29 April 2019 Monday Commentary:

Crude Oil: I wish I could say that the sudden sell-off of crude Friday was unusual and rare- and that it is important and surprising news, but NONE of that would be true. Read this story (below) from Marketwatch.com and it is similar, almost identical, to many other such articles that appeared Friday and over the weekend.

MarketWatch Story from Friday:

Oil ends nearly 3% lower as traders react to Trump’s plea to OPEC for cheaper crude

(source MarketWatch.com: https://www.marketwatch.com/story/oil-prices-pause-bull-run-weekly-streak-of-gains-at-risk-2019-04-26

Oil futures dropped by nearly 3% on Friday as traders weighed uncertainty tied to President Donald Trump’s plea to OPEC to lower prices.

“Gasoline prices are coming down. I called up OPEC, I said you’ve got to bring them down. You’ve got to bring them down,” Trump told reporters Friday.

But oil prices managed to finish off the session’s worst levels after the Organization of the Petroleum Exporting Countries’ Secretary General Mohammed Barkindo said he hasn’t spoken with Trump, nor has Saudi Arabia’s energy minister Khalid al-Falih, according to The Wall Street Journal, citing people familiar with the matter.

As oil futures settled, Trump tweeted that he “spoke to Saudi Arabia and others about increase oil flow.”

Against that backdrop, U.S.-based West Texas Intermediate crude for June delivery CLM9, -3.70% fell $1.91, or 2.9%, to settle at $63.30 a barrel on the New York Mercantile Exchange. WTI fell 1.2% for the week, following seven consecutive weeks of gains, according to Dow Jones Market Data.

Prices also pared losses after data from Baker Hughes BHGE, +0.04% implied a slowdown in oil-drilling activity. The data Friday revealed that the number of active U.S. rigs drilling for oil dropped for a second straight week, down 20 to 805 this week.

June Brent crude LCOM9, -3.74% the global benchmark, fell $2.20, or about 3%, at $72.15 a barrel on ICE Futures Europe. The most-active Brent crude contract edged up by 0.3% for the week, up a fifth straight week.

Earlier this week, prices for U.S. and global benchmark crude had marked their highest settlements in nearly six months.

“Clearly, prices had been technically ‘overbought’ and a correction of some sort was imminent. It remains to be seen how far oil prices will fall given the still supportive market conditions, with the OPEC+ group of producers continuing to restrict supply and the U.S. government tightening sanctions against Iran,” said Fawad Razaqzada, market analyst at Forex.com.

Crude’s multiday rise had come on the heels the U.S. decision to end waivers for countries importing Iranian oil, as part of a bid by the Trump administration to push Iran’s exports to zero. The current waivers expire on May 2.

(END OF STORY)

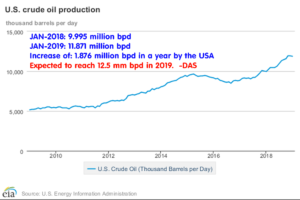

About crude: Also consider how OPEC and other countries have this on-going participation (or at least the rhetoric and appearance of participating) with production cuts – and all the while the United States is producing at an ever increasing rate. Here is a chart from EIA.gov (USA Gov’t) on USA production: (source: https://www.eia.gov/petroleum/production/ )

USA Crude Production

Comments continued: I got an email from a subscriber late Friday and he said what a lot of us were/are thinking. I’ll paraphrase here:

“I had a nice profit on the crude PUT options, then after crude price drop today, I not only gave that back but am now holding a net losing position. What’s going on?”

My comment/reply to this person went like this:

“I am holding my positions and I expect there to be more up and down just about all the time. I think if you wait until next week, you may not feel the way you do today. You are considering the unrealized ‘gains’ you had – versus ‘losses’ you haven’t realized either. I don’t see, as I mentioned in my comments yesterday (Thursday), any fundamentals that support either 85 or 50 prices. But I can’t say what you -personally- should do. I’m going to wait and see what happens next week. One has to consider overall results and if the risk gets larger, what will happen. I do know this: Anyone who says that can tell you with certainty – which way oil will trade Monday morning – has a 50/50 chance of getting it right. Just four days ago, talk was of 80 dollar oil, now look today… and truth be told there has been almost no fundamental change from five days ago until now.”

