06 December 2019, Friday:

Greetings: The regular TRADE COMMENTARY resumes on Tuesday next week, the 10th December.

Crude Oil: Energy ministers from some of the world’s largest oil producers will attempt to ratify a deeper round of output cuts today. Led by Saudi Arabia, the 14-member group agreed in principle to cut production by an additional 500,000 barrels per day through to the end of March 2020, which is much larger than many had expected. ( source: CNBC)

They will get the members to approve, then tell each of them “how much” to cut. Over the last two years (my opinion) they make the ‘agreements’ then many of them just sell what they can. Last week there was a news story out that Saudi Arabia was thinking of stepping down as an OPEC leader because of this. What I read into this, is that they can’t and don’t have the influence to get oil prices to rise much. Good news for option-sellers, I think.

On 13th NOV 2019: I shorted the 75-strike CALL and the 40 PUT for a total of $140. I got 0.06 for the 75 CALL, and got 0.08 for the 40 PUT, a total of 0.14 ($140). The short strangle is priced at about $60 today, up +$80 per strangle since the trade was placed. I expect this short strangle to keep dwindling premium over the month of December but (see below) I may take the profit today.

Here’s the FEB2020 Crude Oil (WTI) chart. FEB20 Crude was priced at $57.11 per on 13 NOV – and this morning (6DEC2019), it is almost the same at $58.01:

Here’s the quotes just before 9 AM today:

FEB20 (/CLG20) trading at 57.80 and the options are each 0.03 ASK, for a total of 0.06 ($60.) That is a profit of $80 for each short strangle. I am considering closing this trade this morning for 0.05 to 0.06. Let me tell you why: If I can close for 0.05, that’s a profit of $90 (excl comm) that I can capture, and then I’m going to shop to sell a similar short strangle out on the MAR2020 Crude Oil early next week. Whenever, you can capture a nice profit and not LEAVE it at risk – AND- the remaining premium is small ($50 or $60), there’s is little reason to risk the $90 to make the remaining $50 or $60. So it’s time to move on. I’m putting in a GTC order (good till cancelled) to close the strangles at 0.05 ($50) and pocket the $90 profit.

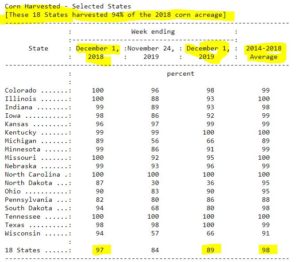

Corn New Crop: Here’s the “crop progress” (harvest progress) that came out this week on Monday:

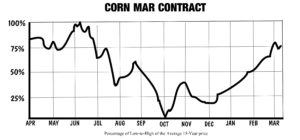

The last time I discussed selling some Corn MARCH-2020 PUT options was in the November 13th post when MAR20 Corn futures were trading 385 cents/ bushel. They are trading 378.25 this morning and the 360 PUT (MAR20 class) are trading about 2.5 cents ($125 each.) These MAR20 360-strike PUT options have enough open interests to trade, but the Prob OTM (the probability they expire Out-of-The-Money) is only 78.92%. As you likely know, I like to have 90% or better, so these are a little more risky than I like. However, this is somewhat offset by the fundamentals: (see Crop Progress report above) Last year, the progress was 97% harvested, the most recent 5-year average at 98%, and now (1st DEC) only 89%. So harvested acres are running behind about 8% to 9%. While part of this is due to late planting due to floods earlier in the planting season, there is a high likelihood of a further reduction in bushels/acre harvested, AND a good chance that fewer acres will be harvested. Re: fewer acres harvested: The logic here is bascially “if they don’t have them harvested already, they aren’t very likely to be harvested at all.” This would result in a reduction of stocks for the coming year and would bode price support. As you can see in the 15 year seasonal average price of the MAR contract, this contract normally makes a low this time (or earlier) in the year. As I stated back on 13th NOV, last year the MAR2018 contract hit a low of near 346 on December 17, 2018.

So to sell the MAR20 360-PUT for 2.5 cents is a consideration for sure – and even if the trade doesn’t go well, it will still be in harmony with seasonal price tendencies, see chart here:

The margin to sell a MAR20 360 PUT is about $740 and the premium if sold at 2.5 cents would be $125. That’s about a 16.8% return. The options MAR20 will expire on February 21, 2020 – 77 days out. A 16.8% return in 2.5 months is a nice return. I’ll give this more thought and let you know what I decide to do on Tuesday next week in the commentary. The 370 is trading about 6 cents ($300) with Prob OTM of 63%, and the 350P has an 88% Prob OTM yield only 1.125 cents ($62.50).

