Greetings!

I had a note in last WED comments that this edition would be posted today after 1 PM, instead of my usual early Sunday post for the TRADE COMMENTARY. This post is today since I was not in the office to write on Sunday as I usually do.

Near mid-day today, I see all the grains are UP considerably. One thing that has a positive (UP) effect on grain prices is the fluctuation of the $US Dollar, which is down a bit today. However, the news driving the market a little higher is that, as I’d discussed before, the new Corn crop will have a later planting – that means a shorter season and less time to mature -this always bodes a lower per acre yield. The USDA in the monthly WASDE reports does not speculate on such things, they just keep their consistent methods of reporting the facts as they ARE, not so much where they COULD BE. This is why the latest WASDE report for this month/May is not figuring in any speculation about late planting or fewer acres — In order to keep their methods consistent from year-to-year, they do not enter such things while they are speculative, they just report the FACTS as they happen. There is late planting of areas of Corn and good reasons to suspect that fewer acres will be planted, and so futures traders are now factoring that “in” to the prices traded in the commodity.

In case you might be thinking that maybe the USDA should factor in those things, let me address this point. It is actually a very good thing they do not do it. Here’s why: Over time, this would create more of a speculative history rather than a factual history of the fundamentals. This would make the stats and surveys of the USDA less reliable as they would be based on hearsay in stead of fact- and of course, that is NOT their job. So it is left to we speculators and commercial traders to trade a commodity based on our ideas and experiences of historical price behavior.

At mid-day DEC19 Corn is trading 403.50, up 5.25 cents. Here is chart: (BELOW) I’ve marked my short 330 PUT – and in the upper right scale I have highlighted in green – some of the strikes that I am considering to sell. More comments about that coming up.

Before I examine some DEC19 CALL-strikes and prices, I’d like to discuss the big picture and the news around the corn market. Barely two weeks ago, the market already saw the flooding and late planting indications, however, the trading and prices were more all about a deal with China. Such a deal could have huge sales to China and much lower stocks of corn due to the USA’s exporting to China and also the potential ethanol exports to China. The USA makes its ethanol from corn, Brazil makes theirs from sugar cane. Last week, the prospects of a USA/China “deal” became unlikely and some are now speculating this could go on for “a long time, perhaps years.” Now, today and late last week, all the ‘Corn news’ is about the late plantings, acres being moved to soybean planting, and about lower yields for the 2019-2020 Corn (new) crop.

Since traders have decided the prospects for less corn to be produced, the market prices have moved up quickly and considerably. Now think “options” for a moment: The volatility of corn prices is up, this means the prices changes have happened more often (higher frequency) and more quickly (higher amplitude) than what they were doing; this is the very definition of “volatility.” With the underlying corn futures have a higher volatility, the probability of the option strikes farther away from the current prices increasing in value, is higher. This, in turn, makes the options more expensive. Option-sellers gain the advantage of collecting more premium when implied volatility (%IV) is higher. When the options are more expensive, the implied volatility – a vital component of an option’s extrinsic value- is higher. Conversely, if a trader is short a strike, an increase in IV% can cause the price of the option to increase (a ‘bad thing’.) This paragraph explains why option-sellers and option-buyers often watch the IV%.

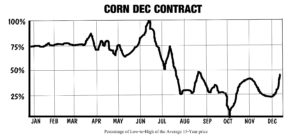

Seasonal IV% patterns: To keep this simple I will use the present action in the Corn and Corn options as the example. With corn prices are seasonal more volatile in the planting and early growth months. In the USA/Corn market this is MAY through JULY, usually. Here’s the average 15-year seasonal price chart of the DEC Corn contract: You can easily see the months of the greatest price volatility (on the average) are from about MAY through JULY – and how the seasonal HIGH is MAY/JUN and the average seasonal low is about the first week of OCT. This is Mother Nature’s doing and Corn traders know that. See how easy it is to see how (on the AVG) that to SELL corn CALLs around the peak prices in MAY-JUL makes a lot of sense. Be aware that is such a thing as counter-seasonal price moves and patterns. This is precisely why we pay major attention to the crop’s fundamentals.

I would never base my trades SOLELY on a seasonal chart but neither would I trade Corn without being acutely aware of mother natures seasonal patterns. The fact that these seasonal moves are (more or less) “fixed” by nature gives trader’s a great advantage. I hasten to add: Use a combination of seasonal patters AND remain very schooled and aware of the crop fundamentals. Using BOTH can be very effective.

