Greetings: 24 September 2019 TUESDAY TRADE COMMENTARY

I continue to hold my short DEC19 Corn 420-strike PUT options as well as my short DEC19 Crude Oil 85-strike CALLs. As you likely are well aware -most investors, and myself among them – know that the stock market is on a shaky precipice, and remaining near all-time highs. Gold has crawled up and up, about $250 per ounce in the last six months. If the stock market crashes and/or news of weak global economy, gold goes up more and probably very fast, thus I don’t choose to sell CALLs right now. Since gold prices have risen so much in the last six months, I am hesitant to sell PUTs right now. What I have decided to do, for now, is watch for the next move for gold prices, and then consider shopping to sell options.

Corn and Soybeans: If Corn goes down 15 to 25 cents, I’ll consider selling PUT options again (at strikes 320 and lower.) As I mentioned last week, I’d like to sell Soybean CALLs, but with the China trade talks in the news and uncertainty everywhere, bean prices could pop up quickly. Fundamentally (supply-demand) this is not warranted but as we have seen too often lately, headlines can rules prices more than the fundamentals on the short term. I am still watching for an opportunity to SELL some soybean CALLs. However, with pending USA/China trade talks scheduled in OCT, I am hesitant but still shopping to be ready.

Just so you know: I get several email morning blurbs with “headlines of the day” early each morning. This was one of those headline I received early today:

China granted new waivers to several domestic state and private firms exempting them from retaliatory tariffs on soybeans imported from the U.S., Bloomberg reported. It said the waivers would apply to between 2 million tonnes and 3 million tonnes of U.S. soybeans. Some of the companies have already reportedly bought about 1.2 million tonnes of soybeans.

At face value, this paragraph/story seems to contain positive news by announcing pending sales of USA soybean to China. We all know that media interpretations and public reaction can get easily overdone. This is actually what I call a “nothing story” and I’ll show you why: The story speaks of sales of 3 + 1.2 = 4.2 million tonnes of soybeans are to be bought by China.

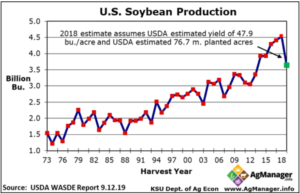

So how much is 4.2 million tonnes of soybeans? 1 metric ton of soybeans. = 36.74 bushels, so 1 million tonnes of soybeans is the equivalent of 36.74 million bushels of beans. 4.2 mm tonnes = 154 million bushels. The latest USDA / WASDE (supply-demand) projections are for production 2019-2020 will be 3.6 Billion bushels.

And now to my point: 4.2 million tonnes (154 mm bushels) is equal to only about 154/3600 (100) = 4% of the crop. These purchases have not yet occurred and if they do, it will be over several months of time. China WAS by far, the largest customer for USA soybeans and usually would buy about 45% of USA exports. So you see, this “big buy” is NOT such a big deal after all. Granted, to USA farmers, all purchases are important, but in the ‘big picture’ this news story is not so important.

The average to-farm price for Corn in the 2019-2020 season is still $3.60. Yesterday’s (Monday) crop weekly crop condition report from USDA had no surprises.

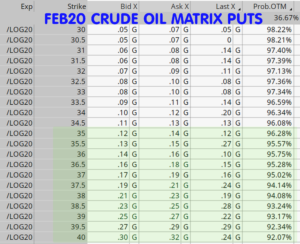

Crude Oil: Regarding the $85-strike DEC19 Crude Oil short CALL: There is a nice profit there which has materialized pretty quickly. This is always a sign to me to consider taking a profit. If you decided to make this trade or a similar trade, it might be prudent to consider banking the profit- especially if you were able to sell it for near 0.23 to 0.27. I sold at 0.19 but that afternoon, better prices were available than my fill. Why consider this when it is so far above the money, and still has about .12 to .13 left on premium? Because it was barely 10 days ago, when missiles hit the Saudi refinery. That’s why. I might take my profits on this sooner rather than later just to “bank it.” I also am shopping for early calendar 2020 CALLs to sell should oil prices get back up near $60 levels or higher. I have my eye on the FEB20 $85-strike CALL now priced at about 0.22 ($220.) If I do sell this (or similar) CALL, I will also be shopping for PUT options to form short strangles. Here’s the FEB20 PUT option matrix this morning:

You can see (above) those FEB20 Crude Oil PUTS of 35 to 40 strikes all have over 92% Prob OTM and (I think) attractive premiums. Here’s a chart of the FEB20 Crude Oil futures (below) I’ve marked the 80CALLS and the 35PUTS for reference only:

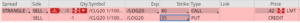

As of this morning: The FEB20 Crude Oil short 80 CALL / 35 PUT strangle is priced at $420 (see below.)

Whether you are a regular subscriber and experienced hand at this or a NEW SUBSCRIBER, remember it is always good practice to use your trading software to practice “shopping.” To do so, gets the brain thinking and ideas come. I am seriously considering a trade the same or similar to the illustration above.

That is all today, have a good day and a great week ahead. – Don

Don A. Singletary

Trial Subscribers: Subscribe today and don’t miss an issue. Thank you.