All of we traders have that “little voice in our heads” that second-guesses ourselves with the fictional perspective of a “Monday morning quarterback.” (We see what we could have done with perfect hindsight.) This does however – have a trader considering various approaches as to “when to take profits.” I can give you a good example right now: As you know, in my current positions – I am short the JUL19 1450-strike Gold CALL. It traded several hours on Friday at 0.30, then close with a last trade of 0.40. The other side of this short strangle is the 1200-strike JUL19 Gold PUT that I sold at 0.90, and this one closed at 0.50. So between the two of these I have a $90 to $100 profit on each of these short strangles (1200P/1450C). I, nor anyone – else can say whether gold with trade up or down on the open Monday (I write my comments on Sunday, as you know even though this post is dated Monday.) My point here is that – will I be asking myself if I should have taken the profit on these strangles on Friday? If you haven’t figured it out yet, for as long as you trade, you will be doing this ‘second guessing’ of your real-time decisions, with the advantage of hindsight. There is no way to avoid this. These Gold 1200P/1450 JUL19 strangles expire in about 58 days. The first thing I do when I think of taking a profit like this is to look at the chart. Here is the

AUG19 Gold chart (remember the options are JUL19 but underlying is the AUG19 futures):

I find looking at the chart keeps me in more of a “big picture” mode. For me, that is helpful. I know Gold went up over $8/oz Friday and that it is (as I see on the chart) much closer to 1200, than 1450. I immediately thought that if Gold goes UP significantly as trading opens Monday, I might just take the profits on my short 1200-strike JUL19 Gold PUTs. Gold is is about $94 from the 1200-strike but $162 from the 1450-strike CALLs. The next thing I consider is the fact that I can write more short strangles on Gold in a more distant contract, hopefully a strike farther OTM and with more premium. So I can tell you that is my plan.

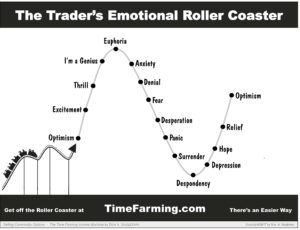

What should you consider doing? That depends on your risk-tolerance, current # of positions relative to your account size, your available margin money, and a half dozen other factors, and something else you might not recognize so easily. I recently read some survey information and articles about the psychology of trading – and this information pointed out something that I feel is very, very true. Something many of us do not realize: One of the most influential factors a trader uses in making trade decision is recent experience. As much as we might wish to think that we can be objective and detached in order to make more rational (logical instead of emotional) decisions, our most recent trading experiences often play a major role in our decision-making. I recall from a psychology class years ago, the phrase telescopic fear, sometimes called irrational fear. An example of this: If a friend died in aircraft, one might have exaggerated (irrational) fear despite the awareness and reassurance (statistics) that it is not dangerous. Another more common example: We have a near-miss of a car crash, and we adjust our behavior to be more cautious. Obviously, this isn’t a “bad” thing, but still we should be aware (in trading) that our recent experiences DO heavily influence our decisioins. In trading, it helps me to go to data, charts, and other information when I feel I could be making a decision based on perhaps an irrational amount of fear due to a recent experience; doing so makes me more grounded.

A friend of mine (probably more than one) would say I over-think things. His solution is what he calls “the stupid test.” He told me a simple view that he uses: “I ask myself, if I do this trade and lose a bunch of money, will I look back and see how stupid it was.” I’ll never tell him, but since he mentioned it to me, I use his “stupid test” quite often.

Another thing that happens often is for a trader to “get married” to his/her trade. This comes from our resistance to admit that a trade has turned badly for us. This is how things get from ‘not pleasant’ to ‘really bad.’ The antidote for this (IMHO) is Sun Tze’s / Art of War quote: In order to survive, do not fight battles you cannot win. I often get email from traders who think because I am knowledgeable in option trading that I can always find a way out of a bad trade by buying or selling more options. This is a popularized myth by wishful thinkers who are married to bad trades. Experienced traders know they will have losses and there is no way to totally avoid them. Parallel to this thought, please remember that most of the time when a trade goes ‘bad’, it is NOT because the trader made a mistake but rather due to things beyond our prediction and control. Be kind to yourself and don’t “marry a trade.” A bad trade is only the cost of doing business. Good business people, professional poker players, high-level athletes, and good parents all have to learn to not let occassional bad outcomes destroy their confidence.