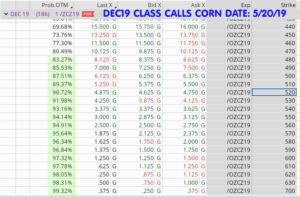

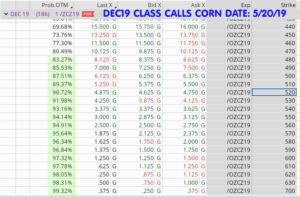

Now I want to show you the option matrix for the DEC 2019 option CLASS, and I will zoom in on the CALL strikes. This chart is from midday 5/20/2019, today:

I have highlighted in GREEN the “Prob OTM”, the probability the option will expire Out-of-the-Money. The option prices are in cents per bushel, and each cent = $50. For example the DEC19 Corn 520 CALL option last traded at 4.875 cents ( 50 x 4.875) or $243.75. I am already short the DEC19 330 PUT strike and the margin on that for me is now $350 – and I just looked and the margin for me to sell a DEC19 Corn 520 CALL-strike is only another $112. This would form a short-strangle with a total margin of ($350 + $112 = $462) and a potential profit of 2 cents for 330 PUT and 4.875 cents for the 520 CALL, a total of $343.75.

The total possible ROI for the strangle is: ($343.75/462) * 100 = of almost 74%. I am NOT going to place that trade today but wait until tomorrow and see what happens. Do I know what that will be? No, I nor anyone else -can say with absolute certainty. I will post a comment here midday on Tuesday and share my thoughts with you. I do know there are an enormous amount of commercial traders still short corn and sooner or later – they will have to buy back those shorts. This doesn’t mean I’ll be correct, but I do feel there’s some room yet for corn to go up. If I’m wrong, I won’t be upset because I’ll still have a fantastic trade here I can do.

If you have ever wondered why you bother to learn and use this “selling commodity options” strategy, it’s trades like this that I love to do.

Since today’s commentary is later than usual, I will wrap this up here and post it. My suggestion to you is to go to your trading software and look at the Corn DEC19 class of options and the CALL strikes. Compare the Prob OTM with the amount of premium you might collect for the strikes (note how the ‘gain’ is always commensurate with risk.) This will give you some good experience of how fun “shopping options” can be. Remember no matter how good things look, I can lose money on a trade like this. It is risky no matter how well I study it — but that is why I can participate for some great profits when things go right. If you have been with the newsletter here for months, you know how long I’ve been anticipating being able to sell Corn options on the DEC19 contract. This is a trade that has worked well for me for many years.

That’s it for now, as I want to get this posted and out to you. I don’t see much happening today in Crude, Gold, and even though soybeans are up over ten cents at midday, my 1100 and 1200 Soybean CALLs do not seem to be in any peril at all for now.

I’ll make another post tomorrow to follow up on today’s comments. – all the best – Don

PS: If you have any questions, email me and I can address them in tomorrow post (anonymously of course.)

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings!

I had a note in last WED comments that this edition would be posted today after 1 PM, instead of my usual early Sunday post for the TRADE COMMENTARY. This post is today since I was not in the office to write on Sunday as I usually do.

Near mid-day today, I see all the grains are UP considerably. One thing that has a positive (UP) effect on grain prices is the fluctuation of the $US Dollar, which is down a bit today. However, the news driving the market a little higher is that, as I’d discussed before, the new Corn crop will have a later planting – that means a shorter season and less time to mature -this always bodes a lower per acre yield. The USDA in the monthly WASDE reports does not speculate on such things, they just keep their consistent methods of reporting the facts as they ARE, not so much where they COULD BE. This is why the latest WASDE report for this month/May is not figuring in any speculation about late planting or fewer acres — In order to keep their methods consistent from year-to-year, they do not enter such things while they are speculative, they just report the FACTS as they happen. There is late planting of areas of Corn and good reasons to suspect that fewer acres will be planted, and so futures traders are now factoring that “in” to the prices traded in the commodity.

At mid-day DEC19 Corn is trading 403.50, up 5.25 cents. Here is chart: (BELOW) I’ve marked my short 330 PUT – and in the upper right scale I have highlighted in green – some of the strikes that I am considering to sell. More comments about that coming up.

Before I examine some DEC19 CALL-strikes and prices, I’d like to discuss the big picture and the news around the corn market. Barely two weeks ago, the market already saw the flooding and late planting indications, however, the trading and prices were more all about a deal with China. Such a deal could have huge sales to China and much lower stocks of corn due to the USA’s exporting to China and also the potential ethanol exports to China. The USA makes its ethanol from corn, Brazil makes theirs from sugar cane. Last week, the prospects of a USA/China “deal” became unlikely and some are now speculating this could go on for “a long time, perhaps years.” Now, today and late last week, all the ‘Corn news’ is about the late plantings, acres being moved to soybean planting, and about lower yields for the 2019-2020 Corn (new) crop.

