Greetings on 04 FEB 2020, Tuesday

At my last post on 27th JAN, Monday of last week- the DJIA was down 400 points due to the Corona virus outbreak. Today, the market is up 469 DJIA points at 28,868 at midday. Gold is down $26.60 per ounce and the April GC (gold) futures are near $1,555 per ounce. Over the last week Crude Oil continued to drop although it did have a couple of higher price trading days along the way.

The USA Presidential State-of-the-Union address is tonight, the Iowa caucus yesterday, and the US Senate still to vote on Presidential impeachment coming up, the OPEC suggesting they will cut 1 million barrels of crude oil production per day, AND (finally) China is seeking an exemption for buying more USA ag products due to the Corona virus shutdowns and quarantines.

My comment is this: I don’t think if Tom Clancy was writing a novel, that he could get a more complicated plot than today’s reality is presenting.

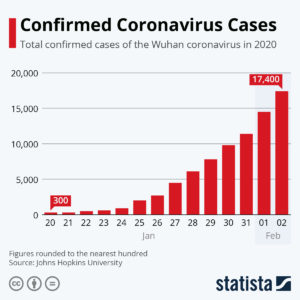

source: https://www.statista.com/chart/20634/confirmed-coronavirus-cases-timeline/

Is there some “good money” to be made for those willing to jump into the middle of all these variable and risks (aka: uncertainty)? Sure there is, but my goal here on Time Farming / Selling Commodity Options is almost he opposite: To sell options so far out of the money that they will expire worthless.

I gave thought this morning as to which of the following might offer the most trading opportunity: Grains, Crude Oil, or Gold. Since China will almost certainly have declining demand for our ag products due to shutdowns and quarantines, I see only uncertainty there.

There is wicked-high volatility in Gold right now – which trades inversely with these huge market gyrations.

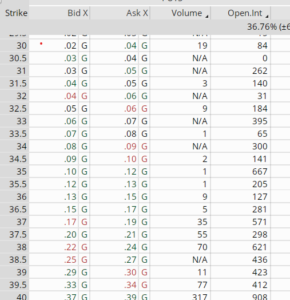

I thought to check Crude Oil. With international production in question (OPEC announced today, they might cut a million barrels a day in production), there is also great uncertainty about demand due to the Corona virus concerns. Here’s a screen shot of the MAY 2020 crude oil puts this morning:

This snippet is the MAY 2020 Crude Oil PUT options. Go down to the 35-strike put and you see that the volume this morning is “1” and the OI / open interests is 667. No volume, very low open interests; not the stats you want to trade it.

Comments continued:

So there is nothing for me to sell in any of these right now. Is this a bit discouraging? Of course, but that’s no reason to expose my account to extreme risk right now, so I will again- this week, stand aside. The odds are selling the 35-PUT MAY 2020 and having it expire worthless are pretty good, but considering this is NOT a normal market in any way whatsoever, personally, I am aside with this.

My hope is that next week, this “picture” might be considerably different.

I like to see OI high, daily trading volume at least nominal (not low as it is now), and a Prob OTM of over 90%. And I would add that in the market we have this week, so very unusual, there is likely too much risk in seemingly in every direction.

If /When things change a bit. I will send you an email to read a post here. thanks.

Wish I had better news today, but it is what it is- of course. I’ve been posting my trades here on this newsletter about three years – and I cannot recall a time period this long where I can’t find an acceptable trade. I just think the risks are too high right now. – Don

I do have a new YouTube Channel: Day Trading the new Micro E-Mini Stock Index Futures, where I teach and show many examples of trading these new lower-risk, smaller 1/10th size contracts. I have up 14 videos there on suggestion of how to trade them. The link to the channel is here (click on the icon): (all the stuff there is free for now.)

There is a free 4-video course (PLAYLIST) with all the basics at this link:

https://www.youtube.com/playlist?list=PLv6Fasp51T9L99jOWgLdB2ZylXpzaXByo

And there is a brand new Playlist (also FREE) of 4 videos named: “MACD Winners” of how to use the 5 minute MACD to trade them:

https://www.youtube.com/playlist?list=PLv6Fasp51T9JGVQCNmRaliEbIpzLQh0od

The examples I use there are using the NASDAQ100 Micro E-Mini for $2.00 per point, so they are low enough risk for most to be comfortable giving them a try.