Simple math can also help you make better decisions. Let me give you an example: Suppose you decide to sell a corn option for 4.125 cents. Many traders will almost always place their limit orders one or two ticks away just to try and edge a tiny bit more from a trade. Do the math and you might see that this is mostly wasted effort. One time it works – and the next time it costs you. Really, do the math for the ROI of the trade and you’ll see it makes very little difference at all (aka: a waste of time.) Efforts to gain such small differences are normally beyond diminishing returns for all the effort taken. Do the math a couple of times and you’ll probably drop this habit quickly and move on to something more productive. The most common example of this “tick shaving” habit is when exiting a position with a profit. It is when our food is the best, we always want one more bite.

Corn: Corn prices suddenly turned UP in trading Friday after having drifted down almost 20 cents since the end of MAR19. Let’s take a look at the chart first, then the “news” that came up Friday:

Chinese President Xi from a world conference platform Friday issued statements that his country is committed to an open economy, improvements in laws, tariff cuts and that there will be a prohibition on forced technology transfer. Just the evening before — on late Thursday, USA President Trump said that President Xi will be visiting the US soon. Seems we have heard all this many times since last summer and it’s sounding the the fable of the “boy who cried wolf” so many times with no results. Until something is done, all political rhetoric can get monotonous for traders at times.

Rumors abound and the most optimistic figures out suggest China could buy as much as the equivalent of 753 million bushels of corn in the next year. The developments Thursday and Friday had the managed money traders 332,215 contracts record # of short contracts reduced by 40,090 in trading action and futures closed up 3 to 5 cents. There has been such news stories in prior weeks, but those did NOT result in net reduction of managed money short contracts like the trading on Friday/Thursday. This could be significant – and could be a turnaround in the trend to something more positive soon. I’ll be watching this week to see if the buying continues. This bodes well for my short DEC19 330-strike PUT options while it also makes me want to hold off on selling any Corn CALL options until I see what develops.

If (perhaps a big “if”) China did buy enough corn and ethanol to amount to 700+ million bushels of corn, this would be huge and bullish for corn prices. Currently the USDA/ WASDE projects a little over 2 billion bushels of ending stocks for corn, a half a billion or more bushels is enough to cause a fundamental shift in prices (bullish). The last thing I want to do is to sell CALLs NOW and risk getting run over by the bulls! This probably means I’ll wait until some of this good news is manifest, allow prices to rise, and THEN sell CALLs. So this becomes a game of patience again, rather than immediate action.

Many corn analysts and traders cite the very wet weather forecast over the next two weeks could curb crop progress and might produce unfavorable to growing conditions for a while.

Soybeans: Notice that on Friday, while Corn traded up as much as 5 cents during the day, the soybean prices were down about 6 cents all day. Sometimes in grains, one member of this group will pull the others up with the market; this did NOT happen Friday. There was no corresponding positive movement in soybean prices – as the stocks remain extremely high and it seems there is no way anyone can buy enough beans to change this. This bodes well for the short bean CALLs I have.

I have no idea of the timing of President Trump’s comment when he says President Xi will be coming to the USA “soon.” If it is truly within a month to six weeks from now, I expect the rest of those traders that are short corn will be buying really fast. No way to know for sure, but this will be interesting to watch. At this point, even the rumor of a Xi trip soon is enough to cause corn prices to rise. Another thing in my mind about that number that China could buy the equivalent of 753 million bushels, is that is a ‘politicians figure’ – and in reality a great deal of that buy might not be in calendar 2019 but out in 2020. This would leave corn ending stocks in September still pretty high. It doesn’t seem likely – given that huge 753 million bushel number – that all that buying would be in calendar 2019. — I am hopeful corn will rise enough to allow me trade some really nice high-strike CALLS over the coming months. Having said all this, I am only planning and watching at this time.

Option Income Training Bulletin Changes:

The new monthly rate for this newsletter is $75.00 $US per month. ALL EXISTING SUBSCRIBERS ON EITHER THE MONTHLY AND ANNUAL RATES ARE NOT GOING TO BE CHANGED – the old rates will be honored as long as you are a paid subscriber. This only effects NEW paid subscribers. There is only a $75 per month rate now, there is no annual rate. Renewals of existing subscribers remain at the old rate for renewals. Also — the new FREE TRIAL time period is 14-DAYS from this time forward. All on the current 60-day trial periods will not have any expiration dates of your trial changed. If you are an existing paying subscriber and have any questions or concerns, just email me please: Don@WriteThisDown.com

New Video Tab Coming Soon

I am almost ready to place the new video library on the TABS here on the website. It will contain tips on commodity trading, option strategy, the psychology of trading, and more. I’ll notify everyone when it gets posted. I expect to start with a dozen or so training videos and add several each month. It will be a consolidated listing of videos that can help anyone learning and using the strategies I practice and discuss here. Thank you.