Trial Subscribers: Don’t miss an issue.

When new subscribers ask me to recommend a broker that has very easy-to-learn and easy-to-use software (free of course) and a good commission rate, I recommend TastyWorks. I have some of my personal accounts there. They also have an 85 cents commission rate on the new Micro Index Futures.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

***************

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: 24 September 2019 TUESDAY TRADE COMMENTARY

I continue to hold my short DEC19 Corn 420-strike PUT options as well as my short DEC19 Crude Oil 85-strike CALLs. As you likely are well aware -most investors, and myself among them – know that the stock market is on a shaky precipice, and remaining near all-time highs. Gold has crawled up and up, about $250 per ounce in the last six months. If the stock market crashes and/or news of weak global economy, gold goes up more and probably very fast, thus I don’t choose to sell CALLs right now. Since gold prices have risen so much in the last six months, I am hesitant to sell PUTs right now. What I have decided to do, for now, is watch for the next move for gold prices, and then consider shopping to sell options.

Corn and Soybeans: If Corn goes down 15 to 25 cents, I’ll consider selling PUT options again (at strikes 320 and lower.) As I mentioned last week, I’d like to sell Soybean CALLs, but with the China trade talks in the news and uncertainty everywhere, bean prices could pop up quickly. Fundamentally (supply-demand) this is not warranted but as we have seen too often lately, headlines can rules prices more than the fundamentals on the short term. I am still watching for an opportunity to SELL some soybean CALLs. However, with pending USA/China trade talks scheduled in OCT, I am hesitant but still shopping to be ready.

Just so you know: I get several email morning blurbs with “headlines of the day” early each morning. This was one of those headline I received early today:

China granted new waivers to several domestic state and private firms exempting them from retaliatory tariffs on soybeans imported from the U.S., Bloomberg reported. It said the waivers would apply to between 2 million tonnes and 3 million tonnes of U.S. soybeans. Some of the companies have already reportedly bought about 1.2 million tonnes of soybeans.

At face value, this paragraph/story seems to contain positive news by announcing pending sales of USA soybean to China. We all know that media interpretations and public reaction can get easily overdone. This is actually what I call a “nothing story” and I’ll show you why: The story speaks of sales of 3 + 1.2 = 4.2 million tonnes of soybeans are to be bought by China.

So how much is 4.2 million tonnes of soybeans? 1 metric ton of soybeans. = 36.74 bushels, so 1 million tonnes of soybeans is the equivalent of 36.74 million bushels of beans. 4.2 mm tonnes = 154 million bushels. The latest USDA / WASDE (supply-demand) projections are for production 2019-2020 will be 3.6 Billion bushels.

And now to my point: 4.2 million tonnes (154 mm bushels) is equal to only about 154/3600 (100) = 4% of the crop. These purchases have not yet occurred and if they do, it will be over several months of time. China WAS by far, the largest customer for USA soybeans and usually would buy about 45% of USA exports. So you see, this “big buy” is NOT such a big deal after all. Granted, to USA farmers, all purchases are important, but in the ‘big picture’ this news story is not so important.

The average to-farm price for Corn in the 2019-2020 season is still $3.60. Yesterday’s (Monday) crop weekly crop condition report from USDA had no surprises.

Crude Oil: Regarding the $85-strike DEC19 Crude Oil short CALL: There is a nice profit there which has materialized pretty quickly. This is always a sign to me to consider taking a profit. If you decided to make this trade or a similar trade, it might be prudent to consider banking the profit- especially if you were able to sell it for near 0.23 to 0.27. I sold at 0.19 but that afternoon, better prices were available than my fill. Why consider this when it is so far above the money, and still has about .12 to .13 left on premium? Because it was barely 10 days ago, when missiles hit the Saudi refinery. That’s why. I might take my profits on this sooner rather than later just to “bank it.” I also am shopping for early calendar 2020 CALLs to sell should oil prices get back up near $60 levels or higher. I have my eye on the FEB20 $85-strike CALL now priced at about 0.22 ($220.) If I do sell this (or similar) CALL, I will also be shopping for PUT options to form short strangles. Here’s the FEB20 PUT option matrix this morning:

You can see (above) those FEB20 Crude Oil PUTS of 35 to 40 strikes all have over 92% Prob OTM and (I think) attractive premiums. Here’s a chart of the FEB20 Crude Oil futures (below) I’ve marked the 80CALLS and the 35PUTS for reference only:

As of this morning: The FEB20 Crude Oil short 80 CALL / 35 PUT strangle is priced at $420 (see below.)

Whether you are a regular subscriber and experienced hand at this or a NEW SUBSCRIBER, remember it is always good practice to use your trading software to practice “shopping.” To do so, gets the brain thinking and ideas come. I am seriously considering a trade the same or similar to the illustration above.

That is all today, have a good day and a great week ahead. – Don

Don A. Singletary

Trial Subscribers: Don’t miss an issue.

When new subscribers ask me to recommend a broker that has very easy-to-learn and easy-to-use software (free of course) and a good commission rate, I recommend TastyWorks. I have some of my personal accounts there. They also have an 85 cents commission rate on the new Micro Index Futures.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

***************

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.