If you check it out and have any questions, just email me at: Don@WriteThisDown.com I’m glad to help when I can.

Thank you – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings on 04 FEB 2020, Tuesday

At my last post on 27th JAN, Monday of last week- the DJIA was down 400 points due to the Corona virus outbreak. Today, the market is up 469 DJIA points at 28,868 at midday. Gold is down $26.60 per ounce and the April GC (gold) futures are near $1,555 per ounce. Over the last week Crude Oil continued to drop although it did have a couple of higher price trading days along the way.

The USA Presidential State-of-the-Union address is tonight, the Iowa caucus yesterday, and the US Senate still to vote on Presidential impeachment coming up, the OPEC suggesting they will cut 1 million barrels of crude oil production per day, AND (finally) China is seeking an exemption for buying more USA ag products due to the Corona virus shutdowns and quarantines.

My comment is this: I don’t think if Tom Clancy was writing a novel, that he could get a more complicated plot than today’s reality is presenting.

source: https://www.statista.com/chart/20634/confirmed-coronavirus-cases-timeline/

Is there some “good money” to be made for those willing to jump into the middle of all these variable and risks (aka: uncertainty)? Sure there is, but my goal here on Time Farming / Selling Commodity Options is almost he opposite: To sell options so far out of the money that they will expire worthless.

I gave thought this morning as to which of the following might offer the most trading opportunity: Grains, Crude Oil, or Gold. Since China will almost certainly have declining demand for our ag products due to shutdowns and quarantines, I see only uncertainty there.

There is wicked-high volatility in Gold right now – which trades inversely with these huge market gyrations.

I thought to check Crude Oil. With international production in question (OPEC announced today, they might cut a million barrels a day in production), there is also great uncertainty about demand due to the Corona virus concerns. Here’s a screen shot of the MAY 2020 crude oil puts this morning:

This snippet is the MAY 2020 Crude Oil PUT options. Go down to the 35-strike put and you see that the volume this morning is “1” and the OI / open interests is 667. No volume, very low open interests; not the stats you want to trade it.

Comments continued:

So there is nothing for me to sell in any of these right now. Is this a bit discouraging? Of course, but that’s no reason to expose my account to extreme risk right now, so I will again- this week, stand aside. The odds are selling the 35-PUT MAY 2020 and having it expire worthless are pretty good, but considering this is NOT a normal market in any way whatsoever, personally, I am aside with this.

My hope is that next week, this “picture” might be considerably different.

I like to see OI high, daily trading volume at least nominal (not low as it is now), and a Prob OTM of over 90%. And I would add that in the market we have this week, so very unusual, there is likely too much risk in seemingly in every direction.

If /When things change a bit. I will send you an email to read a post here. thanks.

Wish I had better news today, but it is what it is- of course. I’ve been posting my trades here on this newsletter about three years – and I cannot recall a time period this long where I can’t find an acceptable trade. I just think the risks are too high right now. – Don

I do have a new YouTube Channel: Day Trading the new Micro E-Mini Stock Index Futures, where I teach and show many examples of trading these new lower-risk, smaller 1/10th size contracts. I have up 14 videos there on suggestion of how to trade them. The link to the channel is here (click on the icon): (all the stuff there is free for now.)

There is a free 4-video course (PLAYLIST) with all the basics at this link:

https://www.youtube.com/playlist?list=PLv6Fasp51T9L99jOWgLdB2ZylXpzaXByo

And there is a brand new Playlist (also FREE) of 4 videos named: “MACD Winners” of how to use the 5 minute MACD to trade them:

https://www.youtube.com/playlist?list=PLv6Fasp51T9JGVQCNmRaliEbIpzLQh0od

The examples I use there are using the NASDAQ100 Micro E-Mini for $2.00 per point, so they are low enough risk for most to be comfortable giving them a try.

If you check it out and have any questions, just email me at: Don@WriteThisDown.com I’m glad to help when I can.

Thank you – Don

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.