14 August 2019: WEDNESDAY

NEW ORDER: I put in a GTC, good until canceled order to make a closing purchase: Buy back the short OCT19 Crude Oil 75-strike CALL for 0.01 ($10) or better.

I made a closing purchase to close out (buy back) the short DEC19 Crude Oil 80-strike CALL for 0.04 ($40) this morning. A profit of +$60 per option excluding commissions.

New Trade: Sold the DEC19 Corn 430-strike CALL for 4.375. 4.375 x $50 = a credit of $218.75

The underlying DEC19 Corn was trading 377. Initial margin: $801

Prob of OTM (expiring out of the money) = 85.28% Expiration date: 22 NOV 2019 (100 days out)

Possible ROI: 218.75/801 = 27.3% (excluding comm. and based on the initial margin for the trade.)

Commentary: I am closing the Crude Oil positions to take profits, so I can sell more CALL options soon on Crude.

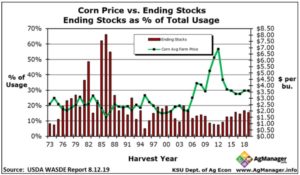

Corn: The USDA/WASDE report on Monday surprised traders as the report announced more planted acres than expected. Also the exports were reduced and the estimated ending stocks were revised higher near 2.2 billion bushels. — ALL of these were bearish and corn sold off 25 cents on Monday and more yesterday. Here’s the updated chart of average to-farm price versus ending stocks from KSU:

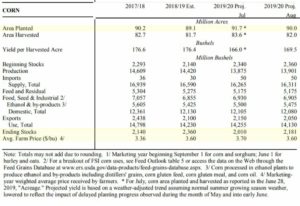

The table (below) is from Monday’s USDA WASDE report. In ‘Area Planted’, the Jul to Aug change was down to only 90 million acres, well above the expected 85 to 88 mm. Usage was revised downward, as was the Avg to farm price to only $3.60. The largest surprise is the Yield (see Yield per Harvested Acre). It was expected to remain near the JUL number of 166, but was raised to 169.5 bushels per acre — the ‘ending stocks’ the bottom-line so-to-speak came out at 2.181 billion bushels. This was very bearish.

The Avg. to-farm was adjusted down to $3.60. Since there is not expected to be any progress on the China/USA trade talks for a long time, there -for now at least- seems to be a lot of corn will be on hand over the next year. This doesn’t mean the USDA won’t revised some of these numbers, but it seems even if they do reduce the yield, it still probably won’t be enough to change the fundamentals much. As always, stay tuned for the USDA numbers are full or surprises this year.

I chose to short the DEC19 430 CALL even though its “Prob OTM” at about 85% is below the 90% that I like to shoot for. Here’s the DEC19 Corn futures chart:

One of the AgWeb commentators I read, Jerry Gulke, did a great job of going over the WASDE for the corn and he discusses some of the surprises in the report, here’s the link: Gulke Article

And here is the link to Monday’s WASDE report: AUG19 WASDE

I still plan on selling some Gold PUTs. Following the news today and the fact that the DJIA is down – 549 at midday; it seems likely there will be more investors taking some profits out of the market in the weeks ahead. As you know, it’s really hard with the volatility to say much of anything for sure right now in regards to the stock market. Notably, Crude Oil is down -2.56 today.

have a good week – Don

Don A. Singletary

Summary of my Positions 14 August 2019:

OCT19 Crude Oil 75-strike CALL for 0.05 ($50)

And, today’s new trade, short the DEC19 430-strike CALL for 4.375

Free ship Amazon Prime

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

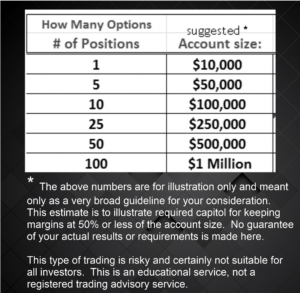

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

14 August 2019: WEDNESDAY

NEW ORDER: I put in a GTC, good until canceled order to make a closing purchase: Buy back the short OCT19 Crude Oil 75-strike CALL for 0.01 ($10) or better.

I made a closing purchase to close out (buy back) the short DEC19 Crude Oil 80-strike CALL for 0.04 ($40) this morning. A profit of +$60 per option excluding commissions.

New Trade: Sold the DEC19 Corn 430-strike CALL for 4.375. 4.375 x $50 = a credit of $218.75

The underlying DEC19 Corn was trading 377. Initial margin: $801

Prob of OTM (expiring out of the money) = 85.28% Expiration date: 22 NOV 2019 (100 days out)

Possible ROI: 218.75/801 = 27.3% (excluding comm. and based on the initial margin for the trade.)

Commentary: I am closing the Crude Oil positions to take profits, so I can sell more CALL options soon on Crude.

Corn: The USDA/WASDE report on Monday surprised traders as the report announced more planted acres than expected. Also the exports were reduced and the estimated ending stocks were revised higher near 2.2 billion bushels. — ALL of these were bearish and corn sold off 25 cents on Monday and more yesterday. Here’s the updated chart of average to-farm price versus ending stocks from KSU:

The table (below) is from Monday’s USDA WASDE report. In ‘Area Planted’, the Jul to Aug change was down to only 90 million acres, well above the expected 85 to 88 mm. Usage was revised downward, as was the Avg to farm price to only $3.60. The largest surprise is the Yield (see Yield per Harvested Acre). It was expected to remain near the JUL number of 166, but was raised to 169.5 bushels per acre — the ‘ending stocks’ the bottom-line so-to-speak came out at 2.181 billion bushels. This was very bearish.

The Avg. to-farm was adjusted down to $3.60. Since there is not expected to be any progress on the China/USA trade talks for a long time, there -for now at least- seems to be a lot of corn will be on hand over the next year. This doesn’t mean the USDA won’t revised some of these numbers, but it seems even if they do reduce the yield, it still probably won’t be enough to change the fundamentals much. As always, stay tuned for the USDA numbers are full or surprises this year.

I chose to short the DEC19 430 CALL even though its “Prob OTM” at about 85% is below the 90% that I like to shoot for. Here’s the DEC19 Corn futures chart:

One of the AgWeb commentators I read, Jerry Gulke, did a great job of going over the WASDE for the corn and he discusses some of the surprises in the report, here’s the link: Gulke Article

And here is the link to Monday’s WASDE report: AUG19 WASDE

I still plan on selling some Gold PUTs. Following the news today and the fact that the DJIA is down – 549 at midday; it seems likely there will be more investors taking some profits out of the market in the weeks ahead. As you know, it’s really hard with the volatility to say much of anything for sure right now in regards to the stock market. Notably, Crude Oil is down -2.56 today.

have a good week – Don

Don A. Singletary

Summary of my Positions 14 August 2019:

OCT19 Crude Oil 75-strike CALL for 0.05 ($50)

And, today’s new trade, short the DEC19 430-strike CALL for 4.375

Free ship Amazon Prime

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.