of 2019 before the discount gradually narrows to $4/b in the fourth quarter of 2019 and throughout 2020. EIA revised down global petroleum and other liquids production growth from the February STEO, largely because of downward revisions to the U.S. and the Organization of the Petroleum Exporting Countries (OPEC) supply forecasts. The production forecast was revised down more than the consumption forecast, and as a result, global stock builds are expected to be lower, indicating a relatively tighter market compared with the February STEO.

(end of EIA)

Comments continued: If you want to learn the vocabulary of oil, this EIA.gov site has extensive reporting and charting and it’s all free courtesy of the US tax payer.

Play Video: https://www.timefarming.com/18MAR2019.mp4

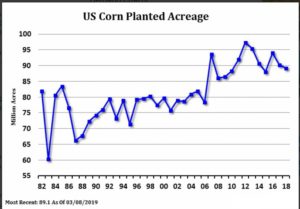

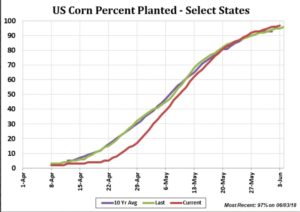

CORN: Last week, I sold the DEC19 Corn 330-strike PUTS. These are really quite FOTM (Far Out-of-The-Money). As I mentioned when I sold these last week, even though the premium seemed small – the actual ROI (Return On Investment) is pretty good. There is a great deal about the “new crop” that is yet undetermined. You should know, as you read about corn fundamentals that IN THE UNITED STATES the futures contracts that comprised the new-crop are SEP and later; the reason being that North American harvest starts in SEP but this contract is very early in the harvest, so we consider the DEC contract to be the first of the futures contracts that has prices based on the new crop. This new crop is planted in the spring and the at risk growing season is normally APR to AUG; during this time period crops are subject to late-plantings due to weather, droughts, floods, and temperatures that can all influence the price of the ‘in progress’ new-crop. Sometimes this is called a “weather premium”, the higher pricing to reflect the risks in growing over these months. This “weather premium” is reflected largely in the DEC futures contract price and forward. Then as harvest begins in mid to late summer, normally the DEC futures price will decline into October. At the end of this month, there is an important report that indicates how many acres of corn (also wheat and soybeans) might be planted for this ‘new crop.’ Two charts are below, one for total acres planted, the other for the timing of the United States corn new crop as a percentage of completion versus average dates.

This information is from a CME link, source: https://www.cmegroup.com/trading/agricultural/corn-reports.html

This link and others are on the website here under the TAB: Resource Links Library There are many useful links there with option expiration date table, commodity symbols, and more.

Just a reminder that my intention is to sell CALLs on the DEC19 Corn (that and my current 330-strike short PUTs will form a short strangle.) Before I do that, I will wait for the planting report at the end of this month from USDA, and also I’ll be waiting to see if any of the China /USA tariff discussions and trade deals have new coming soon. It is now thought that such news come at the end of April. Stay tuned, this seems to change regularly. As I mentioned last week (see: https://www.timefarming.com/blog/13-march-2019/ — these negotiations have the potential to boost corn exports and run up both price and volatility. Selling CALLs on the DEC19 contract at this time is not a good idea. This is a good example of how following the fundamentals of a commodity crop is used in timing trades (even seasonal trades.) Every year, these cycles repeat and each year is always different in some way from the last. I would really welcome news to boost corn prices a lot; this would bring a great trading opportunity to sell CALLs FOTM. It’s all about the timing, though the strategy and the seasonality is already known for such a trade. As you gain experience over several years, you will come to know better how all these factors (fundamentals) influence prices. Over the next few months, you will be hearing and reading about the weather, crop conditions, possible yield numbers – as the crop progresses, and also the USDA crop condition reports. Knowing the release dates of these reports and how each could effect prices is a vital part of trading this market (and many others.)

Gold: This precious metal has had some larger than normal prices movements in both directions of these last few weeks. Two things, primarily, could drive up gold prices: The strength of the $US Dollar, and the overall health of the USA and world economy. There is no good track record for mainline economist in predicting things such as this; when they issue statements their wording is (IMHO) almost comical as they try to appear to give an opinion and then quickly add a counter-opinion statement to their banter. Here is one such comment from an analyst I just read about crude oil:

“We suspect more leadership gains will be seen in crude oil, but we also think that gasoline could lead the way lower if there is any shift away from the bullish fundamentals in the crude oil complex as a whole.”

Such comments look more like a comedy skit about double-talk to me. I read and hear these economist and analysts’ statements and often wonder how they can keep a straight face as they deliver them. They always read as though they will be able to take credit later no matter what eventually happens and we (the listener) are supposed to be polite enough not to call BS on them.

