Greetings: Tuesday: 12 MAY 2020

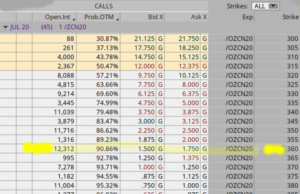

One new trade today: Sold the JUL20 360-strike Corn CALL for 1.50 ($75). Initial Margin: only $468 Expiration in 65 days on June 24, 2020. Prob OTM = ~ 90% Possible return: 75/468 = 16% (if no drawdown.)

See COMMENTS below charts:

CORN COMMENTS:

In round figures, the USA produces about 15 Billion bushels of corn per season. About 1/3 goes to livestock feed and another 1/3 usually goes to ethanol production, the remainder is for exports and food stuffs (sweetners and meal.) Everything about this year has been skewed due to the pandemic / Covid-19. Gasoline demand is way down and will increase more after August than before this JUL20 corn option expires in only 45 days on June 24, 2020. Gasoline and Crude prices are extremely low compare to last year, so this means margins for ethanol producers are very low as is demand. If cattle producers can’t get through processing plants, they will decrease cattle on feed (the overhead is expensive when the lines of production are slowed.) Of course this could easily be offset by higher cattle prices. With corn prices so low, the new crop plantings should not be abnormally large this year.

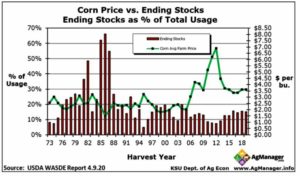

In the table below (KSU supply-demand projections) are posted the USDA’s supply-demand projections. The USDA, and this is very important, does NOT based their figures on speculation but tries to not get ahead of the facts. I am suggesting that these USDA / WASDE (World AG Supply-Demand) figures will not ‘build in’ the extreme weakness of demand for corn from the ethanol producers. The chart only suggests about $3.52 /bushel as the average seasonal price for corn. Since demand for ethanol is weak and margins low – I expect, at least over the short term (until this option expires) that prices for JUL20 futures are not likely to climb to 360 cents per bushel. I almost sold the 340 strike instead but decided, with all the uncertainty in the air about nearly everything, to go the more conservative route and sell the 360.

There is a new WASDE out today for MAY20, here’s the link to download it free: https://www.usda.gov/oce/commodity/wasde/wasde0520.pdf

Current position: Sold 40-strike AUG20 Crude Oil CALL for 0.36 ($360 credit). Trade originated last week: 05MAY20

Here’s an updated Chart on AUG20 Crude Oil, at midday today (5/12/2020) $27.30 +.55

Corn will not be a lot of money for farmers this season and in fact, there could be fewer acres planted and harvested than are in current projections. The fact that the US $dollar remains strong also makes for higher prices for foreign buyers to purchase USA corn; this may dampen demand also.

That is all for now. Stay well. If you haven’t tried trading the new (one year ago ) Micro Stock Index futures called the “Micro E-minis,” they are 1/10th the size of the E-Minis and trade with very low margins and small increments (The S&P 500 Micro E-Mini is only $5 per point and the NASDAQ100 futures, the Micro’s trade at only $2 per point.

I have about 30 videos on my Micro Futures YouTube channel: Check it out at this link:

There is a free 4 video playlist that is for traders new to day trading the new Micro E-Minis, each video is only about ten minutes long. The link to this playlist is: HERE

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: Tuesday: 12 MAY 2020

One new trade today: Sold the JUL20 360-strike Corn CALL for 1.50 ($75). Initial Margin: only $468 Expiration in 65 days on June 24, 2020. Prob OTM = ~ 90% Possible return: 75/468 = 16% (if no drawdown.)

See COMMENTS below charts:

CORN COMMENTS:

In round figures, the USA produces about 15 Billion bushels of corn per season. About 1/3 goes to livestock feed and another 1/3 usually goes to ethanol production, the remainder is for exports and food stuffs (sweetners and meal.) Everything about this year has been skewed due to the pandemic / Covid-19. Gasoline demand is way down and will increase more after August than before this JUL20 corn option expires in only 45 days on June 24, 2020. Gasoline and Crude prices are extremely low compare to last year, so this means margins for ethanol producers are very low as is demand. If cattle producers can’t get through processing plants, they will decrease cattle on feed (the overhead is expensive when the lines of production are slowed.) Of course this could easily be offset by higher cattle prices. With corn prices so low, the new crop plantings should not be abnormally large this year.

In the table below (KSU supply-demand projections) are posted the USDA’s supply-demand projections. The USDA, and this is very important, does NOT based their figures on speculation but tries to not get ahead of the facts. I am suggesting that these USDA / WASDE (World AG Supply-Demand) figures will not ‘build in’ the extreme weakness of demand for corn from the ethanol producers. The chart only suggests about $3.52 /bushel as the average seasonal price for corn. Since demand for ethanol is weak and margins low – I expect, at least over the short term (until this option expires) that prices for JUL20 futures are not likely to climb to 360 cents per bushel. I almost sold the 340 strike instead but decided, with all the uncertainty in the air about nearly everything, to go the more conservative route and sell the 360.

There is a new WASDE out today for MAY20, here’s the link to download it free: https://www.usda.gov/oce/commodity/wasde/wasde0520.pdf

Current position: Sold 40-strike AUG20 Crude Oil CALL for 0.36 ($360 credit). Trade originated last week: 05MAY20

Here’s an updated Chart on AUG20 Crude Oil, at midday today (5/12/2020) $27.30 +.55

Corn will not be a lot of money for farmers this season and in fact, there could be fewer acres planted and harvested than are in current projections. The fact that the US $dollar remains strong also makes for higher prices for foreign buyers to purchase USA corn; this may dampen demand also.

That is all for now. Stay well. If you haven’t tried trading the new (one year ago ) Micro Stock Index futures called the “Micro E-minis,” they are 1/10th the size of the E-Minis and trade with very low margins and small increments (The S&P 500 Micro E-Mini is only $5 per point and the NASDAQ100 futures, the Micro’s trade at only $2 per point.

I have about 30 videos on my Micro Futures YouTube channel: Check it out at this link:

There is a free 4 video playlist that is for traders new to day trading the new Micro E-Minis, each video is only about ten minutes long. The link to this playlist is: HERE

Don A. Singletary

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.