Greetings 21 JAN 2020 TUESDAY:

Closing Purchase this morning: I bought back the MAR20 Corn 365-strike PUT at .75 cents this morning ($37.50). I had sold it on 17 DEC2019 at 2.125 ($106.25.) Thus, the profit on each option = $106.25 – 37.50 = $68.75 (excluding comm.)

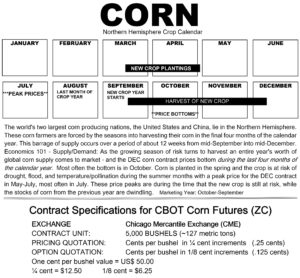

New Trade today: I sold the MAY20 Corn 370 PUT for 4.0 cents ($200). The Prob OTM is only 76% and is a little more risky than I usually trade. Usually I like to see Prob OTM at 90% or higher. This is a seasonal play. Here is the 15 years average pricing timing chart for MAY Corn (below.) You can see the tendency for MAY corn to be steady to rising between now and April. The expiration date of this short 370 PUT is April 24, 2020, about 94 days out from today. The initial margin deposit about $625.

Here is the MAY2020 corn chart indicating my short 370 PUT:

Here is a page from my book that explains some facets of the seasonality of corn: Seasonal Commodity Charts – Designed by Mother Nature, available on Amazon.com at this LINK

NEW TRADE TODAY: I sold the APR20 Crude Oil short strangle 70 CALL and 45 PUT – for a total of 0.22 ($220). I got .11 for each of these options. The Prob OTM is about 95%. The expiration date is 56 days out on March 17, 2020. The initial margin requirement was about $1194. Caution: You can see on the chart below when Crude Oil price spiked to $65 less than a month ago due to MidEast tensions. At any time, this can happen so this trade is risky for this reason. Just this morning in the news an Iranian minister issued a $3 million dollar bounty for anyone who assassinates President Trump. I will have to follow the news closely, but I am willing to take this risk. The APRIL 20 Crude Oil futures are trading about $58.35 / barrel this morning.

Summary: I closed the short MAR20 Corn 360 PUT and sold a MAY20 Corn 370 PUT. I also sold the APR20 Crude Oil short strangle for 0.22 ($220) today. These are my only outstanding positions for now. I shopped to sell Gold options today but decided to wait. The stock market still at all-time highs, and though I’m not predicting it, I will wait for a pull back and for Gold prices to spike higher. OR if new record highs continue, I will visit the idea of selling Gold CALLs. For now, I’m aside on gold. (Gold prices are inversely correlated with the stock market Indexes, usually.)

Comment: Phase ONE of the China/USA agreement is done. Grain traders are left hesitant to believe that China will rush to increase grain purchases, even though the politicians (again) say it will happen. These things are tentative and slow to develop. Talk this morning is that Phase Two, may turn into Phase “2A” (some partial agreement) next. Of course traders and farmers very understandably have a “wait and see what happens” attitude – since news has been unreliable, changes fast, and the timing of any progress is dependent on a verification process that seems non-existent so far. In other words, it will take some action to convince traders that any large buys are going to happen any time soon.

That is all today. Have a great week and thank you. – Don

Don A. Singletary

Book Plug: If you own a portfolio of stocks and do not yet write covered calls on them, please click on this book cover to find out more about my book: The Amazing Covered Call, available on Amazon.com w/ free prime 2 day shipping.

read more about the book here.

Over 100 seasonal charts are in this book, also available on Amazon:

to read more about this book, click here.

I’m the first to agree that sometimes watching option time-decay is as slow as watching paint dry….and that’s a good thing, actually… no excitement and good profits. Having said that, trading the new Micro E-Mini futures is very low cost and can be quite fun to trade. The Micro Futures are quite popular and traded over 72 million contracts in the first six months they came out back in MAY 2019. These new futures contracts are 1/10th the size of regular E-Minis and the commissions to trade them are only a dollar at most brokers (plus exch. fees.) I have a new YouTube Channel, Day Trading the Micros. On the channel, the videos use examples with candlesticks, the MACD, 5-minute increments and trade the NASDAQ100 Micros — to teach day trading them. If you’d like to check it out here the URL: Day Trading Micro Futures

and/or check out the book here:

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings 21 JAN 2020 TUESDAY:

Closing Purchase this morning: I bought back the MAR20 Corn 365-strike PUT at .75 cents this morning ($37.50). I had sold it on 17 DEC2019 at 2.125 ($106.25.) Thus, the profit on each option = $106.25 – 37.50 = $68.75 (excluding comm.)

