Greetings: 17 September 2019 TUESDAY newsletter

Two (2) New Trades today:

I sold the DEC19 Crude Oil 85-strike CALL for .19 ($190).

Expires: 15 NOV 2019 (59 days)

Prob OTM: 96%

Underlying price: $59.11

Initial Margin Req: $810

New Trade:

I sold the DEC19 Corn 420-strike CALL for 1.625 ($81.25)

Expires: 22 NOV 2019 (66 days)

Prob OTM: 92%

Underlying Price: 370.75 cents per bushel

Initial Margin: (already short 320P, additional margin $129*)

*Current margin today with 320P/420C is about $730

Comments 17 SEP 2019:

Crude Oil at midday today has fallen -2.75 and DEC19 trading about 59.26. It closed at 62.01 yesterday. News sources today are saying the Saudis can resume normal production rates again sooner than anticipated. This is presumed to be the reason that prices are falling today. Crude Oil option premiums are high due to the volatility, and though I do realize quite fully that the Crude Oil market is just “one cruise missile or drone attack away” from repeating what happened last weekend — I made the decision to sell the $85-strike CALL for $190 (0.19). This strike is a little over $26 above the current DEC19 futures price. Reuters news cited these reasons this morning: (source: Reuters and CNBC)

- Output will return to normal levels sooner than thought

- Output will be “fully back online” in the next two to three weeks

- Saudi is close to restoring 70% of the 5.7m barrels per day lost

- Impact on oil exports has been minimal, thanks to Saudi’s Aramco’s oil storage

source: Bloomberg

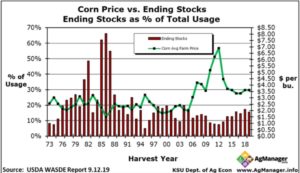

Corn: Corn prices are falling today. The report on Thursday last week, the USDA / WASDE left the crop production, harvested acres, and yield per acre pretty close to the last months report. Here (below) is a part of that report from USDA:

COARSE GRAINS: This month’s 2019/20 U.S. corn outlook is for reduced production, lower corn used for ethanol, and slightly higher ending stocks. Corn production is forecast at 13.799 billion bushels, down 102 million from last month on a lower yield forecast. Corn supplies are down from last month, as a smaller crop more than offsets larger beginning stocks due to lower estimated exports and corn used for ethanol for 2018/19. Corn used for ethanol for 2019/20 is lowered 25 million bushels. With use falling more than supply, corn ending stocks are up 9 million bushels from last month. The season-average corn price received by producers is unchanged at $3.60 per bushel.

Here is the link of origination for my short DEC19 Corn 320 PUT option(s.)

Short DEC19 Corn 320-strike PUTs at 1.50 cents

That is all today. I hope to fare better on this Crude Oil 85-strike CALL, than I did on the 75-strikes. No one can predict when events such as the attack on the Saudi Oil refinery will happen – and it’s always a risk. I hope the rest of this week is quieter. I am always watching the Gold options but nothing for me there today. Thank you. – Don

Don A. Singletary

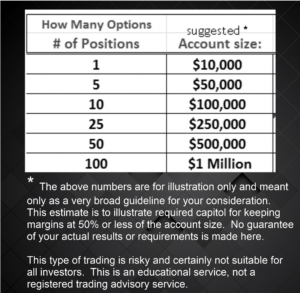

When new subscribers ask me to recommend a broker that has very easy-to-learn and easy-to-use software (free of course) and a good commission rate, I recommend TastyWorks. I have some of my personal accounts there. They also have an 85 cents commission rate on the new Micro Index Futures.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

Trial Subscribers: Don’t miss an issue.

***************

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.

Greetings: 17 September 2019 TUESDAY newsletter

Two (2) New Trades today:

I sold the DEC19 Crude Oil 85-strike CALL for .19 ($190).

Expires: 15 NOV 2019 (59 days)

Prob OTM: 96%

Underlying price: $59.11

Initial Margin Req: $810

New Trade:

I sold the DEC19 Corn 420-strike CALL for 1.625 ($81.25)

Expires: 22 NOV 2019 (66 days)

Prob OTM: 92%

Underlying Price: 370.75 cents per bushel

Initial Margin: (already short 320P, additional margin $129*)

*Current margin today with 320P/420C is about $730

Comments 17 SEP 2019:

Crude Oil at midday today has fallen -2.75 and DEC19 trading about 59.26. It closed at 62.01 yesterday. News sources today are saying the Saudis can resume normal production rates again sooner than anticipated. This is presumed to be the reason that prices are falling today. Crude Oil option premiums are high due to the volatility, and though I do realize quite fully that the Crude Oil market is just “one cruise missile or drone attack away” from repeating what happened last weekend — I made the decision to sell the $85-strike CALL for $190 (0.19). This strike is a little over $26 above the current DEC19 futures price. Reuters news cited these reasons this morning: (source: Reuters and CNBC)

source: Bloomberg

Corn: Corn prices are falling today. The report on Thursday last week, the USDA / WASDE left the crop production, harvested acres, and yield per acre pretty close to the last months report. Here (below) is a part of that report from USDA:

Here is the link of origination for my short DEC19 Corn 320 PUT option(s.)

Short DEC19 Corn 320-strike PUTs at 1.50 cents

That is all today. I hope to fare better on this Crude Oil 85-strike CALL, than I did on the 75-strikes. No one can predict when events such as the attack on the Saudi Oil refinery will happen – and it’s always a risk. I hope the rest of this week is quieter. I am always watching the Gold options but nothing for me there today. Thank you. – Don

Don A. Singletary

When new subscribers ask me to recommend a broker that has very easy-to-learn and easy-to-use software (free of course) and a good commission rate, I recommend TastyWorks. I have some of my personal accounts there. They also have an 85 cents commission rate on the new Micro Index Futures.

TastyWorks: $2,000 minimum to open account. Easy online application, free ACH money transfers. Here’s my affiliate link for TASTYWORKS. International Accounts for 70 countries available.

Trial Subscribers: Don’t miss an issue.

***************

The commentary and examples are for teaching purposes only and are not intended to be a trading or trade advisory service. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein on the web site and/or newsletter, are committed at your own risk, financial or otherwise. Trading with leverage could lead to greater loss than your initial deposit. Trade at your own risk. Investors and traders are responsible for their own investment/trading decisions including entries, exits, position, sizing and use of stops or lack thereof. This is not a trade advisory service and is for educational purposes only. The content on the pages here is believed to be reliable - but we cannot guarantee it.