There was, this morning, news that China will buy soybeans but the amount and when is not specific. Beans traded up 6 cents this morning on that news, not much more than a blip. This isn’t surprising because the ‘trade talks’ have not produced much over the last six months that one can ‘take to the bank’ so-to-speak (I’m saying the news is very unreliable.)

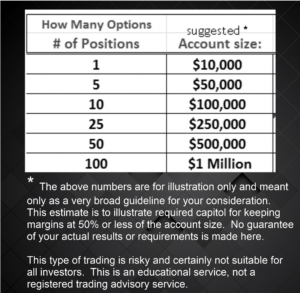

As you know, this is not a trade advisory newsletter. I post my own trades and discuss the process by which I consider them – and I do so for teaching purposes. My choices are normally conservative. This category of investing is risky by nature. Each of us has various aversion-levels to risk, different account sizes, different goals, and additional characteristics that result in our own and unique preferences and risk levels of trading. To be clear: I’m saying that what might be useful and appropriate for one trader is rarely suitable for ALL traders. The decisions you make of course are always your own.

Gold: I just shopped for an April 2020 short strangle in Gold. The 1300 PUT and 1700 CALL premium totals only $120 and the initial margin requirement is about $1050. The expiration date is out 111 days and the potential return is about 120/1050 = 11.4% (excl comm.) I’ve decided to wait on this one also. If the stock market, making near records highs – as we all know- fell a few days, that would result in a much higher implied volatility in Gold and that means more expensive options. With Christmas and end of year coming soon, the market will not likely go straight up with no pauses or corrections. For that reason, (and I’m not predicting the market will fall precipitously) I will wait for a better opportunity. By the way the Prob % OTM for the April20 1700C/1300P is very good at about 97%. You can see on this chart that the 1700/1300 combo seems very far OTM; I just think more volatility could be on the way to make it even better. Here’s the chart:

To give you some idea of the relationship of gold prices to the stock market, and to illustrate its potential volatility. At midday today (Friday 6 DEC19) the DJIA is up 266 points and FEB20 Gold is $1466.30 per ounce, down $16.80 cents for the day. This is the inverse relationship Gold has with the stock market these days. The S&P is up 26.50 at this time. IF, and maybe a big if, the stock market goes into higher volatility with large moves both up and down, it could be better to try and “leg in” to an APR20 short strangle. There is plenty of time left to do this.

I wish you all a great weekend and safe holidays. My next schedule post if Tuesday, December 10th, 2019.

Thank you and good trading. – Don

Don A. Singletary

The seasonal chart of corn above is from my book:

If you care to know more about the new Micro E-Mini stock index futures that trade for $5, $2, and 50-cents per point, I just posted a four video series on my Day Trading Micro Futures YouTube channel. It’s free.

And the book is available e-Book and Paperback at Amazon:

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

06 December 2019, Friday:

Greetings: The regular TRADE COMMENTARY resumes on Tuesday next week, the 10th December.

Crude Oil: Energy ministers from some of the world’s largest oil producers will attempt to ratify a deeper round of output cuts today. Led by Saudi Arabia, the 14-member group agreed in principle to cut production by an additional 500,000 barrels per day through to the end of March 2020, which is much larger than many had expected. ( source: CNBC)

They will get the members to approve, then tell each of them “how much” to cut. Over the last two years (my opinion) they make the ‘agreements’ then many of them just sell what they can. Last week there was a news story out that Saudi Arabia was thinking of stepping down as an OPEC leader because of this. What I read into this, is that they can’t and don’t have the influence to get oil prices to rise much. Good news for option-sellers, I think.

On 13th NOV 2019: I shorted the 75-strike CALL and the 40 PUT for a total of $140. I got 0.06 for the 75 CALL, and got 0.08 for the 40 PUT, a total of 0.14 ($140). The short strangle is priced at about $60 today, up +$80 per strangle since the trade was placed. I expect this short strangle to keep dwindling premium over the month of December but (see below) I may take the profit today.

Here’s the FEB2020 Crude Oil (WTI) chart. FEB20 Crude was priced at $57.11 per on 13 NOV – and this morning (6DEC2019), it is almost the same at $58.01:

Here’s the quotes just before 9 AM today:

FEB20 (/CLG20) trading at 57.80 and the options are each 0.03 ASK, for a total of 0.06 ($60.) That is a profit of $80 for each short strangle. I am considering closing this trade this morning for 0.05 to 0.06. Let me tell you why: If I can close for 0.05, that’s a profit of $90 (excl comm) that I can capture, and then I’m going to shop to sell a similar short strangle out on the MAR2020 Crude Oil early next week. Whenever, you can capture a nice profit and not LEAVE it at risk – AND- the remaining premium is small ($50 or $60), there’s is little reason to risk the $90 to make the remaining $50 or $60. So it’s time to move on. I’m putting in a GTC order (good till cancelled) to close the strangles at 0.05 ($50) and pocket the $90 profit.