My AUG19 short gold CALL strike-$1500 is $185.2 out-of-the-money. The general consensus is that the $US Dollar may get weaker over the short-term (one to three months out) and if this happens AND the stock market tanks – I’ll have to watch this one closely. There is no way to know what is next but it is prudent to stay alert. On the other hand, my short JUN19 Gold 1200 PUT has collected a nice profit. I sold at 1.40 and it close Friday at: 0.50. I might consider taking this profit this week and/or writing another gold short PUT.

Soybeans: I am also on the lookout for opportunities to sell soybean CALLs at 1200-strike and above. I am currently watching the NOV19 soybean 1200-strike CALL. I would like to get 5.0 cents ($250) for it. It closed Friday at 4.125 cents. My thinking here is that even IF China buys a lot of USA soybeans, there is still such a huge supply (stocks) that it seems unlikely prices would top $12.00 per bushel this year. Selling a NOV19 option could capture enough time-value to get a nice return, so I am watching this and similar trades.

Final note: When these short option trades stay so far OTM, there are many days that almost seem boring in this type of trading. That’s a GOOD thing, for we make money as time value decays as surely a gravity hold us to the Earth. It is an important part of money-management to participate in these short option trades so long as the delta of our option remains very low.

The name of the newsletter has changed as you know, now OPTION INCOME TRAINING BULLETIN. I will be promoting for new subscribers and I needed a more descriptive name. I will be adding a new video training library over the next few months. I will use it to feature some of the trades and discussions to help new members acclimate to option-selling and also tips on how to trade and research selected markets.

That is all for today. Have a great week. – Don

Don A. Singletary

Please remember this publication is for educational purposes. Trading futures and commodity options involves substantial risk of loss and is not appropriate for many investors.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: TRADE COMMENTARY 18 MAR 2019

CRUDE OIL: There are some suggestions that the crude oil market could find some price support. The IEA (International Energy Agency) not to be confused with the EIA (United State Energy Information Administration) – has commented that the second quarter of 2019 could shift into a deficit condition. The IEA is based in Paris and has 30 member countries that it allegedly serves with data and information designed to ensure steady product supplies to its membership. Media headlines are reflecting demand expectations and the possible continuation of the OPEC production restraints (to be extended past June19) for the second half of 2019. We option-sellers are fortunate that our strategies do not hang on the day-to-day headlines and price fluctuations. Many of the media headlines are tauting a case for $60 oil prices and citing a reduction of inventory over the most recent four week period, increasing demand from China, OPEC production cuts, and the “fact” that lower prices are discouraging new exploration. I read recent reports from US Energy Information Administration – and while there could be case for $60 oil ahead, I would hardly call the numbers I saw there as being bullish but more neutral. Here is an excerpt from the EIA site: (You really should explore this site, it has so much information and for the most part is not subject to the bias and daily headlines found on most news channels.)

The link is here: https://www.eia.gov/petroleum/weekly/archive/2019/190313/includes/analysis_print.php

This Week in Petroleum

Release date: March 13, 2019 | Next release date: March 20, 2019

EIA forecasts relatively flat crude oil prices despite lower global production growth

In the March 2019 update of its Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) revised its crude oil price forecast to be slightly higher for 2019 because of tighter forecast balances and higher than expected prices during February. EIA forecasts that the Brent crude oil price will average $63 per barrel (b) in 2019 and $62/b in 2020, compared with $71/b in 2018 (Figure 1). EIA expects that West Texas Intermediate (WTI) crude oil prices will average $9/b lower than Brent prices in the first half of 2019 before the discount gradually narrows to $4/b in the fourth quarter of 2019 and throughout 2020. EIA revised down global petroleum and other liquids production growth from the February STEO, largely because of downward revisions to the U.S. and the Organization of the Petroleum Exporting Countries (OPEC) supply forecasts. The production forecast was revised down more than the consumption forecast, and as a result, global stock builds are expected to be lower, indicating a relatively tighter market compared with the February STEO.

Comments continued: If you want to learn the vocabulary of oil, this EIA.gov site has extensive reporting and charting and it’s all free courtesy of the US tax payer.