Since traders have decided the prospects for less corn to be produced, the market prices have moved up quickly and considerably. Now think “options” for a moment: The volatility of corn prices is up, this means the prices changes have happened more often (higher frequency) and more quickly (higher amplitude) than what they were doing; this is the very definition of “volatility.” With the underlying corn futures have a higher volatility, the probability of the option strikes farther away from the current prices increasing in value, is higher. This, in turn, makes the options more expensive. Option-sellers gain the advantage of collecting more premium when implied volatility (%IV) is higher. When the options are more expensive, the implied volatility – a vital component of an option’s extrinsic value- is higher. Conversely, if a trader is short a strike, an increase in IV% can cause the price of the option to increase (a ‘bad thing’.) This paragraph explains why option-sellers and option-buyers often watch the IV%.

Seasonal IV% patterns: To keep this simple I will use the present action in the Corn and Corn options as the example. With corn prices are seasonal more volatile in the planting and early growth months. In the USA/Corn market this is MAY through JULY, usually. Here’s the average 15-year seasonal price chart of the DEC Corn contract: You can easily see the months of the greatest price volatility (on the average) are from about MAY through JULY – and how the seasonal HIGH is MAY/JUN and the average seasonal low is about the first week of OCT. This is Mother Nature’s doing and Corn traders know that. See how easy it is to see how (on the AVG) that to SELL corn CALLs around the peak prices in MAY-JUL makes a lot of sense. Be aware that is such a thing as counter-seasonal price moves and patterns. This is precisely why we pay major attention to the crop’s fundamentals.

I would never base my trades SOLELY on a seasonal chart but neither would I trade Corn without being acutely aware of mother natures seasonal patterns. The fact that these seasonal moves are (more or less) “fixed” by nature gives trader’s a great advantage. I hasten to add: Use a combination of seasonal patters AND remain very schooled and aware of the crop fundamentals. Using BOTH can be very effective.

Now I want to show you the option matrix for the DEC 2019 option CLASS, and I will zoom in on the CALL strikes. This chart is from midday 5/20/2019, today:

I have highlighted in GREEN the “Prob OTM”, the probability the option will expire Out-of-the-Money. The option prices are in cents per bushel, and each cent = $50. For example the DEC19 Corn 520 CALL option last traded at 4.875 cents ( 50 x 4.875) or $243.75. I am already short the DEC19 330 PUT strike and the margin on that for me is now $350 – and I just looked and the margin for me to sell a DEC19 Corn 520 CALL-strike is only another $112. This would form a short-strangle with a total margin of ($350 + $112 = $462) and a potential profit of 2 cents for 330 PUT and 4.875 cents for the 520 CALL, a total of $343.75.

The total possible ROI for the strangle is: ($343.75/462) * 100 = of almost 74%. I am NOT going to place that trade today but wait until tomorrow and see what happens. Do I know what that will be? No, I nor anyone else -can say with absolute certainty. I will post a comment here midday on Tuesday and share my thoughts with you. I do know there are an enormous amount of commercial traders still short corn and sooner or later – they will have to buy back those shorts. This doesn’t mean I’ll be correct, but I do feel there’s some room yet for corn to go up. If I’m wrong, I won’t be upset because I’ll still have a fantastic trade here I can do.

If you have ever wondered why you bother to learn and use this “selling commodity options” strategy, it’s trades like this that I love to do.

Since today’s commentary is later than usual, I will wrap this up here and post it. My suggestion to you is to go to your trading software and look at the Corn DEC19 class of options and the CALL strikes. Compare the Prob OTM with the amount of premium you might collect for the strikes (note how the ‘gain’ is always commensurate with risk.) This will give you some good experience of how fun “shopping options” can be. Remember no matter how good things look, I can lose money on a trade like this. It is risky no matter how well I study it — but that is why I can participate for some great profits when things go right. If you have been with the newsletter here for months, you know how long I’ve been anticipating being able to sell Corn options on the DEC19 contract. This is a trade that has worked well for me for many years.

That’s it for now, as I want to get this posted and out to you. I don’t see much happening today in Crude, Gold, and even though soybeans are up over ten cents at midday, my 1100 and 1200 Soybean CALLs do not seem to be in any peril at all for now.

I’ll make another post tomorrow to follow up on today’s comments. – all the best – Don

PS: If you have any questions, email me and I can address them in tomorrow post (anonymously of course.)

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.