Corn New Crop: Here’s the “crop progress” (harvest progress) that came out this week on Monday:

The last time I discussed selling some Corn MARCH-2020 PUT options was in the November 13th post when MAR20 Corn futures were trading 385 cents/ bushel. They are trading 378.25 this morning and the 360 PUT (MAR20 class) are trading about 2.5 cents ($125 each.) These MAR20 360-strike PUT options have enough open interests to trade, but the Prob OTM (the probability they expire Out-of-The-Money) is only 78.92%. As you likely know, I like to have 90% or better, so these are a little more risky than I like. However, this is somewhat offset by the fundamentals: (see Crop Progress report above) Last year, the progress was 97% harvested, the most recent 5-year average at 98%, and now (1st DEC) only 89%. So harvested acres are running behind about 8% to 9%. While part of this is due to late planting due to floods earlier in the planting season, there is a high likelihood of a further reduction in bushels/acre harvested, AND a good chance that fewer acres will be harvested. Re: fewer acres harvested: The logic here is bascially “if they don’t have them harvested already, they aren’t very likely to be harvested at all.” This would result in a reduction of stocks for the coming year and would bode price support. As you can see in the 15 year seasonal average price of the MAR contract, this contract normally makes a low this time (or earlier) in the year. As I stated back on 13th NOV, last year the MAR2018 contract hit a low of near 346 on December 17, 2018.

So to sell the MAR20 360-PUT for 2.5 cents is a consideration for sure – and even if the trade doesn’t go well, it will still be in harmony with seasonal price tendencies, see chart here:

The margin to sell a MAR20 360 PUT is about $740 and the premium if sold at 2.5 cents would be $125. That’s about a 16.8% return. The options MAR20 will expire on February 21, 2020 – 77 days out. A 16.8% return in 2.5 months is a nice return. I’ll give this more thought and let you know what I decide to do on Tuesday next week in the commentary. The 370 is trading about 6 cents ($300) with Prob OTM of 63%, and the 350P has an 88% Prob OTM yield only 1.125 cents ($62.50).

There was, this morning, news that China will buy soybeans but the amount and when is not specific. Beans traded up 6 cents this morning on that news, not much more than a blip. This isn’t surprising because the ‘trade talks’ have not produced much over the last six months that one can ‘take to the bank’ so-to-speak (I’m saying the news is very unreliable.)

As you know, this is not a trade advisory newsletter. I post my own trades and discuss the process by which I consider them – and I do so for teaching purposes. My choices are normally conservative. This category of investing is risky by nature. Each of us has various aversion-levels to risk, different account sizes, different goals, and additional characteristics that result in our own and unique preferences and risk levels of trading. To be clear: I’m saying that what might be useful and appropriate for one trader is rarely suitable for ALL traders. The decisions you make of course are always your own.

Gold: I just shopped for an April 2020 short strangle in Gold. The 1300 PUT and 1700 CALL premium totals only $120 and the initial margin requirement is about $1050. The expiration date is out 111 days and the potential return is about 120/1050 = 11.4% (excl comm.) I’ve decided to wait on this one also. If the stock market, making near records highs – as we all know- fell a few days, that would result in a much higher implied volatility in Gold and that means more expensive options. With Christmas and end of year coming soon, the market will not likely go straight up with no pauses or corrections. For that reason, (and I’m not predicting the market will fall precipitously) I will wait for a better opportunity. By the way the Prob % OTM for the April20 1700C/1300P is very good at about 97%. You can see on this chart that the 1700/1300 combo seems very far OTM; I just think more volatility could be on the way to make it even better. Here’s the chart:

To give you some idea of the relationship of gold prices to the stock market, and to illustrate its potential volatility. At midday today (Friday 6 DEC19) the DJIA is up 266 points and FEB20 Gold is $1466.30 per ounce, down $16.80 cents for the day. This is the inverse relationship Gold has with the stock market these days. The S&P is up 26.50 at this time. IF, and maybe a big if, the stock market goes into higher volatility with large moves both up and down, it could be better to try and “leg in” to an APR20 short strangle. There is plenty of time left to do this.

I wish you all a great weekend and safe holidays. My next schedule post if Tuesday, December 10th, 2019.

Thank you and good trading. – Don

Don A. Singletary

free Prime shipping at Amazon

If you care to know more about the new Micro E-Mini stock index futures that trade for $5, $2, and 50-cents per point, I just posted a four video series on my Day Trading Micro Futures YouTube channel. It’s free.

And the book is available e-Book and Paperback at Amazon:

free Prime shipping on Amazon

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.