Play Video: https://www.timefarming.com/18MAR2019.mp4

CORN: Last week, I sold the DEC19 Corn 330-strike PUTS. These are really quite FOTM (Far Out-of-The-Money). As I mentioned when I sold these last week, even though the premium seemed small – the actual ROI (Return On Investment) is pretty good. There is a great deal about the “new crop” that is yet undetermined. You should know, as you read about corn fundamentals that IN THE UNITED STATES the futures contracts that comprised the new-crop are SEP and later; the reason being that North American harvest starts in SEP but this contract is very early in the harvest, so we consider the DEC contract to be the first of the futures contracts that has prices based on the new crop. This new crop is planted in the spring and the at risk growing season is normally APR to AUG; during this time period crops are subject to late-plantings due to weather, droughts, floods, and temperatures that can all influence the price of the ‘in progress’ new-crop. Sometimes this is called a “weather premium”, the higher pricing to reflect the risks in growing over these months. This “weather premium” is reflected largely in the DEC futures contract price and forward. Then as harvest begins in mid to late summer, normally the DEC futures price will decline into October. At the end of this month, there is an important report that indicates how many acres of corn (also wheat and soybeans) might be planted for this ‘new crop.’ Two charts are below, one for total acres planted, the other for the timing of the United States corn new crop as a percentage of completion versus average dates.

This information is from a CME link, source: https://www.cmegroup.com/trading/agricultural/corn-reports.html

This link and others are on the website here under the TAB: Resource Links Library There are many useful links there with option expiration date table, commodity symbols, and more.

Just a reminder that my intention is to sell CALLs on the DEC19 Corn (that and my current 330-strike short PUTs will form a short strangle.) Before I do that, I will wait for the planting report at the end of this month from USDA, and also I’ll be waiting to see if any of the China /USA tariff discussions and trade deals have new coming soon. It is now thought that such news come at the end of April. Stay tuned, this seems to change regularly. As I mentioned last week (see: https://www.timefarming.com/blog/13-march-2019/ — these negotiations have the potential to boost corn exports and run up both price and volatility. Selling CALLs on the DEC19 contract at this time is not a good idea. This is a good example of how following the fundamentals of a commodity crop is used in timing trades (even seasonal trades.) Every year, these cycles repeat and each year is always different in some way from the last. I would really welcome news to boost corn prices a lot; this would bring a great trading opportunity to sell CALLs FOTM. It’s all about the timing, though the strategy and the seasonality is already known for such a trade. As you gain experience over several years, you will come to know better how all these factors (fundamentals) influence prices. Over the next few months, you will be hearing and reading about the weather, crop conditions, possible yield numbers – as the crop progresses, and also the USDA crop condition reports. Knowing the release dates of these reports and how each could effect prices is a vital part of trading this market (and many others.)

Gold: This precious metal has had some larger than normal prices movements in both directions of these last few weeks. Two things, primarily, could drive up gold prices: The strength of the $US Dollar, and the overall health of the USA and world economy. There is no good track record for mainline economist in predicting things such as this; when they issue statements their wording is (IMHO) almost comical as they try to appear to give an opinion and then quickly add a counter-opinion statement to their banter. Here is one such comment from an analyst I just read about crude oil:

Such comments look more like a comedy skit about double-talk to me. I read and hear these economist and analysts’ statements and often wonder how they can keep a straight face as they deliver them. They always read as though they will be able to take credit later no matter what eventually happens and we (the listener) are supposed to be polite enough not to call BS on them.

My AUG19 short gold CALL strike-$1500 is $185.2 out-of-the-money. The general consensus is that the $US Dollar may get weaker over the short-term (one to three months out) and if this happens AND the stock market tanks – I’ll have to watch this one closely. There is no way to know what is next but it is prudent to stay alert. On the other hand, my short JUN19 Gold 1200 PUT has collected a nice profit. I sold at 1.40 and it close Friday at: 0.50. I might consider taking this profit this week and/or writing another gold short PUT.

Soybeans: I am also on the lookout for opportunities to sell soybean CALLs at 1200-strike and above. I am currently watching the NOV19 soybean 1200-strike CALL. I would like to get 5.0 cents ($250) for it. It closed Friday at 4.125 cents. My thinking here is that even IF China buys a lot of USA soybeans, there is still such a huge supply (stocks) that it seems unlikely prices would top $12.00 per bushel this year. Selling a NOV19 option could capture enough time-value to get a nice return, so I am watching this and similar trades.

Final note: When these short option trades stay so far OTM, there are many days that almost seem boring in this type of trading. That’s a GOOD thing, for we make money as time value decays as surely a gravity hold us to the Earth. It is an important part of money-management to participate in these short option trades so long as the delta of our option remains very low.

The name of the newsletter has changed as you know, now OPTION INCOME TRAINING BULLETIN. I will be promoting for new subscribers and I needed a more descriptive name. I will be adding a new video training library over the next few months. I will use it to feature some of the trades and discussions to help new members acclimate to option-selling and also tips on how to trade and research selected markets.

That is all for today. Have a great week. – Don

Don A. Singletary

Please remember this publication is for educational purposes. Trading futures and commodity options involves substantial risk of loss and is not appropriate for many investors.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.