It is quite possible I will be posting more commentary this week and notice of some of the trades I’ve discussed. You will be sent the usual email notification. Have a great week. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

29 April 2019 Monday Commentary:

Crude Oil: I wish I could say that the sudden sell-off of crude Friday was unusual and rare- and that it is important and surprising news, but NONE of that would be true. Read this story (below) from Marketwatch.com and it is similar, almost identical, to many other such articles that appeared Friday and over the weekend.

MarketWatch Story from Friday:

Oil ends nearly 3% lower as traders react to Trump’s plea to OPEC for cheaper crude

(source MarketWatch.com: https://www.marketwatch.com/story/oil-prices-pause-bull-run-weekly-streak-of-gains-at-risk-2019-04-26

Oil futures dropped by nearly 3% on Friday as traders weighed uncertainty tied to President Donald Trump’s plea to OPEC to lower prices.

“Gasoline prices are coming down. I called up OPEC, I said you’ve got to bring them down. You’ve got to bring them down,” Trump told reporters Friday.

But oil prices managed to finish off the session’s worst levels after the Organization of the Petroleum Exporting Countries’ Secretary General Mohammed Barkindo said he hasn’t spoken with Trump, nor has Saudi Arabia’s energy minister Khalid al-Falih, according to The Wall Street Journal, citing people familiar with the matter.

As oil futures settled, Trump tweeted that he “spoke to Saudi Arabia and others about increase oil flow.”

Against that backdrop, U.S.-based West Texas Intermediate crude for June delivery CLM9, -3.70% fell $1.91, or 2.9%, to settle at $63.30 a barrel on the New York Mercantile Exchange. WTI fell 1.2% for the week, following seven consecutive weeks of gains, according to Dow Jones Market Data.

Prices also pared losses after data from Baker Hughes BHGE, +0.04% implied a slowdown in oil-drilling activity. The data Friday revealed that the number of active U.S. rigs drilling for oil dropped for a second straight week, down 20 to 805 this week.

June Brent crude LCOM9, -3.74% the global benchmark, fell $2.20, or about 3%, at $72.15 a barrel on ICE Futures Europe. The most-active Brent crude contract edged up by 0.3% for the week, up a fifth straight week.

Earlier this week, prices for U.S. and global benchmark crude had marked their highest settlements in nearly six months.

“Clearly, prices had been technically ‘overbought’ and a correction of some sort was imminent. It remains to be seen how far oil prices will fall given the still supportive market conditions, with the OPEC+ group of producers continuing to restrict supply and the U.S. government tightening sanctions against Iran,” said Fawad Razaqzada, market analyst at Forex.com.

Crude’s multiday rise had come on the heels the U.S. decision to end waivers for countries importing Iranian oil, as part of a bid by the Trump administration to push Iran’s exports to zero. The current waivers expire on May 2.

(END OF STORY)

About crude: Also consider how OPEC and other countries have this on-going participation (or at least the rhetoric and appearance of participating) with production cuts – and all the while the United States is producing at an ever increasing rate. Here is a chart from EIA.gov (USA Gov’t) on USA production: (source: https://www.eia.gov/petroleum/production/ )

USA Crude Production

Comments continued: I got an email from a subscriber late Friday and he said what a lot of us were/are thinking. I’ll paraphrase here:

My comment/reply to this person went like this:

All of we traders have that “little voice in our heads” that second-guesses ourselves with the fictional perspective of a “Monday morning quarterback.” (We see what we could have done with perfect hindsight.) This does however – have a trader considering various approaches as to “when to take profits.” I can give you a good example right now: As you know, in my current positions – I am short the JUL19 1450-strike Gold CALL. It traded several hours on Friday at 0.30, then close with a last trade of 0.40. The other side of this short strangle is the 1200-strike JUL19 Gold PUT that I sold at 0.90, and this one closed at 0.50. So between the two of these I have a $90 to $100 profit on each of these short strangles (1200P/1450C). I, nor anyone – else can say whether gold with trade up or down on the open Monday (I write my comments on Sunday, as you know even though this post is dated Monday.) My point here is that – will I be asking myself if I should have taken the profit on these strangles on Friday? If you haven’t figured it out yet, for as long as you trade, you will be doing this ‘second guessing’ of your real-time decisions, with the advantage of hindsight. There is no way to avoid this. These Gold 1200P/1450 JUL19 strangles expire in about 58 days. The first thing I do when I think of taking a profit like this is to look at the chart. Here is the

AUG19 Gold chart (remember the options are JUL19 but underlying is the AUG19 futures):

I find looking at the chart keeps me in more of a “big picture” mode. For me, that is helpful. I know Gold went up over $8/oz Friday and that it is (as I see on the chart) much closer to 1200, than 1450. I immediately thought that if Gold goes UP significantly as trading opens Monday, I might just take the profits on my short 1200-strike JUL19 Gold PUTs. Gold is is about $94 from the 1200-strike but $162 from the 1450-strike CALLs. The next thing I consider is the fact that I can write more short strangles on Gold in a more distant contract, hopefully a strike farther OTM and with more premium. So I can tell you that is my plan.

What should you consider doing? That depends on your risk-tolerance, current # of positions relative to your account size, your available margin money, and a half dozen other factors, and something else you might not recognize so easily. I recently read some survey information and articles about the psychology of trading – and this information pointed out something that I feel is very, very true. Something many of us do not realize: One of the most influential factors a trader uses in making trade decision is recent experience. As much as we might wish to think that we can be objective and detached in order to make more rational (logical instead of emotional) decisions, our most recent trading experiences often play a major role in our decision-making. I recall from a psychology class years ago, the phrase telescopic fear, sometimes called irrational fear. An example of this: If a friend died in aircraft, one might have exaggerated (irrational) fear despite the awareness and reassurance (statistics) that it is not dangerous. Another more common example: We have a near-miss of a car crash, and we adjust our behavior to be more cautious. Obviously, this isn’t a “bad” thing, but still we should be aware (in trading) that our recent experiences DO heavily influence our decisioins. In trading, it helps me to go to data, charts, and other information when I feel I could be making a decision based on perhaps an irrational amount of fear due to a recent experience; doing so makes me more grounded.

A friend of mine (probably more than one) would say I over-think things. His solution is what he calls “the stupid test.” He told me a simple view that he uses: “I ask myself, if I do this trade and lose a bunch of money, will I look back and see how stupid it was.” I’ll never tell him, but since he mentioned it to me, I use his “stupid test” quite often.

Another thing that happens often is for a trader to “get married” to his/her trade. This comes from our resistance to admit that a trade has turned badly for us. This is how things get from ‘not pleasant’ to ‘really bad.’ The antidote for this (IMHO) is Sun Tze’s / Art of War quote: In order to survive, do not fight battles you cannot win. I often get email from traders who think because I am knowledgeable in option trading that I can always find a way out of a bad trade by buying or selling more options. This is a popularized myth by wishful thinkers who are married to bad trades. Experienced traders know they will have losses and there is no way to totally avoid them. Parallel to this thought, please remember that most of the time when a trade goes ‘bad’, it is NOT because the trader made a mistake but rather due to things beyond our prediction and control. Be kind to yourself and don’t “marry a trade.” A bad trade is only the cost of doing business. Good business people, professional poker players, high-level athletes, and good parents all have to learn to not let occassional bad outcomes destroy their confidence.

Simple math can also help you make better decisions. Let me give you an example: Suppose you decide to sell a corn option for 4.125 cents. Many traders will almost always place their limit orders one or two ticks away just to try and edge a tiny bit more from a trade. Do the math and you might see that this is mostly wasted effort. One time it works – and the next time it costs you. Really, do the math for the ROI of the trade and you’ll see it makes very little difference at all (aka: a waste of time.) Efforts to gain such small differences are normally beyond diminishing returns for all the effort taken. Do the math a couple of times and you’ll probably drop this habit quickly and move on to something more productive. The most common example of this “tick shaving” habit is when exiting a position with a profit. It is when our food is the best, we always want one more bite.