New Trade today: I sold the MAY20 Corn 370 PUT for 4.0 cents ($200). The Prob OTM is only 76% and is a little more risky than I usually trade. Usually I like to see Prob OTM at 90% or higher. This is a seasonal play. Here is the 15 years average pricing timing chart for MAY Corn (below.) You can see the tendency for MAY corn to be steady to rising between now and April. The expiration date of this short 370 PUT is April 24, 2020, about 94 days out from today. The initial margin deposit about $625.

Here is the MAY2020 corn chart indicating my short 370 PUT:

Here is a page from my book that explains some facets of the seasonality of corn: Seasonal Commodity Charts – Designed by Mother Nature, available on Amazon.com at this LINK

NEW TRADE TODAY: I sold the APR20 Crude Oil short strangle 70 CALL and 45 PUT – for a total of 0.22 ($220). I got .11 for each of these options. The Prob OTM is about 95%. The expiration date is 56 days out on March 17, 2020. The initial margin requirement was about $1194. Caution: You can see on the chart below when Crude Oil price spiked to $65 less than a month ago due to MidEast tensions. At any time, this can happen so this trade is risky for this reason. Just this morning in the news an Iranian minister issued a $3 million dollar bounty for anyone who assassinates President Trump. I will have to follow the news closely, but I am willing to take this risk. The APRIL 20 Crude Oil futures are trading about $58.35 / barrel this morning.

Summary: I closed the short MAR20 Corn 360 PUT and sold a MAY20 Corn 370 PUT. I also sold the APR20 Crude Oil short strangle for 0.22 ($220) today. These are my only outstanding positions for now. I shopped to sell Gold options today but decided to wait. The stock market still at all-time highs, and though I’m not predicting it, I will wait for a pull back and for Gold prices to spike higher. OR if new record highs continue, I will visit the idea of selling Gold CALLs. For now, I’m aside on gold. (Gold prices are inversely correlated with the stock market Indexes, usually.)

Comment: Phase ONE of the China/USA agreement is done. Grain traders are left hesitant to believe that China will rush to increase grain purchases, even though the politicians (again) say it will happen. These things are tentative and slow to develop. Talk this morning is that Phase Two, may turn into Phase “2A” (some partial agreement) next. Of course traders and farmers very understandably have a “wait and see what happens” attitude – since news has been unreliable, changes fast, and the timing of any progress is dependent on a verification process that seems non-existent so far. In other words, it will take some action to convince traders that any large buys are going to happen any time soon.

That is all today. Have a great week and thank you. – Don

Don A. Singletary

Book Plug: If you own a portfolio of stocks and do not yet write covered calls on them, please click on this book cover to find out more about my book: The Amazing Covered Call, available on Amazon.com w/ free prime 2 day shipping.

read more about the book here.

Over 100 seasonal charts are in this book, also available on Amazon:

to read more about this book, click here.

I’m the first to agree that sometimes watching option time-decay is as slow as watching paint dry….and that’s a good thing, actually… no excitement and good profits. Having said that, trading the new Micro E-Mini futures is very low cost and can be quite fun to trade. The Micro Futures are quite popular and traded over 72 million contracts in the first six months they came out back in MAY 2019. These new futures contracts are 1/10th the size of regular E-Minis and the commissions to trade them are only a dollar at most brokers (plus exch. fees.) I have a new YouTube Channel, Day Trading the Micros. On the channel, the videos use examples with candlesticks, the MACD, 5-minute increments and trade the NASDAQ100 Micros — to teach day trading them. If you’d like to check it out here the URL: Day Trading Micro Futures

and/or check out the book here:

read more about the book, click here.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.