Greetings! New Trade Today: Shorted the OCT19 Crude Oil 75C/40P strangle.

I opened a new short strangle today: Selling the OCT19 Crude Oil 40-strike PUT and the 75-strike CALL for a total of 0.12 ($120). I got .07 for the 40P and 0.05 for the 75C. This was my fill, but any combination that gets a 0.12 total will do. I put a spread order in, not individual orders – as I often do. This way there is no limit on either side, just a limit for the total premium required for the trade.

Initial net Margin: $543

Prob. OTM: 97%

Expiration for OCT19 Crude Oil options: 54 days out on September 17, 2019

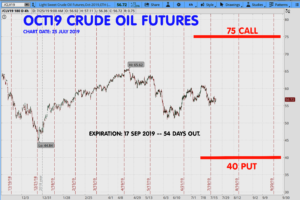

Here’s the chart:

Summary of my Positions 25 July 2019:

DEC19 Crude Oil short 80 CALL for .10 ($100)

DEC19 Crude Oil short 40 PUT for 1.80 ($180)

Short Gold NOV19 1800-strike CALL I sold for $110

Short Gold DEC19 $1250 PUT for 1.2 ($120)

And today’s trade of course: The Crude Oil OCT19 short strangle 75C/40P for 0.12.

Comment: I felt with only 54 days until expiration the 75C/40P should stay out of range for the price of the underlying OCT2019 crude oil futures contract price. My latest comments re: Crude Oil are in the 22nd July post on Monday of this week, see: https://www.timefarming.com/blog/22-july-201h/

That is all for today. Thank you. – Don

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

Futures trading is risky and not suitable for all investors.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings! New Trade Today: Shorted the OCT19 Crude Oil 75C/40P strangle.

I opened a new short strangle today: Selling the OCT19 Crude Oil 40-strike PUT and the 75-strike CALL for a total of 0.12 ($120). I got .07 for the 40P and 0.05 for the 75C. This was my fill, but any combination that gets a 0.12 total will do. I put a spread order in, not individual orders – as I often do. This way there is no limit on either side, just a limit for the total premium required for the trade.

Initial net Margin: $543

Prob. OTM: 97%

Expiration for OCT19 Crude Oil options: 54 days out on September 17, 2019

Here’s the chart:

Summary of my Positions 25 July 2019:

DEC19 Crude Oil short 80 CALL for .10 ($100)

DEC19 Crude Oil short 40 PUT for 1.80 ($180)

Short Gold NOV19 1800-strike CALL I sold for $110

Short Gold DEC19 $1250 PUT for 1.2 ($120)

And today’s trade of course: The Crude Oil OCT19 short strangle 75C/40P for 0.12.

Comment: I felt with only 54 days until expiration the 75C/40P should stay out of range for the price of the underlying OCT2019 crude oil futures contract price. My latest comments re: Crude Oil are in the 22nd July post on Monday of this week, see: https://www.timefarming.com/blog/22-july-201h/

That is all for today. Thank you. – Don

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

Futures trading is risky and not suitable for all investors.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.