Corn: Corn prices suddenly turned UP in trading Friday after having drifted down almost 20 cents since the end of MAR19. Let’s take a look at the chart first, then the “news” that came up Friday:

Chinese President Xi from a world conference platform Friday issued statements that his country is committed to an open economy, improvements in laws, tariff cuts and that there will be a prohibition on forced technology transfer. Just the evening before — on late Thursday, USA President Trump said that President Xi will be visiting the US soon. Seems we have heard all this many times since last summer and it’s sounding the the fable of the “boy who cried wolf” so many times with no results. Until something is done, all political rhetoric can get monotonous for traders at times.

Rumors abound and the most optimistic figures out suggest China could buy as much as the equivalent of 753 million bushels of corn in the next year. The developments Thursday and Friday had the managed money traders 332,215 contracts record # of short contracts reduced by 40,090 in trading action and futures closed up 3 to 5 cents. There has been such news stories in prior weeks, but those did NOT result in net reduction of managed money short contracts like the trading on Friday/Thursday. This could be significant – and could be a turnaround in the trend to something more positive soon. I’ll be watching this week to see if the buying continues. This bodes well for my short DEC19 330-strike PUT options while it also makes me want to hold off on selling any Corn CALL options until I see what develops.

If (perhaps a big “if”) China did buy enough corn and ethanol to amount to 700+ million bushels of corn, this would be huge and bullish for corn prices. Currently the USDA/ WASDE projects a little over 2 billion bushels of ending stocks for corn, a half a billion or more bushels is enough to cause a fundamental shift in prices (bullish). The last thing I want to do is to sell CALLs NOW and risk getting run over by the bulls! This probably means I’ll wait until some of this good news is manifest, allow prices to rise, and THEN sell CALLs. So this becomes a game of patience again, rather than immediate action.

Many corn analysts and traders cite the very wet weather forecast over the next two weeks could curb crop progress and might produce unfavorable to growing conditions for a while.

Soybeans: Notice that on Friday, while Corn traded up as much as 5 cents during the day, the soybean prices were down about 6 cents all day. Sometimes in grains, one member of this group will pull the others up with the market; this did NOT happen Friday. There was no corresponding positive movement in soybean prices – as the stocks remain extremely high and it seems there is no way anyone can buy enough beans to change this. This bodes well for the short bean CALLs I have.

I have no idea of the timing of President Trump’s comment when he says President Xi will be coming to the USA “soon.” If it is truly within a month to six weeks from now, I expect the rest of those traders that are short corn will be buying really fast. No way to know for sure, but this will be interesting to watch. At this point, even the rumor of a Xi trip soon is enough to cause corn prices to rise. Another thing in my mind about that number that China could buy the equivalent of 753 million bushels, is that is a ‘politicians figure’ – and in reality a great deal of that buy might not be in calendar 2019 but out in 2020. This would leave corn ending stocks in September still pretty high. It doesn’t seem likely – given that huge 753 million bushel number – that all that buying would be in calendar 2019. — I am hopeful corn will rise enough to allow me trade some really nice high-strike CALLS over the coming months. Having said all this, I am only planning and watching at this time.

Option Income Training Bulletin Changes:

The new monthly rate for this newsletter is $75.00 $US per month. ALL EXISTING SUBSCRIBERS ON EITHER THE MONTHLY AND ANNUAL RATES ARE NOT GOING TO BE CHANGED – the old rates will be honored as long as you are a paid subscriber. This only effects NEW paid subscribers. There is only a $75 per month rate now, there is no annual rate. Renewals of existing subscribers remain at the old rate for renewals. Also — the new FREE TRIAL time period is 14-DAYS from this time forward. All on the current 60-day trial periods will not have any expiration dates of your trial changed. If you are an existing paying subscriber and have any questions or concerns, just email me please: Don@WriteThisDown.com

New Video Tab Coming Soon

I am almost ready to place the new video library on the TABS here on the website. It will contain tips on commodity trading, option strategy, the psychology of trading, and more. I’ll notify everyone when it gets posted. I expect to start with a dozen or so training videos and add several each month. It will be a consolidated listing of videos that can help anyone learning and using the strategies I practice and discuss here. Thank you.

It is quite possible I will be posting more commentary this week and notice of some of the trades I’ve discussed. You will be sent the usual email notification. Have a great week. – Don

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.